Last week in a nutshell

- The Government Council of the ECB decided to frontload its exit from negative interest rate by hiking its rate by 50 bps leading to a neutral policy rate. This larger than expected move gave food to the hawks of the Council to release an additional instrument to the current ECB tool kit: the “Transmission Protection Instrument”. The EUR/USD hovered at parity.

- The Italian political conundrum repeated itself. Mario Draghi failed to gained the support from three parties (the League, Forza Italia and the Five Star Movement) in a Senate confidence vote. Consequently, he decided to resign as Italy’s Prime Minister, putting the country on course for snap elections this Autumn.

- Russia resumed pumping gas to Europe via its biggest pipeline after a 10-day maintenance. While it alleviated some of Europe's immediate supply concerns, it was not enough to reverse the odds of rationing to cope with potential winter supply shortages. Even before that outage, supplies via Nord Stream 1, which runs under the Baltic Sea to Germany, had been cut to 40% of the pipeline's capacity in the aftermath of Russia’s invasion of Ukraine.

- Euro zone PMIs deteriorated sharply by 2.6pt to 49.4 in July, falling into sub-50 territory which is consistent with activity contracting. The print surprised sharply to the downside as the consensus was expected a 51.0 reading. The PMIs point to weakening inflationary pressures as input and output price indices declined. It may reflect a number of factors such as demand weakening and difficulty for corporates to pass on higher prices.

What’s next?

- The focus will be on the European Central Bank’s tolerance to Italy’s widening yield premium. The central bank has disclosed a new ECB’s Anti-Crisis Tool: the “Transmission Protection Instrument”. The statement is vague enough to leave a question mark over whether Italy can meet the conditions.

- As concerns on slow growth continue to dominate the news flow, investors are looking forward to the release of the euro zone’s Q2 GDP growth rate estimates. The US will join in as well shedding some light on how well the economies have fared through Q2.

- The US Federal Reserve Bank will meet. Chairman Jerome Powell is expected to announce another Fed fund rate hike to continue to curb inflation. The subsequent press conference will reveal how the central bank gauge the current slowdown in the economy.

- The U.S. earnings season will continue after its weakest start since Q1 2020, boosted by Tesla but otherwise with only 43% of companies reporting sales and earnings per share above consensus (as of last week). It is less than the historical average. This week, Amazon and Apple are due.

Investment convictions

Core scenario

- Our exposure keeps an overall broadly balanced allocation.

- While the market environment still appears constrained by deteriorating fundamentals, markets are looking to central bank announcements.

- Facing multi-decade high inflation, the Fed started its hiking cycle in March and plans to add further steps to its funds rate and continue tightening thereafter. In our best-case scenario, the Fed succeeds in landing the economy. As a result, we expect the rise in the US 10Y yields to fade.

- Inflation is also at highs in the euro zone, hitting businesses, consumers, and ECB policymakers alike. The ECB announced an initial rate hike for the month of July and delivered a 50 bps hike. It also unveiled a new tool, the “Transmission Protection Instrument” (TPI). Further hikes are still expected going forward and will depend on the evolution of future economic data.

- Facing high inflation, central bank policy tools have triggered a sharp tightening in financial conditions while the global economic slowdown is now well underway. The war in Ukraine and the slowing global weigh on confidence. The economic activity in China slowed down considerably in April and May but should pick up during H2 as stimulus measures kick-in.

- The reasons for a balanced allocation have been called into question by the decline in Russian gas flow, even after the re-opening of the Nord Stream 1 pipeline at the end of July. The European Union is especially vulnerable to the tug of war with Russia. The risks we previously outlined are starting to materialize and are now part of the scenario.

Risks

- Investor concerns are shifting from inflation concerns to growth concerns.

- The war in Ukraine is pushing upwards gas prices. European activity is at the mercy of flows staying open.

- A brutal, faster-than-anticipated rate tightening - if inflationary pressures increase via a new energy shock or simply persist at current levels- could jeopardize any soft landing.

- Other countries may face the Bank of England (BoE) stagflation dilemma: Even as the growth outlook deteriorates sharply, signs of upward pressure on inflation expectations, near-term wage and price setting behaviours remain.

- The threat of COVID-19, and its variants, remain as the virus keeps evolving and spreading at various speed throughout the world.

