The surprising election of US President Donald Trump, or the Brexit vote and its continuing saga, make one wonder whether 2016 may have marked the peak of globalization. Nations now seemingly wish to sever multi-national links and treaties and retreat to home markets, potentially heralding a new era of protectionism -- or at least, some “de-globalization”.

Will the return of nationalism end the growth streak for emerging markets?

If we are at the dawn of a new era, what will it look like? For decades, the growth of emerging economies has lifted bourses. Will that be a thing of the past?

Conversely, financial markets are increasingly correlated, as we discovered during the Financial Crisis. Will correlation increase just as growth slows? Is there a two-headed dragon in the cave?

The past: Those were the days….

The end of WW II marked the beginning of extraordinary economic growth around the world, and of unprecedented globalization. From Bretton Woods in 1944, through the the entry of China into the WTO in 2001, history has marked 75 years of extraordinary changes in the interconnections of economies.

The world has been transformed. Global growth has been strong, and income distribution has reached levels of equality unseen in millennia. Billions of workers have been integrated into what is now a global economy, finally enjoying the productivity benefits of 'comparative national advantage' first imagined in the early 19th century. Around the world, affordability of everyday goods was enhanced as the production of goods and services migrated to the lowest-cost geography. Inflation and interest rates declined and stabilized.

Emerging nation populations have benefitted. But while globalization has enhanced the development and income growth of many emerging markets, in the developed nations, the industrial working class saw their jobs migrate to lower-cost countries. The lower middle class in developed nations suffered as labor’s share of economic growth – that is, wages – declined sharply. In the developed nations, economic growth allowed income from capital markets and company profits to soar.

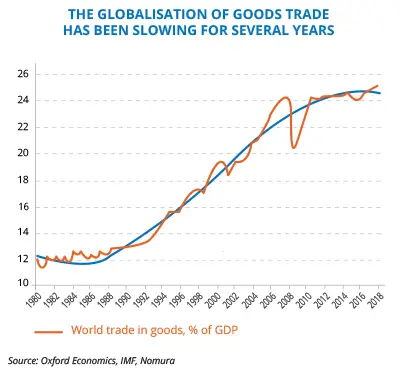

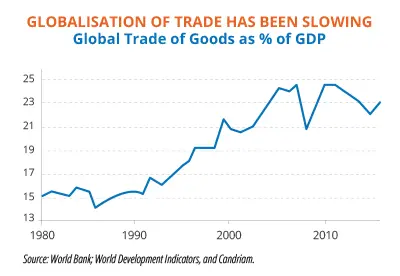

The present: A shift towards services

Wages are converging among developed and emerging nations, becoming a less significant element in global trade. Rising incomes in the EM nations mean that goods once manufactured for export are now also sold and consumed in their country of origin. The ‘trade intensity’ of physical goods is declining.

Services, such as communications and technology, have been growing faster than manufactured goods. The US is running a substantial surplus of traded services. Further, a substantial part of the value of manufactured goods is now contributed by embedded services, such as R&D, design and engineering, and logistics. Technology is also reducing previous EM advantage of cheap labor, and increasing demand for skilled workers, in both emerging and developed countries. Re-shoring production back to the developed world is unlikely to solve the problems of unemployment and stagnant real incomes for its middle class.

These trends, together with the need of shorter time for goods to market and environmental considerations, are forcing companies to 'regionalize' supply chains. Production and consumption of goods and services are speeding up, and moving geographically closer. Competing economic and even geo-political trading blocks, led by the US and China, may be created by trade frictions, creating new winners and losers among nations, but particularly among companies.

The Future: Regionalisation and established local consumers?

If globalization has benefitted global productivity, especially for emerging markets, could the de-globalization and regionalization put these markets into reverse?

We expect emerging nations will continue their progress, each in its own way, but not as a homogenous group. Those that have taken the opportunity to restructure their economies, and now produce higher-value-added products and services, will thrive. They have created their own middle class-driven consumer markets, and have greater means to survive and adapt.

China, for example, is likely to continue to grow, albeit at a slower pace than in the last few decades. We also expect the trade war will force China to become less dependent on the US and Europe, speed up its technological development, stimulate its consumer and services markets, and create regional cooperation with other countries.

Whether other emerging countries will continue to grow and develop will depend on their ability to adapt to the potential creation of a few global competing economic blocks, led by the US and China. This also goes for companies. Either they will grow as domestic players (for example Tencent, HDFC Bank), or they will have to become international leaders, exporting and producing goods and services abroad. Samsung Electronics, Alibaba and others are some of many examples.

For the financial markets, this also means that the trend of synchronization and correlation of emerging financial markets with the developed equity markets, which has increased during the last decade, will likely diminish as a result of economic cycles that will gradually widen again as part of the de-globalization trend.

Performance dispersion between winners and losers should rise within the emerging markets equities class. We expect performance disparities to rise not only between sectors and markets, but even more so between individual companies. Even modest 'de-globalization' is likely to generate growing idiosyncratic differences in development, management quality and ability to adapt.

While this will undeniably bring uncertainty and new challenges for the emerging markets investor, at the same time it will create great opportunities and an additional argument for an active investment approach in managing emerging markets equity portfolios.

Increased stock-picking, and decreased correlation? "The Times, They Are A-Changin' ".