European equities: Germany and UK outperform in December

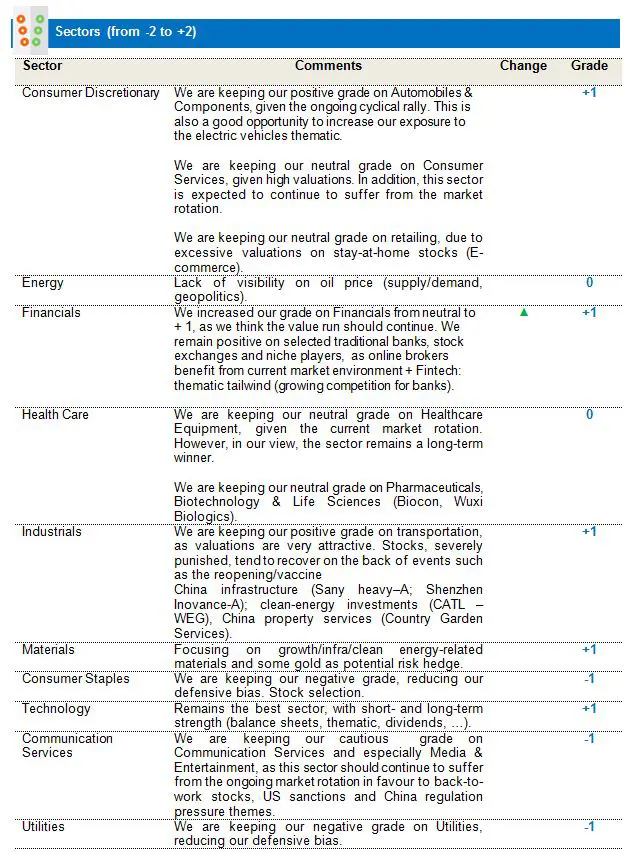

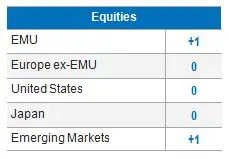

The global stock market concluded the year on an all-time high, with investors cheering the news flow and the start of the vaccination process in regions such as the US, the UK and the Eurozone, despite a pandemic still out of control in many of those – and other – regions. The stronger economic data signalled a future recovery. As such, the global stock market rallies and "reflation trade" sectors (IT, Discretionary, Materials and Financials) were again the best outperformers, whereas Staples, Utilities and Healthcare lagged.

The global stock market concluded the year on an all-time high, with investors cheering the news flow and the start of the vaccination process in regions such as the US, the UK and the Eurozone, despite a pandemic still out of control in many of those – and other – regions. The stronger economic data signalled a future recovery. As such, the global stock market rallies and "reflation trade" sectors (IT, Discretionary, Materials and Financials) were again the best outperformers, whereas Staples, Utilities and Healthcare lagged.

European markets rose in December, with Germany and the UK outperforming after a reduction in political uncertainty once lawmakers had agreed on a Brexit deal. Additional stimulus globally also helped support the rally, while vaccine approvals acted as a tailwind. These factors overshadowed the rising COVID-19 infections in the region, whose effects are expected materialise in early 2021.

Brexit deal: on 24 December, officials finalized the legal text, setting out an agreement on future trading terms. Although the agreement on a UK-EU deal on the future relationship is far from the end of the story for either party, it did remove the threat of a disruptive “no-deal” outcome. Over the medium term, the deal has secured tariff-free trade in goods while leaving a range of non-tariff barriers in place and limiting the UK’s ability to provide services to EU-based customers compared to the status quo. That suggests an additional hit to UK activity in excess of 2% of GDP, given that Brexit-related uncertainty has limited business investment.

Additional stimulus: the ECB raised the envelope on its PEPP purchases by €500bn, to 1,850bn, and extended, by nine months, the horizon over which it will make these purchases to end-March 2022. The Bank also announced additional PELTROs and, more importantly, three additional TLTRO-IIIs for June, September and December 2021. With COVID19 far from under control, the rise in cases forced many governments to toughen their restrictions. Although the latest PMIs point to resilient activity, the apparent deterioration in mobility indices could translate into a weaker Q1.

Although the vaccination pace is different across the area, it should help the economy return to close to its former track by the end of 2021: on average in 2021, GDP should grow by 6%. This outlook is supported by our central scenario, which foresees (a) vaccination of most of the population by the end of 2021 and (b) the beginning of implementation of the Next Generation EU plan starts by year-end.

Governments’ policy response continues to be uneven. While the German government plans to double its net borrowing for 2021, France, Italy and, to a larger extent, Spain, are lagging. Although the Next Generation EU programme has been adopted by the Council, it still has to be ratified by the national Parliaments before it can be implemented.