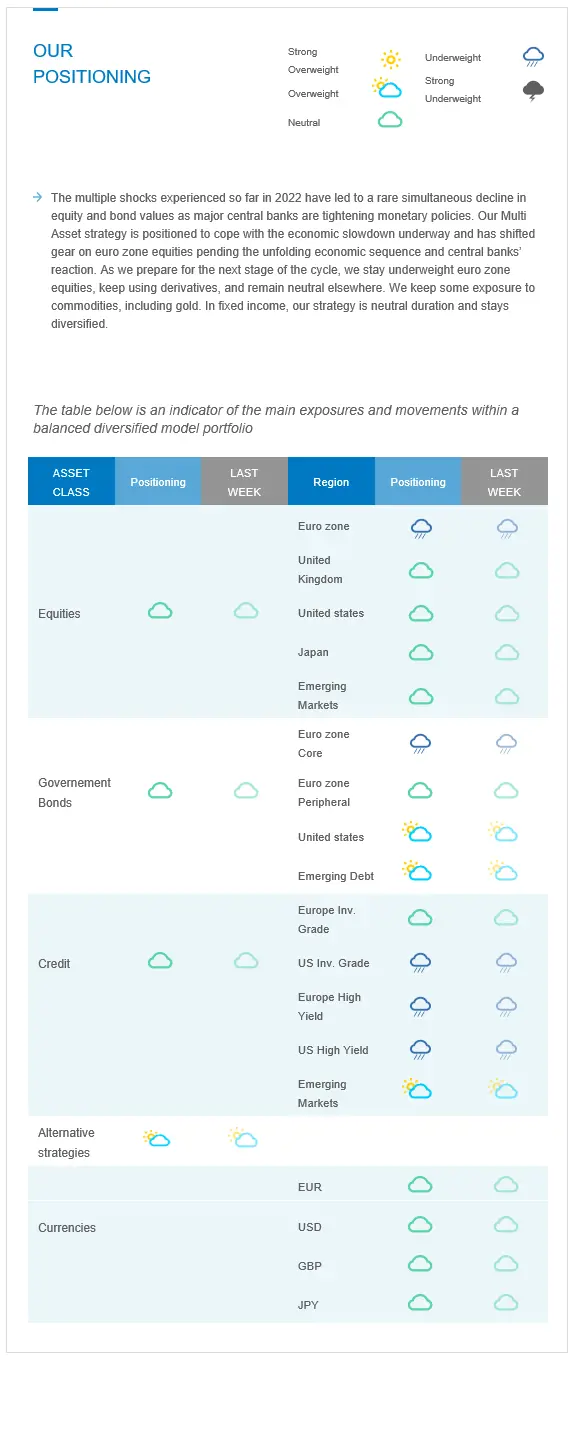

Recent actions in the asset allocation strategy

The multiple shocks experienced so far in 2022 have led to a rare simultaneous decline in equity and bond values as major central banks are tightening monetary policies. Our Multi Asset strategy is positioned to cope with the economic slowdown underway and has shifted gear on euro zone equities pending the unfolding economic sequence and central banks’ reaction. As we prepare for the next stage of the cycle, we stay underweight euro zone equities, keep using derivatives, and remain neutral elsewhere. We keep some exposure to commodities, including gold. In fixed income, our strategy is neutral duration and stays diversified.

Cross asset strategy

- Our multi-asset strategy stays more tactical than usual and can be adapted quickly in this highly volatile context:

- Underweight euro zone equities, with a derivative strategy in place to catch the asymmetric potential. We have a preference for the Consumer Staples sector where we find pricing power.

- Neutral UK equities, resilient segments, and global exposure

- Neutral US equities, with an actively-managed derivative strategy, as we remain attentive to the Fed’s forward guidance.

- Neutral Emerging markets, because our assessment indicates an improvement, especially in China, both on the COVID-19 / lockdown and stimulus fronts during H2.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure act as opposite forces for investor attractiveness.

- With some exposure to commodities, including gold.

- In terms of sectors, we favour “long duration” assets, i.e. tech names, as we expect less headwinds from bond yields during H2.

- In the fixed income universe, we acknowledge downward revisions in growth, highs in inflation expectations and strong central bank rhetoric regarding the willingness to tighten and fight inflation. We are neutral duration, with a preference for US duration.

- We continue to diversify and source the carry via emerging debt.

- In our long-term thematics and trends allocation: While keeping a wide spectrum of long-term convictions, we will favour Climate Action (linked to the energy shift) and keep Health Care, Tech and Innovation, Demographic Evolution and Consumption.

- In our currency strategy, we are positive on commodity currencies:

- We are long CAD.