European equities: Mixed data

Economic data were mixed in November in Europe. On the positive side, the euro area PMI flash survey rebounded after three consecutive months of decline. Several countries have already reintroduced new mobility constraints to curb the spread of the virus. Together with inflation, these measures have weighed on consumer sentiment, which has decreased slightly in recent months, but remains at pre-Covid levels.

Economic data were mixed in November in Europe. On the positive side, the euro area PMI flash survey rebounded after three consecutive months of decline. Several countries have already reintroduced new mobility constraints to curb the spread of the virus. Together with inflation, these measures have weighed on consumer sentiment, which has decreased slightly in recent months, but remains at pre-Covid levels.

In the third quarter, economic activity was almost back to its pre-crisis levels. However, some sectors were still lagging the recovery, especially in Spain.

The improvement on the labour market should support consumption, and consumer confidence appears to be holding up pretty well for the time being. While mobility is expected to be affected by the last wave of COVID-19, the effect on Q4 activity should be relatively muted. Favourable demand expectations should support moderate growth in business investment.

Supportive EU-wide fiscal policies and the slow rebalancing of national public deficits should allow GDP (Eurozone) to grow by 4.3% in 2022, but discussions around the new budget rules are likely to be heated.

The ECB will be patient. While committed to ending PEPP purchases in March 2022, the PEPP should still be part of the ECB’s toolbox… as a matter of precaution. We expect no lift-off in 2022.

In terms of sector performance, over the last four weeks, we can observe that IT and healthcare suffered the most, while utilities and consumer staples were slightly positive.

Regarding Price-to-Book vs Return-on-Equity, we can observe that IT seems to be quite expensive, while energy and materials look rather cheap.

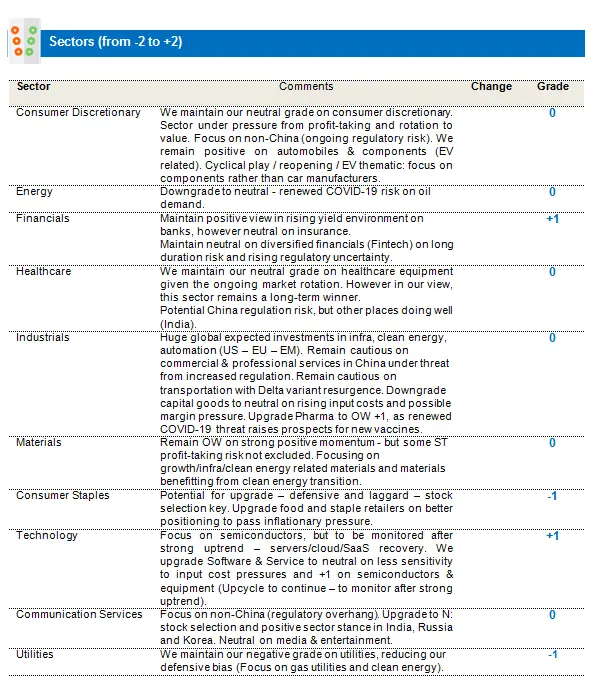

We have upgraded industrials (tactical call) and consumer staples (strategic call for 2022)

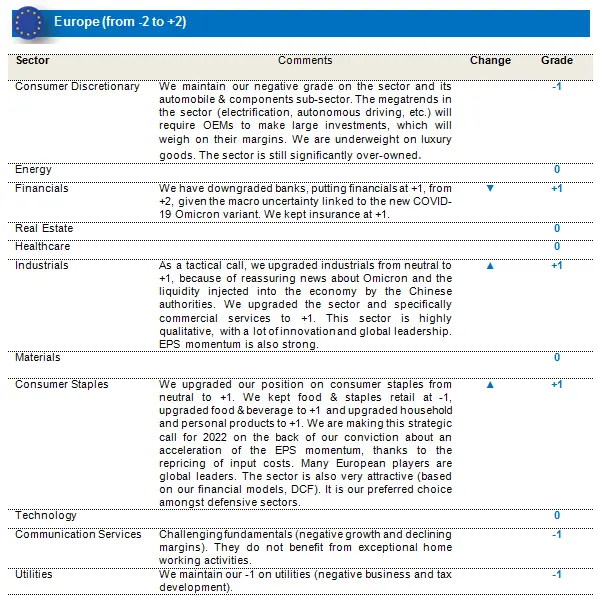

- We are upgrading our position on consumer staples from neutral to +1. We are keeping food & staples retailing at -1, upgrading food & beverage to +1 and upgrading household and personal products to +1. We are making this strategic call for 2022 on the back of our conviction about an acceleration in the EPS momentum, thanks to the repricing of input costs. Many European players are global leaders. Also, the sector is very attractive (based on our financial models, DCF). It is our preferred choice amongst defensive sectors.

