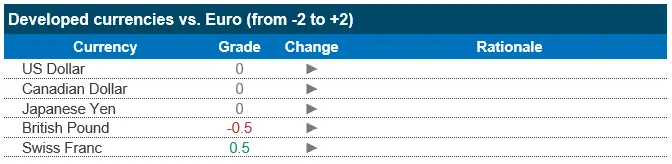

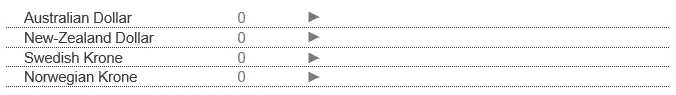

June marked another month of strong volatility, with core rates moving sharply upwards over the first half, while the second half saw some respite, albeit in a fairly turbulent environment. A new development since the beginning of the year was the material decline in commodity markets, where not just oil and natural gas prices moved substantially lower, but also elements like wheat registered flash crashes. The US 10-year spiked to 3.47% before ending the month at 3% (and subsequently moving even lower), and the German 10-year moved closed to 1.8%, before settling at around 1.2%. Eurozone peripherals were but an accentuated reflection of core rates, as the upwards and downwards movements were very sharp and particularly acute, especially Italian rates where the 10-year reached a whopping 4.2%, though ended the month at 3.2%. While broadly, in spite of the volatility, sovereign bond markets still managed to eek out a positive performance over the month, spread products suffered materially. High-yield markets (both in EUR and USD) posted negative performances, while both hard currency and local currency emerging debt also stumbled considerably in June, mirroring equity markets. In high-quality credit, covered and senior IG credit outperformed the more riskier tranches of the capital structure, such as hybrids and bank contingent convertibles. From a sector perspective, defensive sectors (telecoms, healthcare) outperformed cyclicals (automotive) and real estate. The dollar continues its forward march, temporarily attaining parity vs the euro, while safe havens like the yen also strengthened. On the emerging front, eastern European currencies weakened, while Latin American FX posted positive returns.

