The better outlook on the growth/inflation mix for the year ahead has quickly been incorporated by risky assets, from equities to high yield via credit markets. As the extreme investor pessimism of last October is now in the distant past, we are reducing our overall equity allocation to a more neutral stance. As already discussed in our year-ahead Outlook, the rise in risky assets we expected for 2023 should be limited to the upside by central bank action, as they will ensure that financial conditions do not ease too quickly if the economy is holding up. Given the fundamental support from all major economic regions, we think that central banks’ data dependency could become an obstacle for markets as the economy appears more resilient than most expected only a couple of months ago.

A rising tide lifts all boats

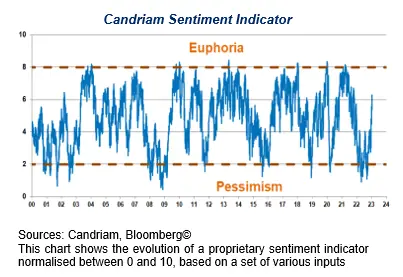

In addition to our fundamental analysis, we use a large number of technical and statistical data to assess and quantify the odds in favour of market reversals. In October, our investment strategy became more constructive on attractive price levels. At that time, our proprietary sentiment indicator pointed towards extreme pessimism, which constituted a contrarian buy signal.

The bounce observed since October, and which has continued unabated since the start of this year, has reached an unusual, extreme steepness. A pause in the steep returns registered since the start of the year, notably for the tech-heavy indices, appears appropriate going forward. Accordingly, we have downgraded our US equity stance from overweight to neutral.

Yes, financial markets have received fundamental support from all major economic regions:

- In the US, our soft-landing scenario has become more consensual. Rapid job growth and a moderation in wages have raised expectations of a soft economic landing.

- In Europe, falling energy prices have led to lower inflation and higher growth perspectives. The eurozone avoiding a recession is quickly becoming consensus.

- In China, we can observe a powerful reopening. The end of the zero-Covid strategy prior to the New Lunar Year amplifies the reopening boom, while the authorities need to make sure reopening is a success. Interestingly, equity valuations on emerging markets remain relatively attractive, prompting us to maintain an overweight stance on the region.

The improvement in the economic environment and the subsequent market performances is changing investors’ attitudes: the Candriam Sentiment Indicator has quickly rebounded, lifted by falling volatility, tightening credit spreads and wider market breadth

Central banks could become an obstacle

Central bank meetings at the beginning of the month acknowledged the disinflation underway. On top of the base effects compared to one year ago, easing bottlenecks, falling energy prices, moderation in demand and monetary restriction are all acting in the same direction. However, based on inputs from manufacturing prices in the US and producer prices in China, we note that disinflation is no longer accelerating.

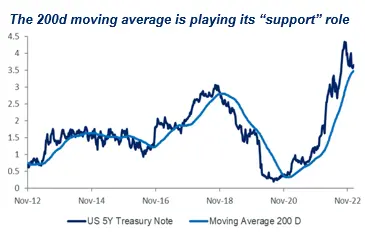

As central banks become more data dependent, and, for the time being, the economy is surprising on the upside, the markets might price in a more restrictive Federal Reserve than currently anticipated. Technically speaking, the 200-day moving average may offer some support, and even facilitate a rebound in US 5-year or 10-year yields. Accordingly, we are reducing our US duration by -0.25Y.

Neutral equities with a positive view on emerging markets

In our view, US equities have already priced in a better economy: we expect 2023 GDP growth in the US of 1.2%, which implies that profit growth could turn slightly positive. However, the Fed could drive equity valuations lower considering its data dependent approach: the federal funds rate should go to 5 - 5.25% and remain there for longer relative to market pricing.

We continue to expect emerging markets to outperform in this context, as valuations remain relatively more attractive, while Asia maintains superior long-term growth prospects vs. developed markets, specifically in a reopening scenario with significant pent-up demand and household excess savings to be deployed.

Credit is a strong conviction, including via emerging market debt

Regarding bonds, Credit is a strong conviction in our global multi-asset allocation for the start of 2023, since the carry that was reconstituted by the rise in yields in 2022 looks attractive. Furthermore, the deceleration in inflation should lead to a drop in volatility on bonds, also allowing for an easing of volatility on other asset classes. In this environment, we also expect alternative investments to perform well.

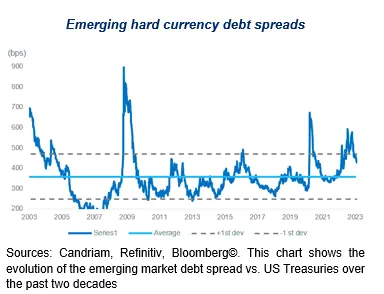

We are overweight on Credit, including via emerging market debt (EMD). Following the sharp rally, valuations look decent, with spreads, albeit lower since Q4 2022, remaining above one standard deviation vs. 20-year history.

The EMD outlook has brightened on the back of upgrades of global financial conditions, Fed policy, Chinese growth and EMD fundamentals. Clearly, emerging markets appear to be entering a more benign economic environment.

In addition, emerging market inflation has overall peaked and monetary policy in emerging countries, which are generally ahead of developed markets, are either on hold or have room to ease. With oil prices in a lower range, trade balances are improving.