- We remain underweight on both telecom services and utilities.

- As a tactical call, we are upgrading industrials from neutral to +1 because of reassuring news about Omicron and the liquidity injected into the economy by the Chinese authorities. We are upgrading the sector and specifically commercial services to +1. This sector is highly qualitative, with a lot of innovation and global leadership. EPS momentum is also strong.

- We downgraded banks at our exceptional meeting held on 26 November, from +2 to +1, putting financials at +1, from +2, given the macro uncertainty linked to the new COVID-19 Omicron variant. We kept insurance at +1.

- We remain negative on consumer discretionary. The sector is very expensive. We are more specifically negative on automobile and components, as the megatrends in the sector (electrification, autonomous driving, etc.) will require OEMs to make large investments, which will weigh on their margins. We are also underweight on luxury goods. The sector is still significantly over-owned.

US equities: Omicron: between hope and fear

US economic activity moderated slightly in the third quarter of the year, but the latest surveys continue to point to a strong economic momentum. Despite tensions in the manufacturing sector, the ISM Services Index has remained at an all-time high. Fiscal support has faded, but compensations have started to take over, resulting in firm services activity. Separately, President Biden finally signed a long-awaited $550 billion bipartisan infrastructure bill in order to upgrade America’s roads, bridges and railways and deploy electric vehicle charging stations across the country.

Inflation, in the meantime, remains high. The unique nature of the crisis has created unusual tensions on the labour market, which has induced wage pressures in low-paid industries. Candriam expects consumer prices tensions to linger, before easing in 2022. Still, with inflation risks rising, the Federal Reserve has prepared for a possible pivot. If needed, the central bank will accelerate its tapering to prepare for an earlier-than-expected rate hike. In this context, Candriam’s economists expect growth in 2022 to remain above its long-term trend close to 4% in 2022.

The discovery of a new COVID-19 variant, named Omicron, has brought pandemic and lockdown fears back to the surface over the past month. So far, nobody knows whether the new variant will significantly reduce the effectiveness of existing vaccines, which is clearly a key issue to monitor over the coming weeks. However, even in the worst-case scenario that vaccine efficacy is significantly reduced, drug companies seem confident that they could produce new vaccines within about three months. Also, new antiviral pills could help reduce hospitalisations within a few months.

So it is unlikely that, even in the worst-case scenario, equities would experience the same degree of volatility seen at the start of the pandemic. We are quite confident that the new COVID-19 variant will not have the same effect as previous ones, especially as it seems to be highly contagious, but cause less severe illness. We should know by the end of the year whether COVID-19, and in particular the Omicron variant, will materially disrupt our quite positive economic and market outlook for the coming two to three months.

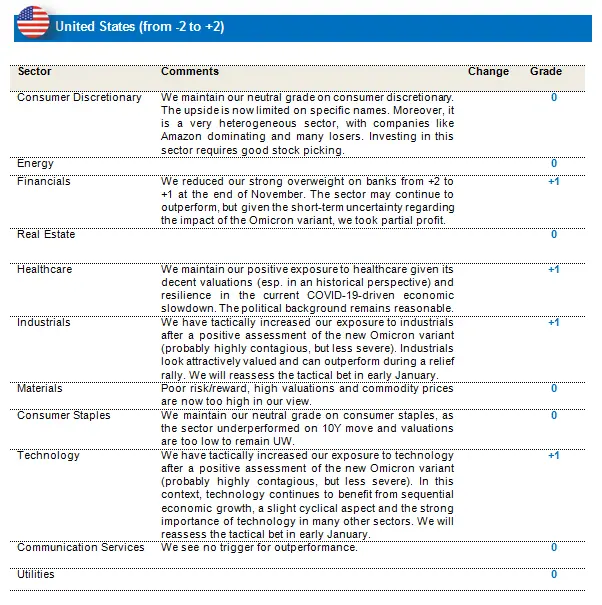

In this context, we have made no strategic changes. However, we have made some short-term tactical changes:

- Already at the end of November, we decided to reduce our strong overweight on banks from +2 to +1. We remain convinced that the sector can continue to outperform with higher expected long-term rates in the coming twelve months. However, given the short-term uncertainty regarding the impact of the Omicron variant on the macroeconomic environment and long-term rates, we took partial profit.

