"Make America great again"!

"Make America great again" is POTUS’s self-coined slogan. To effect this transformation, he is using the full panoply of economic tools at his disposal. This translates, in fiscal terms, into lower taxes. At the same time, he has turned traditional trade practices on their head in his dealings with his main partners. He has also renegotiated treaties with Canada and Mexico, threatened retaliation against the Germans (on grounds of trade imbalances) and increased customs tariffs on Chinese imports. He also wants a say in monetary policy. He has accused the Fed of keeping interest rates too high, suggesting it take a leaf out of the ECB and BOJ’s book and waxing lyrical in particular over the New Zealand, Indian and Thai central banks, who all recently cut their official rates. However, he really would like devaluation to be his trump card, frustrated as he is by the strong USD.

Why is the greenback so strong?

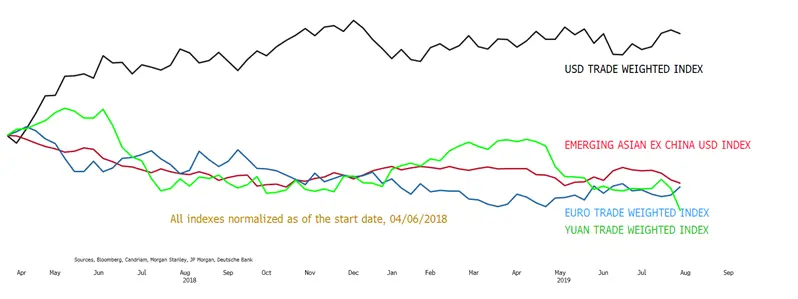

The strong dollar is driven, among other things, by greater growth momentum in the US than in Europe and ASEAN. The US-China trade war has weakened a Chinese economy already rocked to the core and competing with countries like Germany and South Korea, for which globalisation is a godsend. Result: since the start of the trade war with China, the USD has strengthened against most other currencies, in particular the euro and emerging Asian currencies, as shown in the graph below, which compares changes in the trade-weighted indices of the aforementioned currencies. Regardless, the sitting president has recently shown – via recent customs tariff hikes – how serious he is about upping the ante. Another reason quoted is the rate spread, especially compared with Europe and Japan. Sure, the Fed did cut its rate in July by 25bps, but Powell’s speech was considered dovish. The reduction must also be weighed against the imminent decisions of the other central banks, in particular the ECB. This has led to Trump training his ire against the issuing institution, accusing it of incompetence . If the Fed remains reactive or proves slow in meeting market expectations, the US dollar could remain strong.How can Trump cut the rate?

The Fed could actually impose an aggressive rate cut. Indeed, markets are now expecting a substantial 1% cut in the coming year. For the reduction to benefit the greenback, it would have to exceed these forecasts, either in terms of the percentage or the timeframe. Booming US consumption could, however, prevent this occurring. Analysts, given the recurring nature of the US president’s comments, are thus wondering whether the US will use the FX market to weaken its own currency. The president has a mandate to take such decisions, requiring neither Congress nor Fed approval. He has enough economic arguments up his sleeve, with even the IMF of the opinion that the USD is overvalued by between 6 and 12%. The theory of purchasing power parity also justifies the decision, the only hiccup being that the US Treasury only has around 100 billion dollars to play with, versus a daily trade volume estimated at some 5100 billion dollars. To be really effective, the Fed – which could free up 3600bn in assets – would have to intervene. Supply might even be unlimited, given its money-making powers and ability to sell what it mints. The Fed’s balance sheet would bear the brunt if it were to agree to impose no limits. Lest we forget, however, previous interventions took place in collaboration with the other central banks, in order, for instance, to curb market volatility.We are by now used to Trump tearing up the rule book. And he may well do so again. At any rate, he’ll continue to turn the screw on the Fed, which might find itself between the classic rock and a hard place: either drastically cut interest rates or … do something completely new.