This article was produced in conjunction with Alexis Midol, Associate Director at Kartesia

Financer of Growth, Creator of Jobs: How Private Debt Supports SMEs and the Real Economy

Private Debt Helps Fuel the Economy

The Draghi report[1] on EU Competitiveness and others[2] outline the need for private capital to enable small, growing, and innovative firms. These economists look to small- and medium-sized enterprises (SMEs) to enhance the competitive position of the EU in the global economy.

Policymakers and researchers often mention the financing needs in terms of venture capital and private equity. But growing businesses need debt financing, too, and the ownership dilution that comes with every new round of equity financing for a small firm can rapidly reach the limits its founders will accept.

Banks are not able to provide all the debt financing needed for these growing firms. Banks have overall capacity constraints on their use of capital, making lending to SMEs increasingly difficult. Banks are also capped by regulators in the proportion of their loan books which can be lent to any single industry. Further, they are hesitant to lend to some of the ‘asset-light’ technologies that the EU sees as crucial in the drive to improve Europe’s competitive landscape.

Adaptable to Growing Companies

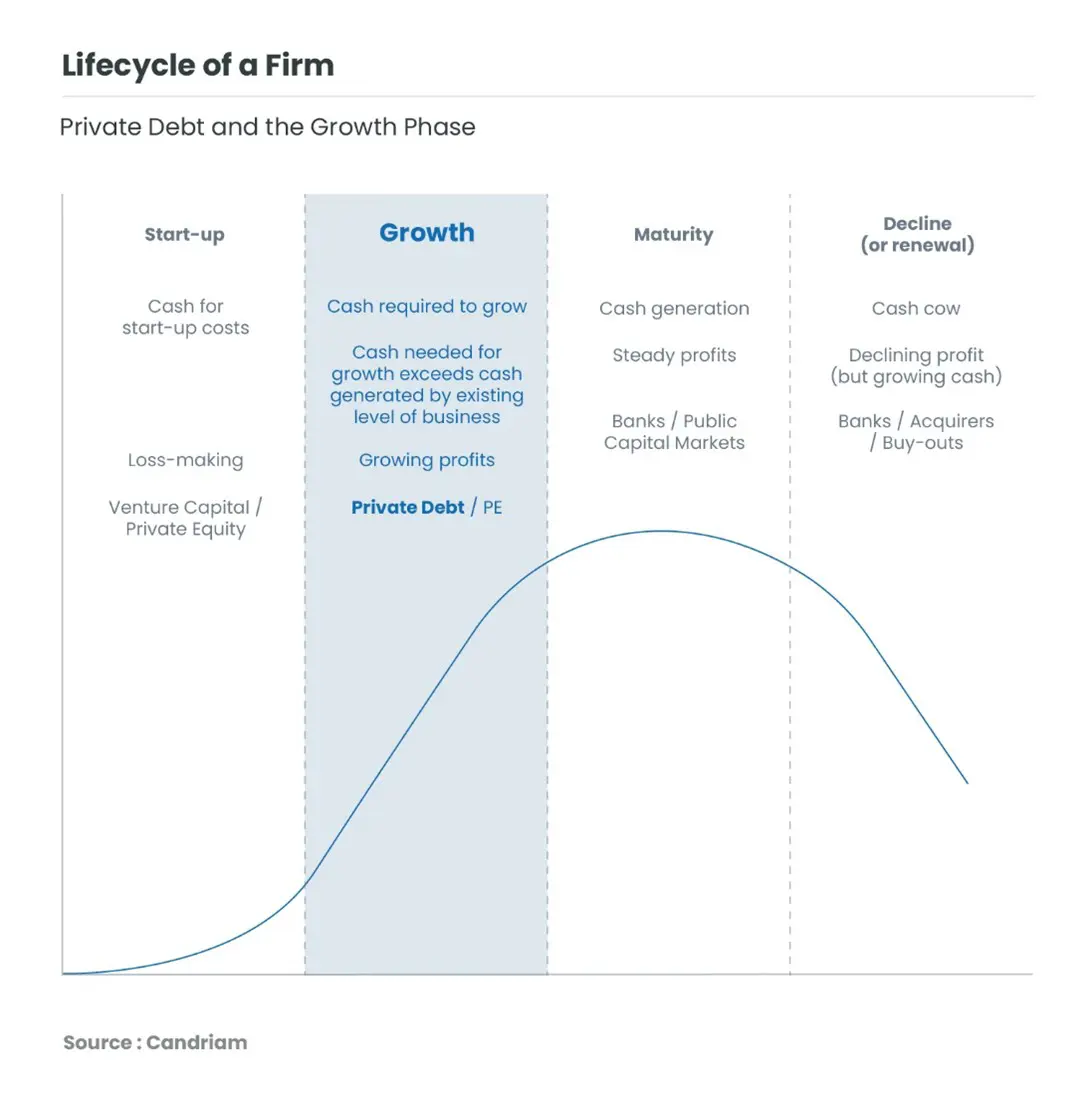

Rapidly-growing companies need financing to support their (also rapidly-growing) working capital needs. For rapid growers, working capital is not just a seasonal need, but a permanent funding needs as long as the growth phase continues – hopefully a number of years.

