European equities: positive equity flows

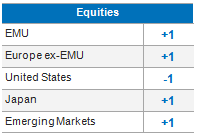

European equities closed May up. After a relatively slow start, vaccination rates in Europe have picked up. Across the major economies, vaccines are being provided to around 0.8% of the population per day – in line with the UK. At this pace, the Eurozone will soon have provided at least one dose to the over-50s. Prospects of a strong growth rebound this year have therefore risen and this helped European equities in May.

In EU countries, the epidemic also seems to be coming under control. However, they still lag the United States by three months.

Q1 2021 GDP was weak, due to sanitary restrictions. However, the latest monthly surveys point to stronger growth ahead. Rebuild inventories and the pick-up in demand will boost production and business investment. Eurozone PMIs for May were also positive. While manufacturing has been recovering since last year, the rebound in the services sector had been delayed by ongoing restrictions. Vaccinations appear to now be boosting confidence in the services sector, as evidenced by the improvement in the services PMI business survey to a level above 55.

The Own Resources Decision has been ratified by all Member States. EU funds should spur public investment. National budgets will remain supportive in 2021 and, for the coming years, the pace of rebalancing looks reasonable.

Although inflation has increased, a sustained acceleration seems unlikely. Price pressures facing businesses grew, with the input-price component of the manufacturing business surveys hitting record highs. It should come as no surprise, then, that inflation slightly rose by 0.6% m/m.

We expect GDP to grow by 4.9% in 2021 and therefore be close to trend by year-end. Consumer confidence is now rebounding and consumption should accelerate. Our scenario foresees most of the population being vaccinated by the end of 2021. Implementation of the Next Generation EU plan will have started by year-end.

For several weeks now, equity flows have been positive in Europe, a sign of the region's renewed attractiveness to investors.

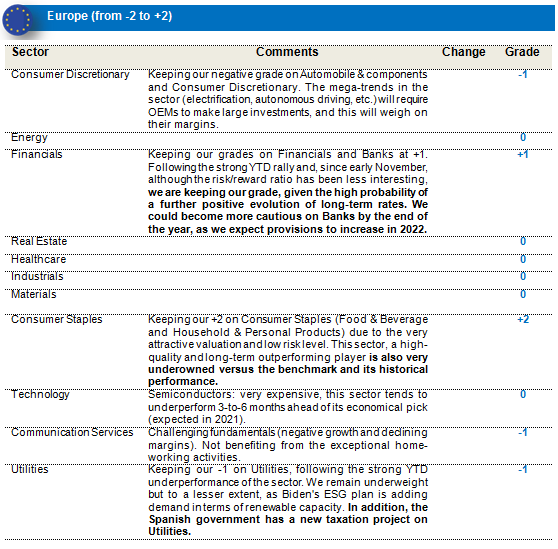

In terms of sectors, Consumer Discretionary was the best performer, following the lifting of COVID-19 constraints. Utilities, on the other hand, was the worst performer. In terms of style, Growth outperformed Value.

Since the last committee, our grades on Utilities (-1) and Communications Services (-1) have paid off. On the other hand, we lost out from our Consumer Discretionary performance (-1).

Despite volatility on the stock market, our positioning will again favour the growth/quality investment style in the coming months, by capitalising on more attractive valuations. We will look for economic segments that are set to accelerate in the coming years against a backdrop of new regulations, ESG or otherwise, and innovation. Finally, value is the pain trade now, with the rotation underway for more than six months. In our view, we should be approaching the end of this rotation period.

All our grades remain unchanged.

Those on Financials and Banks remain at +1. Following the strong YTD rally and, since early November, although the risk/reward ratio has been less interesting, we have kept our grade, given the high probability of a further positive evolution of long-term rates. We could become more cautious on Banks by the end of the year as we expect provisions to increase in 2022.

That for Automobile & components and Consumer Discretionary remains negative. The mega-trends in the sector (electrification, autonomous driving, etc.) will require OEMs to make large investments and this will weigh on their margins.

That for Utilities remains at -1, following the strong YTD underperformance of the sector. We remain underweight but to a lesser extent as Biden's ESG plan is adding demand in terms of renewable capacity. In addition, the Spanish government has a new taxation project on Utilities.

That for Consumer Staples (Food & Beverage and Household & Personal Products) remains at +2, due to the very attractive valuation and low risk level. This sector is a high-quality and long-term outperforming player, also very underowned versus the benchmark and its historical performance.

US equities: Technology and Consumer Discretionary under pressure

US equity markets closed the month slightly higher, despite the strong earnings performance, as the technology and consumer discretionary sectors came under pressure. The ongoing vaccine rollout is allowing many economies to gradually reopen, which, in combination with sizeable fiscal support, particularly in the US, is supporting a big bounce back in economic activity. Nevertheless, markets were constrained in May by concerns that upside data surprises might result in more persistent inflation that could force central banks to bring about a premature end to the growth rebound.

