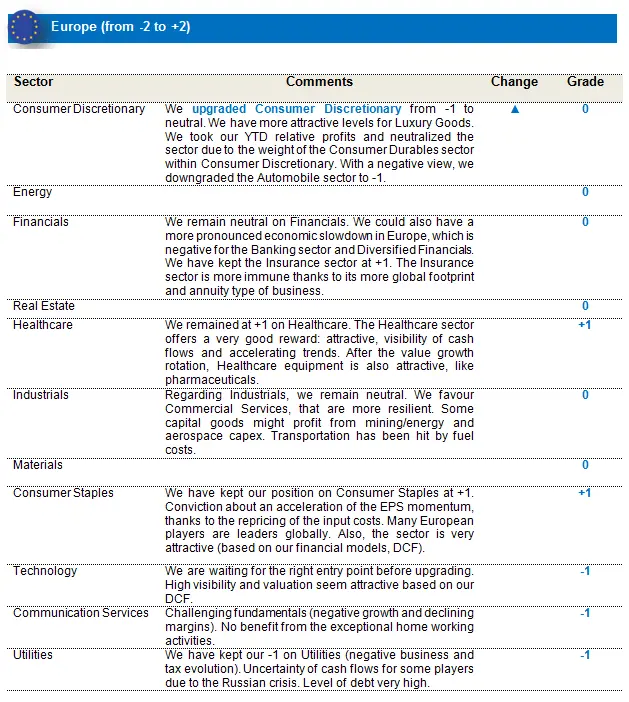

European equities: The impact from the war is starting to materialize

At the beginning of 2022, economic activity returned to its pre-pandemic level and the omicron wave had less of an impact on activity than previous ones.

At the beginning of 2022, economic activity returned to its pre-pandemic level and the omicron wave had less of an impact on activity than previous ones.

However, the impact from the war in Ukraine is starting to materialize:

- Energy prices have jumped and will add more than 2% to inflation in 2022.

- Consumer confidence has tumbled and could take a toll on consumption.

- New disruptions to global trade are likely to reinforce supply side tensions and to weigh on industrial activity.

Measures taken by governments and accumulated savings could help cushion the erosion of household purchasing power and allow GDP (Eurozone) to grow by 2.9% in 2022. However, a cut in natural gas delivery from Russia represents a major downside risk for growth.

The ECB is in a difficult position: while downside risks to growth from the Ukrainian war are mounting, the labour market is tighter than ever and inflationary pressures show no sign of abating.

In terms of style performance, over the last 4 weeks, Growth stocks continued to outperform Value stocks.

Regarding Cyclical vs Defensive stocks, the situation is mixed. It really depends on the sector.

In terms of sector performance, over the last 4 weeks, we have seen that Financials performed the best, together with IT and Consumer Discretionary. On the other hand, the Energy sector was the worst performer, being rather stable.

Regarding Price to Book vs Return on Equity, we have seen that, despite being the best performer over the last 4 weeks, the Financials sector remains one of the cheapest sectors. On the contrary, IT, also one of the top performers for the last 4 weeks, remains the most expensive sector.

UPGRADE OF CONSUMER DURABLES FROM -1 TO NEUTRAL

- We remain at +1 on Healthcare. The Healthcare sector offers a very good reward: attractive, visibility of cash flows and accelerating trends. After the value growth rotation, Healthcare equipment is also attractive, like pharmaceuticals.

- We remain neutral on Financials. We could also have a more pronounced economic slowdown in Europe, which is negative for the Banking sector and Diversified Financials. We have kept the Insurance sector at +1. The Insurance sector is more immune thanks to its more global footprint and annuity type of business.

- Regarding Industrials, we remain neutral. We favour Commercial Services, which are more resilient. Some capital goods might profit from mining/energy and aerospace capex. Transportation has been hit by fuel costs.

- We have kept our position on Consumer Staples at +1. Conviction about an acceleration of the EPS momentum, thanks to the repricing of input costs. Many European players are leaders globally. Also, the sector is very attractive (based on our financial models, DCF).