For longer-term financing, banks loans typically require amortization, in which repayments begin early in the life of the loan. Prudent for the bank, and practical for larger, cash-generative, or mature businesses, amortization does not suit growing firms which require capital during their high-growth phases. This structure can choke the prospects of rapidly-growing companies who are consuming cash both for working capital and for fixed assets and other long-term investment in their growth.

Private debt helps fuel the growth of small- and medium-sized enterprises which either cannot access public markets, or choose not to. Private debt is often structured as a bullet repayment at the end of the term, with interim interest payments. This helps young, growing firms plan without fear that a change in lending practices may interrupt their growth and investment plans.

Intangible Support

In addition to funds, the SMEs that drive economic growth often need help managing their growth. Private debt managers, like private equity and venture capitalists, may also provide business support. On a general level, private lenders can advise on corporate governance, suggest improvements in internal monitoring, and help establish the environmental and social governance and reporting that European investors increasingly expect. On an industry sector level, many private debt managers, just like venture capitalists and private equity managers, specialise in particular industries or technologies, with in-house specialists who can provide directly relevant consulting to the SMEs.

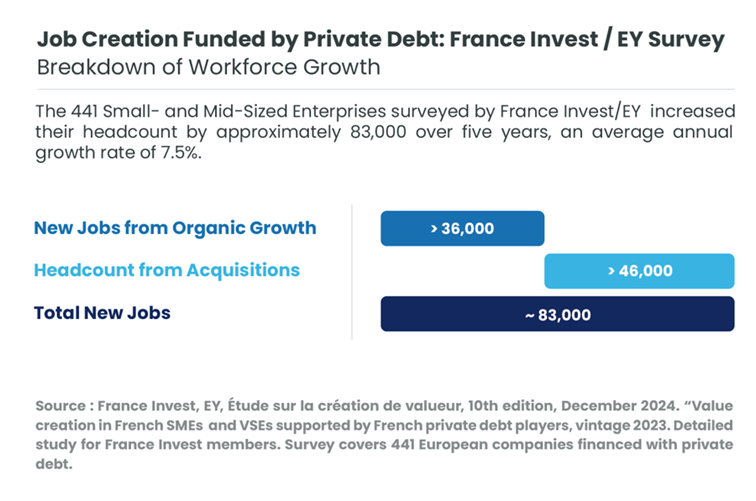

Growing Businesses, New Jobs

Access to finance is a pre-requisite to growth and job creation. Our private debt partner Kartesia has found that the growth of their portfolio companies exceeds that of the overall economy in almost every instance – boosting job creation. Many of these young, growing businesses are part of the service economy, heroes of job creation.

A New Branch to the Tree?

The geopolitical situation is providing incentive at many levels for ‘re-sourcing’. SMEs may find new customers who wish to diversify their offshore suppliers with an additional supplier closer to home. Governments are supporting onshoring. This may be good news for growth of SMEs, and for job creation in some of the industry clusters that the EU hopes to build. If this trend has staying power, private debt will once again be there to fuel economic growth.

Investing in the Real Economy: Enter the ELITF

With the new European ELTIF[3] investment product in Europe, asset managers can now slice portfolios of these long-term investments in sizes for individual investors. The EU only allows asset managers to make these available to those who are able to invest a portion[4] of their savings in illiquid assets and understand that the investment will be for a number of years, in return for a steady expected income and a lump sum at the end.

Your investments can support job creation. Interested? We’ll be back with more on private debt!

[1] Draghi, Mario.The future of European competitiveness, European Commission, September 2024.

[2] Dahlqvist, Fredkrik et al. Private capital: The key to boosting Europan competitiveness. McKinsey & Company, April 2025.

[3] ELTIF = European Long-term Investment Fund, ELTIF

[4] Less than 10%. There can be no assurance that the investment objective of the investment product will be achieved or that investors will receive a return. The possibility of partial or total loss of the investment exists.