- We have tactically increased our exposure to both industrials and technology after a positive assessment of the new Omicron variant. If the variant indeed proves to be highly contagious but less severe, a short-term relief rally cannot be excluded. In this context, industrials look attractively valued, while technology continues to benefit from sequential economic growth, a slight cyclical aspect and the strong importance of technology in many other sectors. We will reassess the tactical bet in early January.

- We remain positive on healthcare. For us, this is clearly a GARP (growth at a reasonable price) sector and Biden’s healthcare plans are quite soft.

- We remain neutral on materials. The risk/reward is poor, valuations are high and commodity prices are now reaching their short-term high in our view. Most commodity prices are above pre-pandemic levels.

- We maintain our neutral grade on consumer staples, justified by low valuations.

- We remain neutral on consumer discretionary. For us, this is clearly a sector in which stock picking is vital.

Emerging markets post slight recovery with continuing regional divergence

November was another volatile month for EM equities. After starting the month on a relatively stable note, sentiment soon became risk-adverse as the Fed signalled a faster-than-expected wind-up of the current asset purchase programme. The news about Omicron, another “variant of concern” from South Africa but spreading in Europe and other regions too, added to market concerns. As investors looked for safety, MSCI EM declined by 4.1% (in USD terms, underperforming MSCI AC World by 1.6%), while US treasuries declined by 11bps to 1.44%, while the USD gained 2%.

Most major EM regions corrected over the month, with the exception of Taiwan (+2.6% in USD), thanks to the strong performance of the semi-conductor sector. The index’s largest weight by region, China, fell back to negative returns for November after a brief October recovery. It is worth highlighting the significant divergence of onshore Chinese equities (CSI 500 +3.3% for the month), while offshore China sentiment remained clouded with global uncertainties. Korea, too, ended the month in the red (down 4.6%), as new COVID-19 variant concerns, inflation worries and monetary and regulatory tightening kept equity returns under pressure. Indian equities saw momentum decline, with the region correcting by 3.1% due to inflation and tapering concerns. EM EMEA, which had been one of the better markets YTD, also shed a large part (-7.1%) of its gains, as energy prices declined and COVID-19 concerns lingered.

In commodities, oil (Brent) fell back below $70/bbl (down about 16.9% for the month), while most metals, from steel to copper, saw varying declines in prices, as worries over global growth came to the fore. EM currencies receded by 7.6% against the dollar index as investors sought safety.

Regional ratings change: Upgrade Taiwan, downgrade ASEAN and EMEA to neutral

Taiwan Upgrade:

The region remains relatively better positioned from an earnings growth perspective versus other EM regions. As risk of accelerated Fed tapering comes to forefront, higher quality earnings growth and supportive structural (cloud adoption) and emerging trends (metaverse) make us more constructive on the region. Continuing semiconductor tightness, despite a slight normalisation, adds to the positive outlook for index heavyweights.

ASEAN Downgrade:

Downgrade on renewed COVID-19 risk, risking delay in reopening parts of ASEAN. Also, the macro outlook is weaker for some ASEAN countries, especially in the case of an accelerated taper of asset purchases.

EM EMEA Downgrade:

Renewed COVID-19 risk for South Africa from the new variant. Geopolitical risk and decline in energy prices, weighing on the prospects of a Russian recovery. We remain constructive on other EM EMEA regions, including Poland and Hungary.

Changes to sector ratings:

Downgrade energy to neutral:

In view of renewed COVID-19 risks, the possible risk of mobility restrictions on oil demand, we are downgrading energy to neutral

Upgrade Pharma to 1:

With the new COVID-19 Omicron variant, demand for more vaccinations and increased pharma spends, we are turning more constructive on EM Pharma.

Outlook:

We continue to monitor a number of factors that are important in determining the outlook for EM equities and the portfolio. A key addition to these drivers in November was the risk from the Omicron variant, delaying the global recovery and changing the Fed’s stance towards inflation, with the US central bank hinting at a faster wind-up of the asset-purchase programme. Both these factors have called for caution in terms of stock selection and reducing risk at portfolio level. A few of these active changes have been implemented in the portfolio, including the addition of more quality stocks, with solid balance sheets, backed by sustained cash flows, and less dependent on global growth. From a regional perspective, we maintain a benchmark neutral weight in China, with a preference for onshore local shares versus the offshore H shares and no exposure to China ADRs. Overall, the portfolio continues to be well balanced and focused on structural growth stocks in EM, benefiting from tailwinds from local themes at play.