- We upgraded Consumer Durables from -1 to neutral. We have more attractive levels for the Luxury Goods companies after the selloff of February and early March. The sector is resilient in an environment of strong input costs and slowing global consumption. We took our YTD relative profits and neutralized the sector due to the weight of the Consumer Durables sector within Consumer Discretionary. The only industry within CDI with a negative view is the Automobile sector at -1. Therefore, we are neutralizing.

- We have kept our -1 on Utilities (negative business and tax evolution). Uncertainty of cash flows for some players due to the Russian crisis. Level of debt very high.

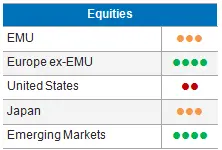

US equities: Recovering from the sell-off

US equity markets recovered from the sell-off they experienced at the end of February due to the Russian invasion of Ukraine. The crisis nevertheless continued to have a significant impact on oil and gas prices that have been quite volatile over the month. In the meantime, the Federal Reserve hiked its key interest rate for the first time by 25 bps to fight inflationary pressures. In this context, we recognize the relative outperformance of the energy sector, materials, healthcare and information technology. Financials didn’t benefit from an increase in long-term rates, while consumer staples underperformed.

From an economic perspective, the year got off on the right footing with activity indicators pointing to a continuation of above-trend growth. High inflation, rising interest rates and uncertainty surrounding the conflict between Russia and Ukraine, have nevertheless started to impact manufacturing activity indicators. The latest ISM manufacturing for instance was a bit disappointing in March due to some supply-chain tensions, as shown by component suppliers’ deliveries, and rising input prices. This is in line with our expectations. Although US trade exposure to both Ukraine and Russia is limited, the war in Ukraine will probably lead to new supply-chain interruptions and hold back production.

The weakening in economic activity indicators seems nevertheless limited to the Manufacturing sector for the time being. Indeed, consumption remains firm, despite ending fiscal supports, as disposable income gives no signs of losing momentum. The fading fiscal support and rising energy prices that weigh on households’ purchasing power are currently compensated by continuing job creations and accumulated savings.

In the meantime, the US central bank hiked its key interest rate for the first time, as expected by 25 bps, making clear that further increases will be needed. The median voting member of the Federal Reserve now expects seven hikes this year and four next year.

In this context, growth in 2022 should remain moderately above trend in 2022 (around 3%) with higher inflation as the most important downside risk to our main scenario.

In the meantime, the earnings season for the first quarter of 2022 is about to kick off. Before the start, we recognize that earnings revisions in the US are slightly negative, but not dramatic.

Most US sectors are expected to post healthy earnings growth again and consensus expectations count on almost 9% earnings growth throughout the entire year 2022. That expected earnings growth is in line with economic growth of around 2.5% and can be seen as too cautious.

As a result of the expected earnings growth for 2022, the US’ 12-month forward price/earnings remained slightly below 20, which is still above its long-term median.

