Big numbers. Big, big numbers. For investors, too.

Someone will be producing products, infrastructure, and software services to address the issues related to climate change. Let's find those companies!

In 2013, McKinsey© estimated that upfront capital investment of Euro 530 billion per year would be needed by 2020 to avert climate change.[1] In October 2019, Forbes quoted a report from a major brokerage house that $50 trillion will be required in five key areas of technology[2] by 2050…roughly three times as much investment per year as McKinsey estimated seven years ago.

Nailing down a specific figure is not what matters. When the Intergovernmental Panel on Climate Change, the IPCC, publishes forecasts, the authors stress that their estimates incorporate numerous assumptions. Consensus holds not only that the investment figure required to address the challenges of climate change is large; consensus also holds that the longer investment is delayed, the larger that investment will need to be.

"Climate change is one of the greatest challenges of our time"[3], said the leaders of the G20 in a joint statement in November 2015.

For investors, climate change may also be one of the greatest opportunities of our time.

Climate actions can be of two main types – mitigating potential future climate change, and adapting to climate change problems which have already arisen. The sizes of these markets are inter-related. The more governments delay climate mitigation legislation and investment, the more adaptation spending rises, and the more quickly that market develops.

Certain mitigation businesses immediately spring to mind. Cutting emissions through solar power and other renewable energies, electric cars, and improved mass transport. New technologies, such as new battery and other storage technologies to store solar, wind, and turbo-generated power to use when the sun isn't shining. Agricultural methods which use less water, and emit fewer greenhouse gases (GHGs). Greener buildings. Some companies provide services; for example, collecting data on traffic flows in cities and altering it to reduce congestion, reducing GHGs in the process.

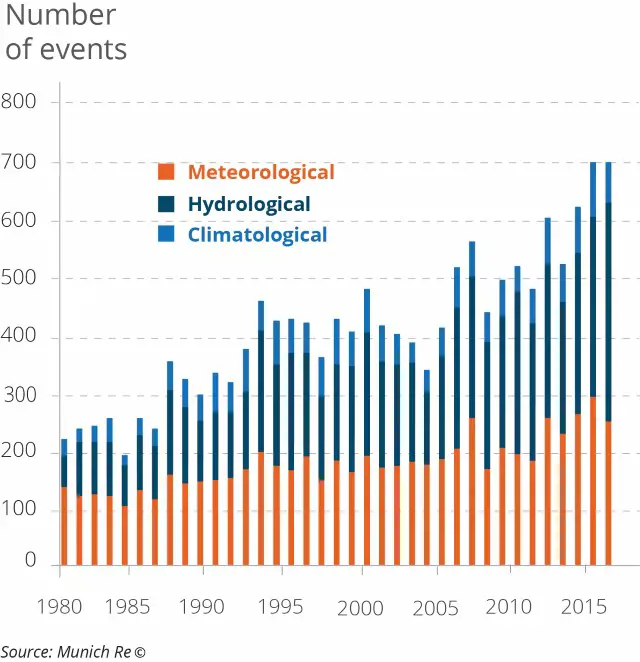

Climate adaptation presents the second huge opportunity category for investors. Climate change is already here. The number of weather-related natural disasters doubled between 1990 and 2018, according to insurance company Munich Re. Assuming an orderly energy transition, we still have to adapt.

Extreme Weather Events are More Frequent

Number of Extreme Weather Events by Type, 1980 to 2016

Adaptation is already in progress. More insulation and vegetative 'green' roofs in areas where temperatures are less comfortable than before. Building codes requiring more energy-efficient homes and offices, and even the return of simple solutions such as working shutters on windows. Seed companies are developing new strains of drought-resistant crops for countries which are suffering from lack of water. Cities such as Copenhagen and Tokyo are building 'sponge' or other flood control, or stadiums on stilts as flood risks rise. These costs may be borne through public funding, but often a company is designing and building this infrastructure.