In advanced economies, the epidemic seems to be coming under control. On both sides of the Atlantic, COVID-related hospital bed occupancy has significantly fallen.

With the ongoing economic normalization, inflation has accelerated. The US PMIs for manufacturing and services both beat expectations in May, rising to their highest levels on record. PMI details showed not only that consumer demand remained buoyant but also that businesses were facing rising input costs. Headline inflation rose to 4.2% y/y for April. Although a rise in inflation was expected, given the fall in prices this time last year, even month-on-month inflation rose 0.8%, well above consensus expectations. However, with half of core inflation barely linked to the cycle, inflationary pressures are likely to slowly recede. Finally, despite companies having difficulties filling positions, wage pressures are still far from extreme.

Most domestic demand components were oriented upwards in Q1. While residential investment should gradually slow down, given the low inventories and the increase in interest rates, business investment should continue to support growth.

The two components of the Build Back Better programme are now being debated. On top of the $2.2 trillion infrastructure plan, the Biden administration has released the $1.8 trillion American Families Plan, which aims at supporting education and families. These plans should be financed through an increase in corporate and high-income taxes.

Low-wage workers have been particularly hit by the crisis (more so than in previous recessions). However, fiscal measures have helped support their consumption and increase their savings. In 2021-22, only part of the “under-consumption” savings are expected to be spent. As “maximum employment” is still a long way ahead, the Fed should remain accommodative.

We expect GDP to grow by 6.5% in 2021 after a 3.5% contraction in 2020. Our scenario foresees most of the population being vaccinated by the summer of 2021, allowing a gradual end to social distancing. Fiscal measures support the recovery.

The US remains the most expensive region, with an average P/E of 21.8. The region is still ahead of Europe, EM, the UK and Japan in terms of its economic cycle, thanks to its powerful vaccination campaign.

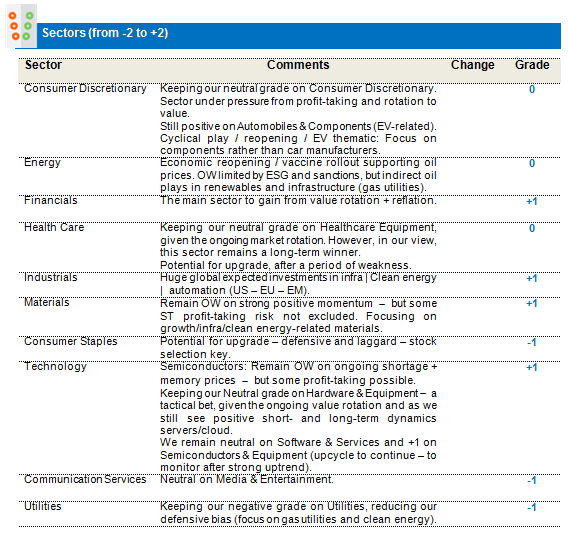

In terms of sectors, Energy was the best performer, given its low valuation and the increase in the WTI. Materials, on the other hand, underperformed, with some profit-taking occurring after its recent outperformance. In terms of styles, the growth-stock outperformance from April was completely swept away by the outperformance of value stocks in May. Growth sectors such as IT (especially the software part) underperformed in May.

Since the last committee, all our grades have paid off, our best contributors being our strong overweight on Banks - supported by upward pressures on inflation and interest rates - and our underweight on Telecom Services. On the other hand, we lost out from our +1 on Healthcare, a sector coming under pressure with the advance of the vaccination campaign (less COVID-19-related revenue).

Despite upward pressures on inflation and long-term interest rates, we are convinced that the outperformance of the Value style is a short-term phenomenon and that the Quality/Growth style should outperform in the medium/long term. Value is the pain trade now, as the rotation has already been largely consumed.

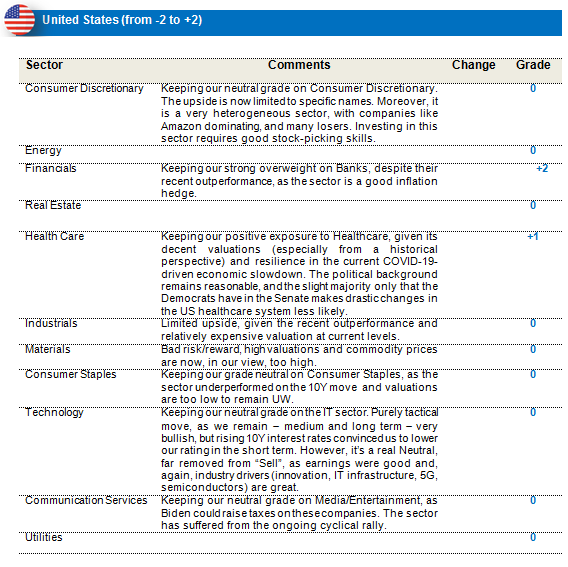

All our grades remain unchanged, as we await greater visibility.

