Last week in a nutshell

- Preliminary Global PMI estimates confirmed a softening in manufacturing activity while services keep surprising on the upside.

- Uncertainty about the outlook for inflation, growth and interest rates weighted on the euro zone ZEW Indicator of Economic Sentiment.

- China’s economy advanced at its strongest pace since Q1 2022 with a figure of 4.5% YoY during Q1 2023, accelerating from a 2.9% growth in Q4 and exceeding market estimates of 4%.

- The FOMC Minutes revealed some additional policy firming may be appropriate as inflation is still too high and labour markets too tight.

What’s next?

- First estimates of GDP growth rates for the euro zone and the US will help investors assess the width and length of the central banks’ landing strip as higher borrowing costs bring us closer to a slower activity.

- China will publish its PMI indexes on manufacturing and non-manufacturing activity and YTD industrial profits as we keep monitoring the recovery in factory activity from the slump caused by pandemic disruptions.

- The US will publish a series of real estate-related data. Affordability is still challenged by tightening credit standards.

- The Eurogroup, that brings together finance ministers from the euro zone countries, will meet and discuss Banking Union and banking sector developments in an era of geoeconomic fragmentation.

Investment convictions

Core scenario

- Our main scenario incorporates slow growth, both in the US and the euro zone and remains the most likely. However, we acknowledge that the risk of a more adverse scenario has increased. All economic scenarios – though with different trajectories – point to lower growth, lower inflation, lower Fed Fund rates and lower 10-year bond yields by the end of next year.

- We have increased our fixed income duration and we stand ready to reduce portfolio risk in the case of complacent financial markets.

- Credit has been a strong conviction at the start of 2023 since the carry that was reconstituted by the rise in yields in 2022 looked attractive. We are overweight Credit, including Emerging market debt.

- We expect emerging markets equities to outperform as valuation is relatively more attractive, China’s re-opening is very quick and growth surprises on the upside.

- In Europe, sentiment, labour market and consumption are holding up. With the re-opening of China, the region is a main beneficiary via a resumption of its export growth.

- On a medium-term horizon, we expect Alternative investments to perform well.

Risks

- Financial conditions tightening leading to banking turmoil has become a new macro risk. Financial stability risks have resurfaced recently and led the US to add liquidity into the financial system.

- Central banks will have to compromise between price stability (rate hikes) and financial stability (decisive action).

- The uncertainty linked to the financial turmoil and the potential credit restrictions along with central bank’s anti-inflation stance are capping the upside potential for risky assets.

- On the other hand, inflation is declining, and a slow but positive growth is limiting the market downside.

- Among the upside risks, the Chinese re-opening is good news for domestic and global growth as long as there is no inflation spill over via a resurgence of commodity prices in the context of constrained supply.

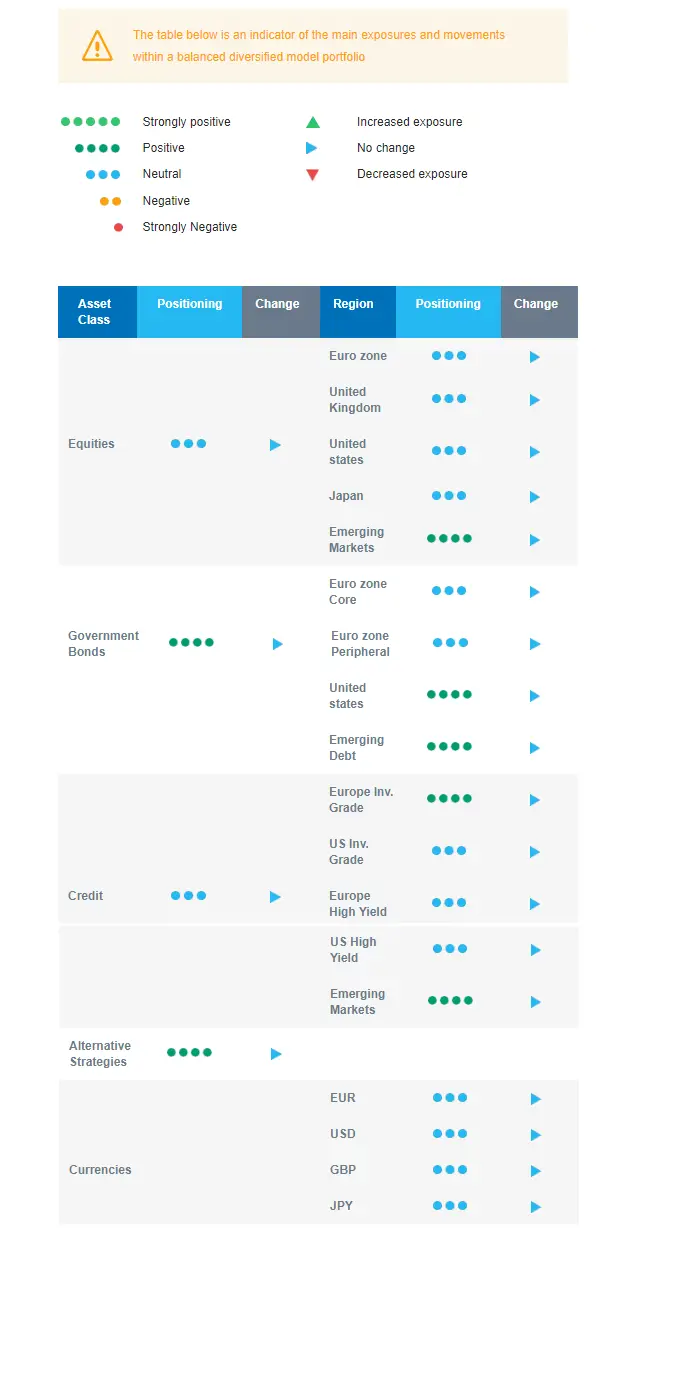

Cross asset strategy

- As better activity and lower inflation readings are mitigated by several vulnerabilities, we keep the neutral stance on equities and are increasing fixed income duration gradually, especially via the US.

- Within a neutral equities positioning, we have convictions in specific assets:

- In terms of regions, we believe in Emerging markets: China reopening is unfolding and a significant growth driver for emerging markets. Besides, there is no monetary headwind ahead as inflation readings in the region surprise on the downside.

- With cyclicals pricing a strong rebound in the economic activity, we prefer defensive sectors, such as Health Care and Consumer Staples. The former is expected to provide some stability: No negative impact from the war in Ukraine, defensive qualities, low economic dependence, innovation, and attractive valuations.

- In addition, the current context continues to favour companies with pricing power, which we find in the Consumer Staples segment.

- In the fixed income space, we are buying US government bonds as the slowdown is the most advanced in the region. We will further add duration if we see better levels in the coming weeks.

- European investment grade credit is one of our convictions. We also have exposure to emerging debt, which should benefit from dovish local central banks, a lower USD and low investor positioning.

- We have exposure to some commodities, including gold and commodity-related currencies, including the Canadian dollar.

- In our long-term thematics allocation we favour investment themes linked to the energy transition and keep Technology in our long-term convictions. We expect Automation and Robotisation to recover in 2023, and a growing interest in Climate and Circular Economy-linked sectors (such as Industrials and Technology and selective Utilities titles).

Our Positioning

We started buying duration via the US and are thereby long duration overall. We will keep looking for entry points. Further on the fixed income side, we have a constructive view on Investment Grade credit and Emerging market debt. In equities, our current positioning remains neutral. In the context of robust growth and the reopening in China, we remain allocated to some commodities.