Valuations of most of the cyclical sectors are high now. The Financial, Real Estate, Consumer Staples, Energy and Communications Services sectors are still attractive if you look at PE FY2. Despite their excellent performances at the beginning of the COVID-19 crisis, Consumer Staples and Healthcare remain attractive, being respectively at the 93rd and 76th percentiles. However, it is too early, in our view, to come back to Consumer Staples. Financials – at the 76th percentile – also remains attractive, even after its strong outperformance in November. Although Real Estate and Energy have performed well since November, these sectors will be durably impacted by the COVID-19 crisis.

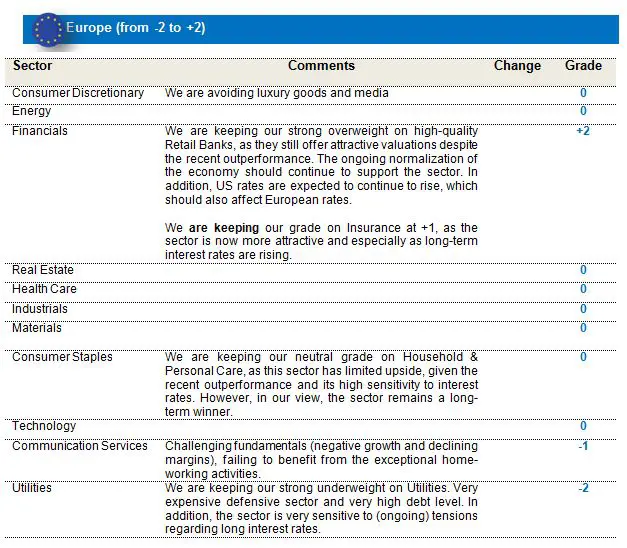

In terms of sectors, Utilities, Materials and Industrials – supported by the ongoing economic normalization and the future implementation of the EU recovery plans – outperformed. Consumer Staples, on the other hand, underperformed, being too defensive, given the Cyclical rally.

In terms of themes, Momentum and Small Caps were the best performers, while Min Vol underperformed with the sharp rise in the European market. The strong increase in PMIs benefited Small Caps. However, PMIs are now close to their pre-COVID-19 levels, meaning that there is not lot of space for any further run on Small Caps.

Since the last committee, our grade on Insurance (+1) and Communication Services (-1) has paid off. On the other hand, we lost out slightly from our strong overweight (+2) on Banks and our strong underweight (-2) on Utilities.

We still think that the rotation has further to run. Despite its recent outperformance, there is some upside left on Financials and especially Retail Banks. Materials are now fairly valued but, supported by the future implementation of recovery plans, there is now a bad Risk/Reward when investing in this sector. Market rotation is healthy, in line with earnings levels and with valuation and economic outlooks. Sectors which were leading, like Information Technology, continue to perform well. Economic indicators should continue to improve as the vaccination rate increases. US rates are expected to continue to rise, which should also affect European rates. The announced recovery plans should be implemented this year. All these elements should allow the Value/Cyclical rotation to continue.

As a result, we are keeping our grade on Insurance to +1, as the sector is attractive and especially as long-term interest rates are rising. We are also keeping our strong overweight on high-quality Retail Banks, as they still offer attractive valuations despite the recent outperformance. The ongoing normalization of the economy should continue to support the sector. In addition, US rates are expected to continue to rise, which should also affect European rates. We are keeping, too, our strong underweight on Utilities. We currently have a very expensive defensive sector and debt level. In addition, the sector is very sensitive to (ongoing) tensions on long interest rates. We are keeping our Neutral grade on Household & Personal Care, given its high sensitivity to interest rates. However, in our view, this sector remains a long-term winner. We are keeping our negative grade (-1) on Communication Services, Challenging fundamentals (negative growth and declining margins).

US equities: Strong returns for growth, value, cyclicals and small caps

In December, US equity markets saw a broad rally in the US market, with growth, value, cyclicals and small caps displaying strong returns. The announcement of three vaccines that are effective against the virus drove a risk-on mood in markets and added fuel to the post-US election rally, eclipsing worries about the near-term economic outlook.

The epidemic is far from under control. The US infection situation has continued to escalate, with new cases continuing to rise. COVID-19 vaccine approvals from the FDA, however, helped market sentiment, even as daily infection rates, hospitalizations and deaths climbed.

Economic activity is resilient, despite the resurgence in cases. Despite new local lockdowns, the latest economic indicators, such as the Manufacturing & Services ISMs, point to an ongoing recovery. Household consumption, which stalled in November, seemed to recover in early December.

Fiscal policy will remain supportive. Congress passed a new COVID relief bill of $920bln. Temporary unemployment programmes have been extended until mid-March and a second round of forgivable Paycheck Protection Program loans should help support business operating results and prevent a sharp contraction of investment. Democrats have won control of the Senate, offering the President-elect more leeway. This new package will boost economic growth in the first quarter of 2021 by 7%. However, without additional measures, fiscal support will turn negative from Q2.

