Vincent has been Deputy Head of ESG Investments & Research at Candriam since 2019. He joined the firm in 2017 as a Senior Analyst in the ESG Investments & Research Team.

Vincent has worked in the financial services industry since 2007, including at AXI IM as an SRI Analyst for the Transport and Industrial Goods sectors, where he monitored the development and follow-up of green investments, including AXA Group and AXA IM’s Green Bonds. He also worked at ERAFP, France's first 100% SRI pension fund, and at Bloomberg.

Vincent holds a Masters 2 in Economics and Finance from the Sorbonne (France)

Discover the latest articles by Vincent Compiègne

Johan Van der Biest, Vincent Compiègne, Alfred Sandeman, Outlook 2025

Si se espera que los inversores sean precoces en la detección de tendencias futuras, nuestra comunidad piensa sin duda que la IA es el futuro. ¿Continuarán las sorpresas? Para ayudar a formar la respuesta de ChatGPT, analizamos los ingresos tangibles que han surgido hasta ahora, y consideramos el "punto dulce", los "subcampeones" y los "demasiado pronto".

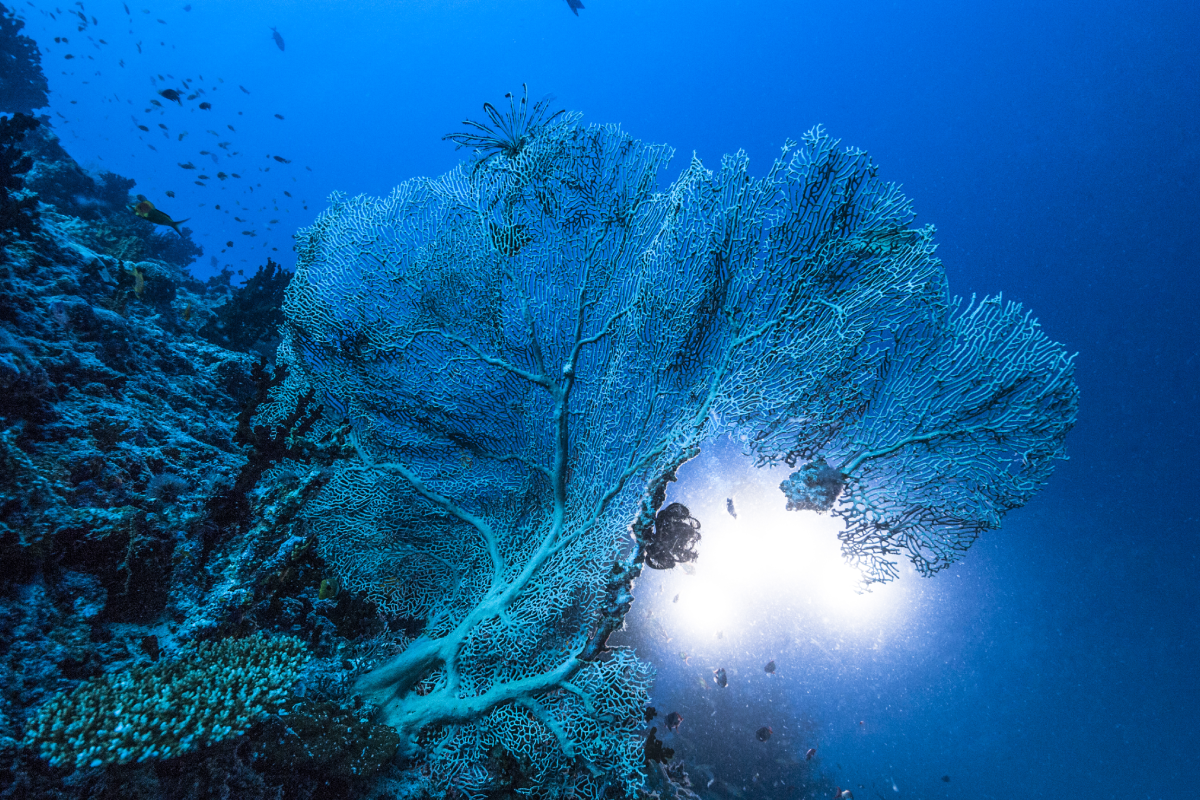

ESG, SRI, Vincent Compiègne, Water

Entrevista con analista de sostenibilidad soberana ESG – ¿Por qué el agua?

Por ejemplo, considerando el enigma del automóvil. China domina toda la cadena de valor de los motores eléctricos de transporte. La Unión Europea ha impuesto aranceles provisionales para proteger a su industria automovilística regional del "dumping", o fijación de precios desleales, de las importaciones subvencionadas de vehículos eléctricos procedentes de China. Sin embargo, la UE está intentando acelerar la adopción de vehículos eléctricos para cumplir sus objetivos de emisiones para 2035.

Research Paper, ESG, SRI, Sovereign Sustainability, Vincent Compiègne, Kroum Sourov, Water

El agua es algo más que un recurso

Puede que el cambio climático sea la mayor amenaza para la sostenibilidad, pero la vulnerabilidad hídrica es potencialmente la más urgente, ya que es probable que se manifieste en un plazo más corto.

Research Paper, Adapt to thrive, ESG, SRI, Fixed Income, Dany da Fonseca, Vincent Compiègne, Patrick Zeenni

¿Más allá del bono verde?

Las nuevas normas de transparencia en Europa, en su conjunto, cambian las reglas del juego para los bonos con grado de inversión en euros (CSRD, SFDR y una etiqueta de bono verde de la UE). Esperamos que esto aumente el interés por la sostenibilidad, pero también la necesidad de un análisis crediticio fundamental en profundidad, una cuidadosa valoración de los riesgos y una gestión activa de las estrategias de bonos IG. ¿Crees que estás preparado?

Lucia Meloni, Hien Nguyen, Vincent Compiègne, ESG, SRI, Research Paper

Gobierno corporativo en los mercados emergentes: ¿qué hay detrás del telón?

Seguimos observando discrepancias en las prácticas actuales de gobierno corporativo en los mercados desarrollados y emergentes. Algunos países han reforzado las obligaciones y funciones de los consejos de administración, así como la transparencia y la comunicación con los accionistas, demostrando su voluntad de mejorar sus normas de sostenibilidad. Sin embargo, se podría seguir avanzando.