Last week in a nutshell

- In Jackson Hole, Jerome Powell reaffirmed his commitment to fight inflation over the long term even if it would lead to negatively affect economic growth. More hawkish than anticipated, financial markets were shaken by this commitment to keep rates higher for longer, pushing yields up and equity valuations down.

- The US economy created 315K new jobs in August, in line with consensus expectations. Another strong gain but a sharp deceleration from the 526K increase in July. This leaves some latitude for the FOMC to decide between a 50 bp rate hike or a 75 bp rate hike at their September meeting, depending also on the inflation data.

- Russian energy giant Gazprom shut down the Nord Stream 1 gas pipeline, compounding concerns for Europe, which, strives to secure supplies ahead of the colder months.

- The 9.1% inflation level in the euro zone in August is a new record according to preliminary figures. The high energy prices remain the main driving force. Consumer prices rose for the ninth consecutive month in the region but with regional divergence. It slowed in Spain and France but is at its highest level in Germany and Estonia.

What’s next?

- Europe will be the first in focus with the announcement of the new leader of the Tory party in the UK. The Queen will officially appoint the designated successor to Boris Johnson. Polls are in favour of Liz Truss.

- The highlight for investors is the ECB meeting in the aftermath of the publication of high inflation data and hawkish comments from some ECB officials. The likelihood of a 75bp rate hike is more than ever on the table, supported by several council members’ statements.

- Following the Jackson Hole symposium, we will hear from Fed Chairman Jerome Powell and the Fed’s Beige Book will be released. It usually paints a portrait of the economy, depicts its head- and tailwinds as reported by Bank and Branch directors and interviews with key business contacts, economists, or market experts.

- Key economic data on services activity will be released for China, the euro zone, and the US. In Asia, China's inflation data and an array of indicators and surveys from Japan throughout the week will be published.

Investment convictions

Core scenario

- Our exposure keeps an overall broadly balanced allocation before positioning for the next stage of the cycle, whether it be a soft or a hard landing. We have an underweight stance on EMU equities, as the region is especially vulnerable to the tug of war with Russia.

- While the market environment still appears constrained by deteriorating fundamentals, markets are looking to central bank announcements, which, in turn, are becoming increasingly data dependent.

- Facing multi-decade high inflation, the Fed continues on its hiking cycle along with a quantitative tightening, i.e. a balance sheet reduction. In our best-case scenario, the Fed succeeds in landing the economy. As a result, we expect the rise in the US 10Y yields to fade.

- Inflation is also at highs in the euro zone, hitting businesses, consumers, and ECB policymakers alike. The ECB started its monetary policy tightening cycle in July and delivered a 50bp hike. It also unveiled a new (“unlimited”) tool, the “Transmission Protection Instrument” (TPI). This week could well see an even more significant hike.

- The risks we previously outlined are starting to materialize and are now part of the scenario.

Risks

- Investor concerns are continuously shifting between inflation and growth.

- The war in Ukraine is pushing upwards gas prices while European activity is at the mercy of flows staying open. An emergency plan, “Save gas for a safe winter”, is in progress to curb consumption and find alternative sources of supply.

- The threat of COVID-19, and its variants, remain as the virus keeps evolving and spreading at various speed throughout the world.

Recent actions in the asset allocation strategy

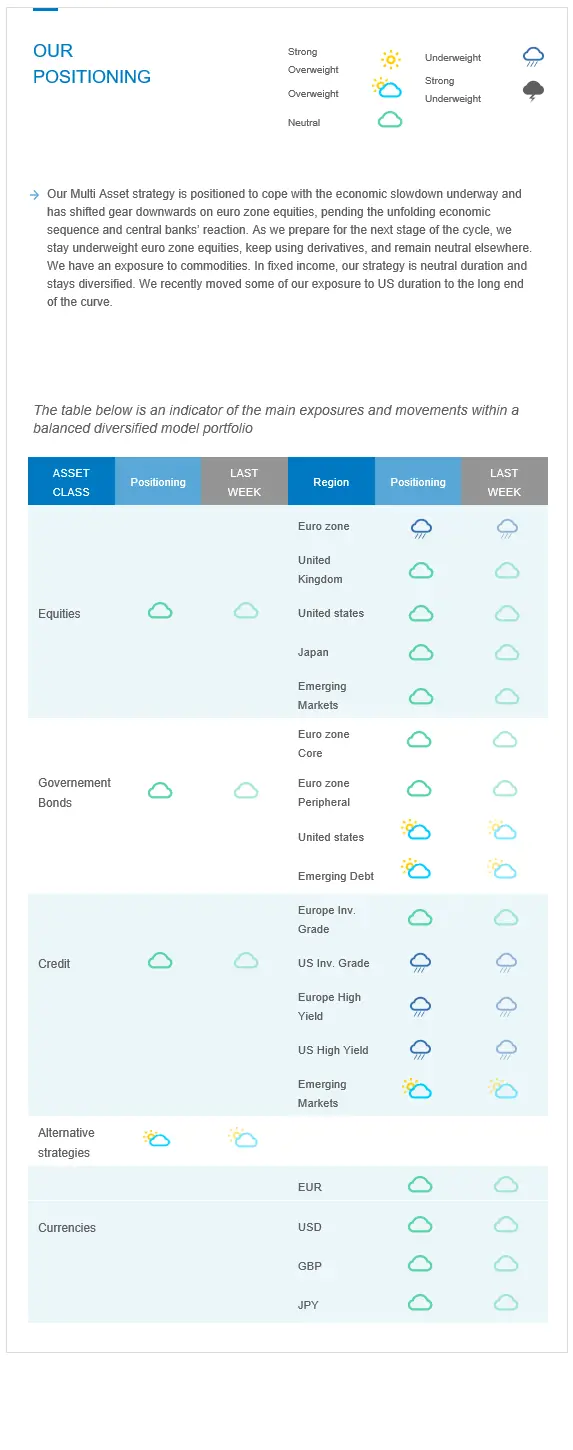

Our Multi Asset strategy is positioned to cope with the economic slowdown underway and has shifted gear downwards on euro zone equities, pending the unfolding economic sequence and central banks’ reaction. As we prepare for the next stage of the cycle, we stay underweight euro zone equities, keep using derivatives, and remain neutral elsewhere. We have an exposure to commodities. In fixed income, our strategy is neutral duration and stays diversified. We recently moved some of our exposure to US duration to the long end of the curve.

Cross asset strategy

- Our multi-asset strategy stays more tactical than usual and can be adapted quickly:

- Underweight euro zone equities, with a derivative strategy in place to catch the asymmetric potential. We have a preference for the Consumer Staples sector where we find pricing power.

- Neutral UK equities, resilient segments, and global exposure.

- Neutral US equities, with an actively-managed derivative strategy.

- Neutral Emerging markets, because our assessment indicates an improvement, especially in China, both on the COVID-19 / lockdown and stimulus fronts during H2.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure act as opposite forces for investor attractiveness.

- With some exposure to commodities, including gold.

- In the fixed income universe, we acknowledge downward revisions in growth, highs in inflation expectations and strong central bank rhetoric regarding the willingness to tighten and fight inflation. We are neutral duration, with a preference for long US duration.

- We continue to diversify and source the carry via emerging debt.

- In our long-term thematics and trends allocation: While keeping a wide spectrum of long-term convictions, we will favour Climate Action (linked to the energy shift) and keep Health Care, Tech and Innovation.

- In our currency strategy, we are positive on commodity currencies:

- We are long CAD and took partial profit to the benefit of the USD.