We have maintained our grade on Materials. Bad risk/reward, high valuations and commodity prices are now, in our view, too high, most commodities being above pre-pandemic levels.

We have kept our strong overweight on Banks, despite their recent outperformance, as this sector is a good inflation hedge.

We have kept our neutral grade on IT, as it is still too early to increase our exposure. However, this is a purely tactical move, as, although we remain - medium and long term - very bullish, rising 10Y interest rates convinced us to lower our rating in the short term. However, it’s a real Neutral, far removed from “Sell”, as earnings were good and, again, industry drivers (innovation, IT infrastructure, 5G, semiconductors) are great.

We have kept our neutral grade on Consumer Staples, as the sector underperformed on the 10Y move and valuations are too low to remain UW.

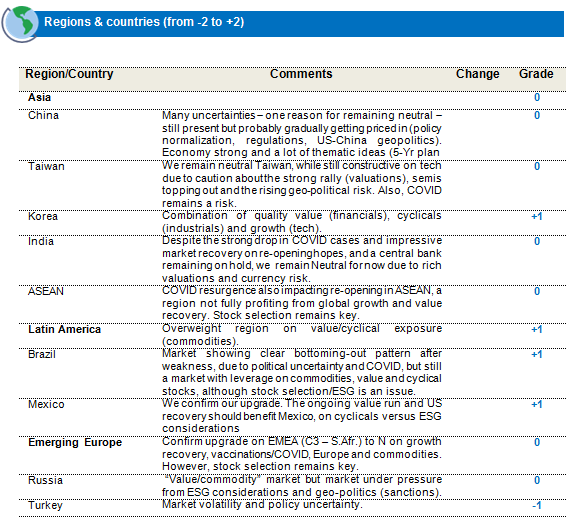

Emerging Markets: still confronted with high reproduction rates

Global emerging markets delivered positive returns (MSCI EM +2.1% in USD) in May, outperforming both their global and DM counterpart indexes by +0.7% and +0.8% respectively. The start of the month was particularly weak for EMs, due to concerns about higher inflation and rising COVID cases in India, Taiwan and Brazil. However, a weakening dollar and the improving global growth outlook brought EMs back to positive returns for the month.

Amongst regions, LatAm and EMEA were the best-performing markets, with, respectively, +7.8% and +5.3% returns, driven by the faster pace of vaccination and helped by higher commodity prices. EM Asia was muted for the month (with a 1.1% return), with index heavyweight China (0.5%) further heightening regulatory surveillance and Taiwan (-1.2%) impacted by the COVID-related slowdown. Amongst sectors, energy and consumer staples were outperformers, while consumer discretionary and IT were laggards. EM currencies posted a 1.2% positive return, with the dollar index ending lower, by 1.6%, over inflation concerns. Commodities remained strong, with oil (Brent) ending the month at US$68.7/bbl (+3.3%).

All our grades remain unchanged.

We are keeping our +1 on Mexico, as the ongoing value run and US recovery should benefit Mexico, on cyclical versus ESG considerations.

We confirm our upgrade on Emerging Europe from -1 to neutral on growth recovery, the evolution of vaccinations and Commodities. However, stock selection remains key.

We are keeping our grade on Brazil, a market still under pressure due to political uncertainty and COVID, but one with leverage on commodities, value and cyclical stocks. The market seems oversold, with stock selection/ESG an issue.

We are keeping our Neutral grade on ASEAN, where the reopening has also been affected by COVID. The region has not fully profited from the global growth and value recovery..

We are keeping our Neutral grade on India, after the recent strong market recovery following weakness on the serious COVID resurgence, due to rich valuations and currency risk. While caution is still needed on the serious and under-reported COVID situation, the market seems to be stabilizing.

We are keeping our Neutral grade on Taiwan, while still constructive on tech, due to some caution on the strong rally (valuations), semis topping out, COVID and the rising geo-political risk.

We remain overweight (+1) on Materials on an expected strong long-term supply/demand support, although some ST profit-taking after a strong performance is not excluded.

We are keeping our neutral grade on Healthcare. However, we remain, long term, positive, seeing the potential for an upgrade after a period of weakness.

We remain overweight Semiconductors & Equipment, based on strong positive supply/demand momentum, although some ST profit-taking after a strong performance is not excluded.

Finally, we continued to keep a balanced portfolio, combining value/cyclical and ‘opening-up’ exposure, with quality growth stocks and sectors (technology, healthcare, CD) somewhat protecting the portfolio from profit-taking in more interest-rate-sensitive and longer-duration growth stocks, which came under selling pressure towards the end of the month. As a result, in terms of styles, we are more balanced between growth/value and cyclicals, and are reducing the momentum bias as a funding source, despite our longer-term positive view.