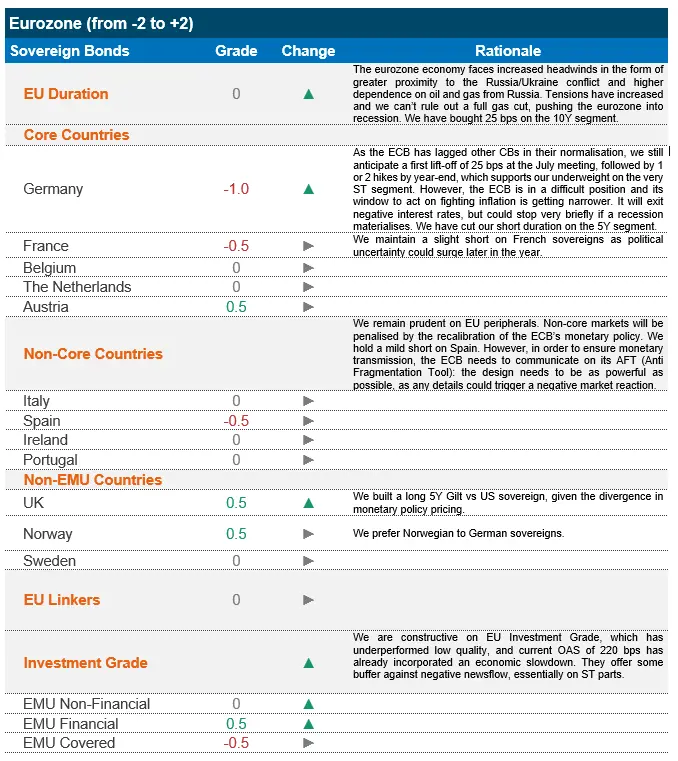

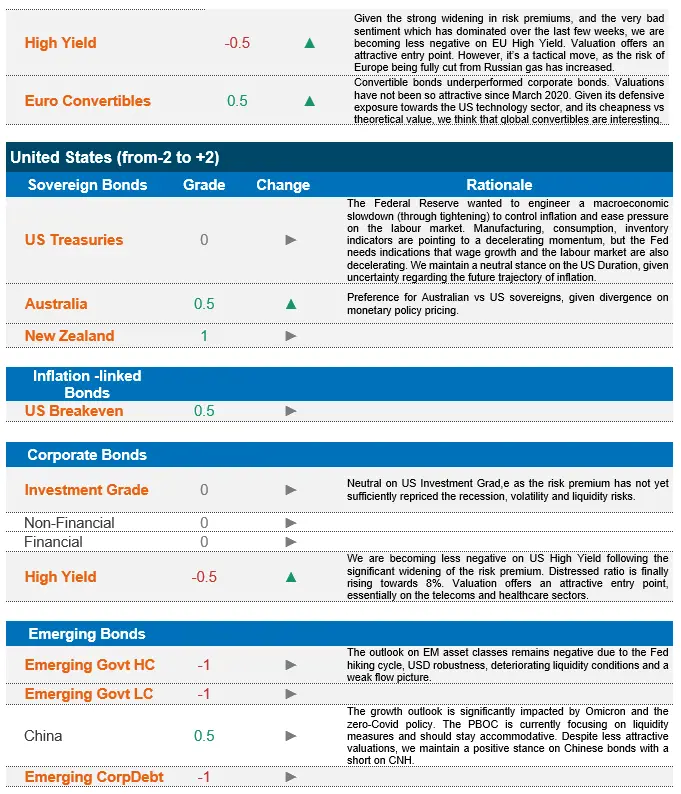

There has been an undeniable temporary respite in inflation data, driven primarily by the sharp downturn in commodity prices. Though CPI prints in Europe and US remain elevated, we see some downwards movement in the US and EU 5y5y inflation swaps (a key indicator in central bank policies). On the macroeconomic front, not only has growth momentum weakened considerably, but the probability of a recession is growing. Geopolitical risk remains omnipresent, with no end in sight in the Russia/Ukraine conflict. Adding to this issue are not only the incremental sanctions that are impacting Russia, but also the potential shutdown in oil/gas flows from Russia to Europe, which will have severe ramifications. Blockages and embargoes on food commodities are also having a severe impact in macroeconomic terms. Supply chain issues are also omnipresent, and are likely to remain so, as the lockdowns in China have resumed in several regions, casting a long shadow over global growth as well as being yet another source of higher inflation. In the face of these inflationary pressures, central banks across the globe (excluding China) are compelled to persevere in their hawkish stance. The Federal Reserve has indicated that they are willing to engineer a macroeconomic slowdown (through tightening) in order to control inflation. We expect, as a base case scenario, a 75 bps rate hike at the next FOMC meeting, and we will very carefully monitor the resulting impact on the US economy. After extensive external hawkish deliberations among ECB members, President Christine Lagarde clarified that a 25 bps rate hike was imminent in July, and that further (and potentially stronger) rate hikes were in the offing should inflationary pressures persist. However, after seeing the impact of its hawkish rhetoric on peripheral rates (particularly Italy), the ECB did hint at an anti-fragmentaion tool, confirming it will apply flexibility in reinvesting redemptions falling due in the PEPP portfolio. The question remains on how the European and indeed global economy will react to these rate hikes, as eurozone growth data does not appear to be as sturdy as the US’s, and its proximity to the Russia/Ukraine conflict and its dependence on Russian oil makes it more fragile. Given such a context, we can certainly not rule out a recessionary scenario.

We expect volatility to remain high against this backdrop. We recommend a neutral stance on US Duration and an underweight on EU Duration, as the ECB is under pressure to normalise more rapidly, as the window is getting narrower. Valuations on fixed income markets are certainly more compelling, and we are becoming less negative on credit asset classes, although we recognise the need to wait for rates to stabilise before we turn positive on these asset classes. We expect dispersion to materialise soon, as fundamentals return to the forefront (in the absence of external support) and the impact of key trends (de-globalisation, decarbonation and digitisation) starts to materialise. However, currently, in a market that is expected to continue to be negatively impacted by the external factors mentioned above, we aim to maintain our overall defensive stance while monitoring markets very closely. We also have a cautious view on emerging markets as the economic slowdown, Fed policy tightening and USD weigh on the asset class. The political situation will likely deteriorate, as cost of living concerns start to severely impact economies that are more commodity-dependent and less resistant. On the positive front, we believe that short-term inflation-linked bonds can offer investors a good hedge against high inflation levels, which are set to persist. In the context, we maintain a positive view on the asset class.

Strategy & Positioning

It is important to note that Candriam Global Bond and Credit strategies have no exposure to Russian sovereign debt. Russia has been excluded from our sovereign investment universe based on sustainability characteristics.