The prospect of mass vaccination and the new COVID bill make a return of the economy to its former tack by end-2021 more likely. Our central scenario sees most of the population vaccinated by the end of 2021.

After contracting by 3.5% in 2020, GDP should increase by 4.8% in 2021. In addition, Democrats have gained control of the Senate. With a narrow majority, this is no blank cheque for Biden’s platform; still, it makes further fiscal support more likely and increases the likelihood of our central scenario. It also reduces the risk of partisan gridlock and facilitates the confirmation of Biden nominees.

Positive earnings estimates in the US, led by the technology sector. We continue to see strong positive inflows in the US, which means that investor interest is still high in the quality/growth sector, despite high valuation levels.

Valuations of the Healthcare, IT, Financial and Energy sectors are attractive if you look at PE FY2. Despite their strong 2020 performances, the Healthcare and IT sectors are still cheap, being respectively on the 78th and 96th percentiles. Financials, on the 95th, also remains attractive, despite the recent Value-run, fuelled by the ongoing economic normalization. Energy (despite a slight increase in its earnings estimates) and Real Estate remain the most impacted sectors, as their earnings level (47%) will, in 2022, remain largely below their 2019 level (72%).

In terms of sectors, Financials and Materials – supported by the ongoing massive vaccination and further recovery plans – outperformed. Consumer Staples, penalized by the Cyclical Rally, underperformed.

In terms of styles, Small Caps and Momentum – driven by the resilience of PMI – outperformed. Naturally, Min Vol, given the strong market movements, underperformed.

Since the last committee, all our grades have paid off. Our overweights on Financials, Healthcare and Information Technology, as well as our underweights on Consumer Staples and Telecom Services, generated Alpha.

We still think that the rotation has further to run. The market rotation is smooth, and sectors which were leading, like Information Technology, continue to perform well. Economic indicators should continue to improve as the vaccination rate increases. US rates are expected to continue to rise. The announced recovery plans should be implemented this year. All these elements should allow the Value/Cyclical rotation to continue.

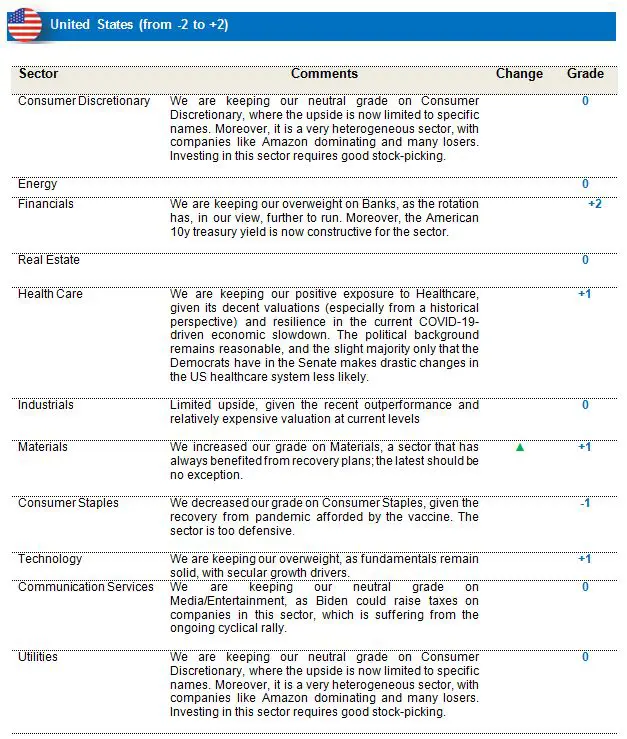

As a result, we increased our grade on Materials, a sector that has always benefited from recovery plans; the latest should be no exception. We are keeping our grade on Consumer Staples, given the recovery from the pandemic afforded by the vaccine. This sector, nonetheless, is too defensive. We are keeping our overweight on Banks, as the rotation has, in our view, further to run. Moreover, the American 10y treasury yield is now constructive for the sector. We are keeping our neutral grade on Media/Entertainment, as Biden could raise taxes on companies in this sector, which is suffering from the ongoing cyclical rally. We are keeping our overweight on Technology, as fundamentals remain solid, with secular growth drivers. We are keeping our neutral grade on Consumer Discretionary, where the upside is now limited on specific names. It is also a very heterogeneous sector, with companies like Amazon dominating and many losers. Investing in this sector requires good stock-picking. We are keeping our neutral grade on Industrials, as this sector has limited upside, given the recent outperformance and relatively expensive valuation at current levels. Finally, we are keeping our positive exposure to Healthcare, given its decent valuations (especially from a historical perspective) and resilience in the current COVID-19-driven economic slowdown. The political background remains reasonable, and the slight majority only that the Democrats have in the Senate makes drastic changes in the US healthcare system less likely. Most Republicans, and even some Democratic senators, would probably oppose a really progressive healthcare agenda. Still, the topic of drug prices will come up (though probably not a number-one priority for the new legislation) from time to time and could cause volatility. We do not expect drastic changes and see the healthcare sector and most of its sub-sectors as an interesting long-term performer.