We have been discussing adaptation under an orderly energy transition. On 5 November, 2019, the United States gave formal notice of intent to withdraw from the 2015 Paris Agreement – the earliest possible day to do so under the terms of the agreement. What if the global energy transition becomes chaotic – a sad state of affairs, but might it result in an even larger investment opportunity in climate adaptation?

Under a chaotic energy transition, more would be spent on adaptation, and more quickly. There could be additional negative impacts on developing nations, through crop failures and water supply problems. In richer countries, homeowners might be expected to invest more in flood control, rebuild with better materials, add air-conditioning or insulation, change their landscaping if water is too expensive, add irrigation to farmlands that were previously naturally supplied with water.

Investment opportunities today

Yes, governments are lagging behind where the IPCC says they need to be. Yes, the biggest figures mentioned always seem to be about 2030, 2040, or 2050. Even so, the size of today's market is considerable. Under one scenario to reach the 2⁰ goal[4], more than 40% of GHG reductions would be derived from improvements in power production, 20% from transport improvements, and 10% from reduced building emissions.

Today, 26% of global power generation is produced by renewables. That is expected to grow by 1,200 gigawatts, or 50%, in five years – equivalent to the total power capacity of the United States in 2018[5]. That's significant growth of an already-sizeable market. That's a lot of solar panels, wind turbines, design fees… and investment opportunities.

Today, there are an estimated 5.2 million electric vehicles in service globally, as of the end of 2018[6], and a forecast of almost 20% compound annual growth over the next decade. In the UK, for example, the sales of electric and hybrid vehicles, roughly 7% of the market, grew 28% in the first 7 months of 2019. Meeting environmental goals may be a long way off, but the market for these vehicles is established and growing[7].

Today, new building codes are being put in place. New builds face new requirements, beginning now. From 2020, EU regulations require new buildings to be 'nearly zero energy'. The UK is currently proposing new building codes, some of them expected for the end of 2020[8], 12 months from now.

Today, financial market support for carbon-emitting businesses is declining. In November 2019, the European Investment Bank, the EIB, announced it will no longer fund fossil fuel projects, removing $2.2 billion of funding annually for these projects. As throughout history, older technologies are replaced by newer ones.

The future is now. Investments in climate change can present a unique investment opportunity.

[1] "Market Report Series: Renewables 2019": October 2019, IEA / International Energy Agency, https://www.iea.org/newsroom/news/2019/october/global-solar-pv-market-set-for-spectacular-growth-over-next-5-years.html, accessed 19 November, 2019.

[2] "Global EV Outlook 2019", IEA, https://www.iea.org/gevo2019/, accessed 20 November, 2019

[3] "New car market declines in July but pure EV registrations almost triple", August 2019, SMMT, Society of Motor Manufacturers and Traders, https://www.smmt.co.uk/2019/08/new-car-market-declines-in-july-but-pure-ev-registrations-almost-triple/, accessed 19 November 2019, and Candriam analysis.

[4] IEA World Energy Outlook 2017, Candriam Climate Action Fund Review analysis.

[5] " Pathways to a low-carbon economy: Version 2 of the global greenhouse gas abatement cost curve; McKinsey & Company", September 2013. https://www.mckinsey.com/business-functions/sustainability/our-insights/pathways-to-a-low-carbon-economy

[6] "Stopping Global Warming Will Cost $50 Trillion: Morgan Stanley Report", Forbes, 25 October, 2019, https://www.forbes.com/sites/sergeiklebnikov/2019/10/24/stopping-global-warming-will-cost-50-trillion-morgan-stanley-report/#498bb5b851e2, accessed 12 November, 2019.

[7] "G20 Leaders' Communiqué", Antalya Summit, 15-16 November 2015. https://www.consilium.europa.eu/media/23729/g20-antalya-leaders-summit-communique.pdf

[8] "Government reveals plans for emission-reduced homes to reach climate targets", October 2019, Climate Action, climateaction.org, accessed 19 November 2019.