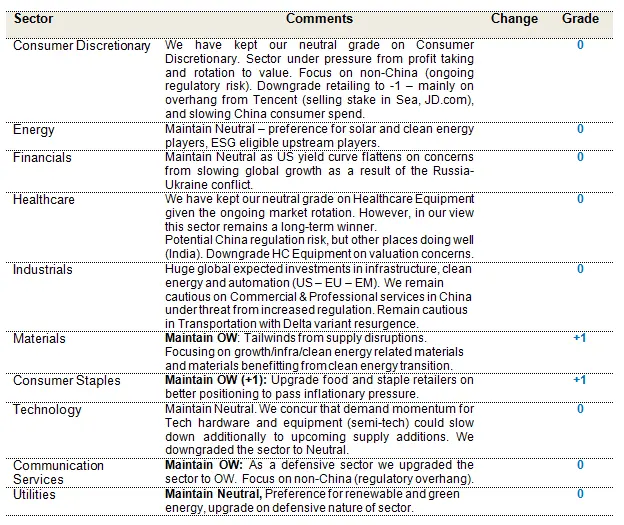

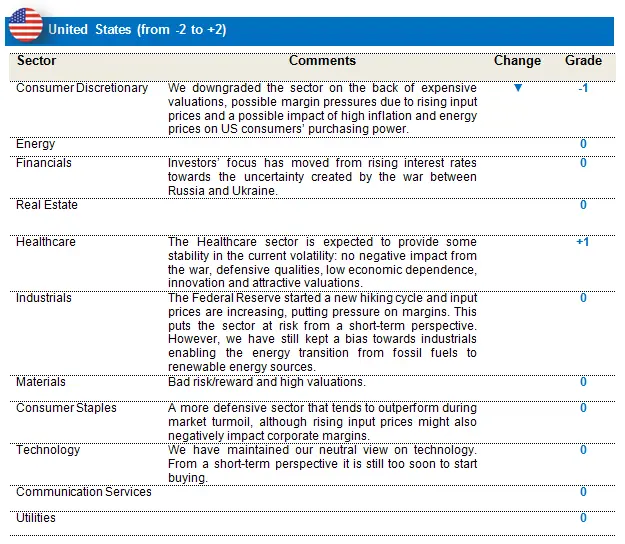

DOWNGRADE OF CONSUMER DISCRETIONARY FROM NEUTRAL TO -1

High inflation, rising interest rates and a lack of visibility due to the war in Ukraine, urge us to remain cautious and a bit more defensive. In this context, we have downgraded consumer discretionary to -1 from neutral. Healthcare remains our sole positive sector conviction on top of increasing stock picking importance, while keeping in mind that reactivity will nevertheless be crucial in these rapidly evolving market circumstances.

- We have downgraded Consumer Discretionary to -1 from neutral. We recognize that the sector rebounded strongly in March and has become quite expensive at more than 30 times expected earnings for 2022. In addition, Consumer Discretionary is vulnerable to increasing input prices and might thus face margin pressures in a context in which the US consumer’s purchasing power might also be impacted by high inflation and energy prices.

- We have kept our +1 on the Healthcare sector. The Healthcare sector is expected to provide some stability in the current volatility. The absence of a negative impact coming from the Russia-Ukraine conflict, its defensive qualities, the low dependence on economic conditions and the advancing innovation in all Healthcare segments stand out in this environment. For us, Healthcare is clearly a GARP sector with positive earnings and an attractive valuation.

- We have kept our neutral grade on Consumer Together with Healthcare, this is a more defensive sector that tends to outperform during market turmoil, although rising input prices might also negatively impact corporate margins.

- We have kept our neutral grade on Financials. Although the sector can still benefit from the support of higher interest rates from a mid-term perspective, investors’ focus has moved in response to the uncertainty created by the war between Russia and Ukraine.

- We have maintained a neutral grade on I With a Federal Reserve that has started a new hiking cycle and increasing input prices, and thus margin pressures, the sector is at risk from a short-term perspective. However, we still keep a bias towards Industrials enabling the energy transition from fossil fuels to renewable energy sources. The Ukrainian situation has resulted in a jump in energy prices and an increasing search for more energy independency, accentuating the importance of the energy transition. This will lead to an accelerated substitution of fossil fuels, energy efficiency investments and increased capex in other renewables and hydrogen.

- We have maintained our neutral view on Technology. From a short-term perspective it is still too soon to start buying. From a mid-term perspective, we still see value in the Technology sector, that isn’t overly expensive. The sector continues to benefit from sequential economic growth, a slight cyclical aspect and the strong importance of innovative technology in many other sectors. In addition, several sub-segments, such as semiconductors, will benefit from a lengthened cycle on the back of the current shortages.