Emerging Markets: Vaccine and weakening dollar boost sentiment

Despite severe new waves of COVID-19 spreading throughout Europe, Asia and the US, as well as Brexit uncertainty, a strong December rally closed one of the strongest quarters in a long time in an exceptional year (2020) during which one of the worst COVID-driven economic and social crises ever contrasted with strong equity market returns.

The early delivery of the first vaccines, combined with ongoing fiscal and monetary support as well as a weakening dollar, supported hopes of a quick economic recovery, resulting in a rally in growth-sensitive markets and sectors like the commodity complex (oil, metals). Even gold regained, while Bitcoin went through the roof. Not surprisingly in this growth-sensitive and weak dollar environment, emerging markets (+7% in December), seeing a return of global investors, continued their outperformance.

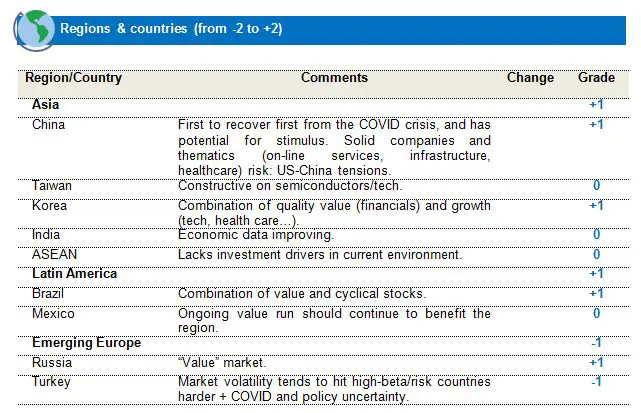

While India, Korea and Taiwan rallied – the latter on strong tech recovery – Asia slightly underperformed the other regions, as heavyweight China underperformed, mainly on anti-trust uncertainty surrounding the giant tech stocks as well as continued China-bashing by the US.

In December, commodity-rich and earlier-lagging markets in Latam, led by Brazil, and EMEA, with South Africa, Russia and – even more – Turkey, outperformed. In terms of sectors, cyclicals (materials, tech) led the performances. Strong metal prices were not only linked to growth expectations but also to the expected strong demand from the coming investment spree in the clean-energy and EV segments. While, over the last quarter, Latam strongly outperformed, over the year only the 4 largest Asian markets managed to end 2020 in very positive territory: Korea, Taiwan, China and India. This was enough to push the entire MSCI EM index to a gain of 19.3% for the quarter and 15.8% for the year 2020, in USD, outperforming the developed markets (14.1%).

In terms of sectors, the best performers were Information Technology, Materials and Industrials. In terms of countries, the best performers were Korea, Turkey and Taiwan.

In our view, the cyclical rally has further to run. Economic indicators should continue to improve as the vaccination rate increases. US rates are expected to continue to rise. The announced recovery plans should be implemented this year. All these elements should allow the Value/Cyclical rotation to continue.

As a result, we increased our grade on Financials from neutral to + 1, as we think the value run should continue. Within Financials, we are mainly positive on selected traditional banks, stock exchanges and niche players, as online brokers benefiting from current market environment + Fintech: thematic tailwind (growing competition for banks). We are keeping our positive grade on Automobiles & Components, given the ongoing cyclical rally, not least towards the electric vehicles thematic. We are keeping our neutral grade on Consumer Services, given its high valuation. In addition, this sector, given its defensive bias, should continue to suffer from the ongoing rotation. We are keeping our neutral grade on retailing, due to excessive valuations on stay-at-home stocks (E-commerce). We are keeping our grade on Healthcare Equipment, given the current market rotation. However, in our view, the sector remains a long-term winner.

We are keeping our negative grade on Communication Services and especially Media & Entertainment, as this sector could underperform due to the ongoing market rotation in favour of back-to-work stocks, US-China tensions and the Chinese anti-trust regulations. We are keeping our positive grade on Latin America, as this a typical region with high bombed-out value and cyclical content (financials, energy, commodities). The ongoing value rally should benefit the region. We are keeping our grade on transportation, as valuations are attractive. Stocks, severely punished, should recover on the back of the reopening/vaccine. Risk/reward is clearly to the upside. We continued to keep a balanced portfolio, combining value/cyclical and ‘opening-up’ exposure with quality growth stocks and sectors (technology, healthcare, CD). As a result, in terms of styles, we are more balanced between growth/value and are reducing the momentum bias as a source of funding, despite our longer-term positive view.