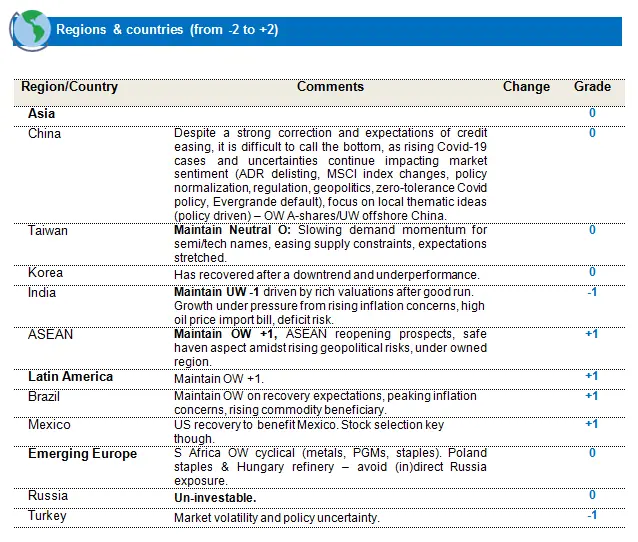

Emerging Markets: Risk off continues in Emerging Markets

Emerging markets saw muted equities performance for March, ending lower by 2.5% (in USD, all % returns in this section are in USD returns) against DM equities, +2.5% gain for the month. The decline was led by heavyweight China, where sentiment remained cautious with worries around slowing growth compounded by rising Covid cases and lockdown announcements in the key services and manufacturing hubs of Shanghai and Shenzhen. In a volatile month, that eventually saw the Chinese Government’s reassurance of policy support to stabilize growth and markets, MSCI China still ended the month lower by 8%. Ex-China, a number of concerns continued to weigh on equities returns, including the ongoing Russian invasion of Ukraine, rising commodity prices and inflation prints, and the FED moving to end its bond purchase programme and starting the rate hiking cycle with +25 bps, with as many as 7 expected hikes for the year. As 10-year treasuries gained, inching closer to 2.5% (before ending the month at 2.34%), the dollar continued to strengthen (DXY index up by 1.7%), adding to headwinds for EM returns.

Rising commodities did however provide some tailwinds for LATAM markets that remained the strongest performing markets for the month (+12.2%) as well as YTD (+26.1%). Within Asia, Taiwan also corrected by -2.5% as China slowdown worries and peaking global growth concerns spilled over to the region. South Korea saw the outcome of presidential elections, with a newly elected government, raising expectations of relaxed regulations on the Internet and Banking sectors. Korean markets ended the month flat with -0.2% for the month, but still lower by -10% for the quarter. India rebounded (+3.6%) following the sell-off in February, as concerns around rising inflation subsided and domestic demand remained strong. EM EMEA saw negative returns, as Russia was removed from the MSCI EM index, following its inability to meet market accessibility conditions.

Changes to Regional views:

No major changes to our regional views.

In a broader sense, given the late cyclical views, we maintain neutral/underweight views on regions with high reliance on commodity/energy imports, that are at extended valuations or at risk from peaking global growth.

At the same time, we have a relative preference for commodity/energy exporting regions (LATAM, South Africa and parts of ASEAN) that are seeing tailwinds from higher commodity and energy prices.

Changes in sector ratings:

Upgrade Household & Personal Products in Staples to Neutral (0):

In line with the broader upgrade of Staples we moved the Household and Personal Products sector to neutral.

We continue to remain cautious on the outlook for EM equities in the face of continuing uncertainties, including the ongoing Russian invasion of Ukraine, with little evidence of de-escalation, and FED tightening into a slowing global growth environment. On a relative basis, however, we remain optimistic for parts of EM equities, particularly key commodity exporting regions, including LATAM, South Africa and ASEAN, that remain well positioned to benefit from elevated commodity prices. At the same time, for index heavyweight China, following the prolonged market correction since February 2021, the risk premium currently stands at the highest levels in a long time, pricing a lot of the risk from geopolitical concerns to consumption slowdown. Any signs of policy support and recovery in consumption could turn the sentiment positive for the region. We remain neutral and selective as we wait for evidence of policy support and easing.

More broadly from a portfolio positioning perspective, we continue to maintain a balanced portfolio approach complementing sustainable growth beneficiaries in EM with selective exposure on Energy, Materials and Financials. In view of the increased geopolitical risks, we have added slightly to the defensive exposures too, by adding to quality Telecoms and Utilities.