Luiz Inacio Lula da Silva narrowly won the second round of Brazil’s election, beating incumbent Jair Bolsonaro. Initial fears that Bolsonaro wouldn’t accept the result, particularly if it was tight, have receded. Bolsonaro said that he would follow the constitution and play by the rules, while his chief of staff, acknowledged the defeat.

While Lula was successful it was a particularly narrow victory and Lula will have to work towards consensus in the years ahead.

Brazil continues to suffer from concerns around its relatively high debt levels, corruption – to which Lula himself is far from immune – and inequality, much like many emerging markets. But the trajectory is at least more favorable from a macroeconomic standpoint than many countries, which have been facing an extremely difficult environment in 2022 driven by high inflation and tightening global interest rates.

Lula certainly has a much better track record on conservation, having said that he will fight to achieve zero deforestation in the Amazon. In contrast, deforestation under Bolsonaro rose sharply after years of decline under the previous administration.

Putting the current post election uncertainty to one side, Brazil has looked economically attractive versus many other emerging nations for some time. This is largely because it has managed to keep inflation under relative control, thanks to its central bank which has been particularly pro-active.

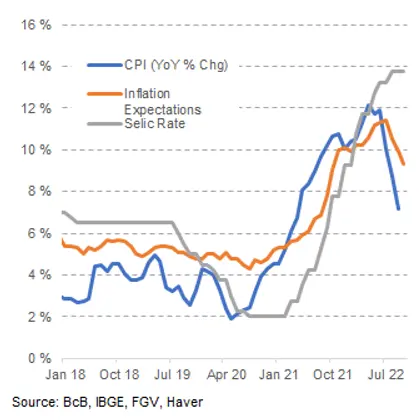

Brazil’s central bank started tightening policy in March 2021, making it one of the earliest countries in the world to do so after the record low rates seen during the Covid pandemic. Notably, Brazil has been far ahead of the US Federal Reserve, which only started increasing policy rates a year later.

The result of this foresight is one of the only countries where inflation - and importantly the population’s inflationary expectations – have been falling rapidly (see chart). Real policy rates are now particularly high relative to peers.

Brazil’s growth has largely held up despite that tightening cycle and the currency has been one of the best performing in emerging markets in 2022. It is one of the few that is stronger versus the dollar this year.

The country also remains resilient to external shocks given its small current account deficit, which is fully funded with foreign direct investment, local foreign currency sovereign debt, and high foreign exchange reserves.

From an investment perspective, while we are cheering Lula’s return from an environmental perspective, we are eager to see a continuation of sound economic management from the central bank as well as the new government in the years ahead.

So we continue to view the country favourably but prefer exposure to Brazil via local, rather than hard currency debt, given where valuations currently reside and our expectation that Brazil will be one of the first countries to start easing policy in the years ahead.

This marketing communication is provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

Candriam consistently recommends investors to consult via our website www.candriam.com the key information document, prospectus, and all other relevant information prior to investing in one of our funds, including the net asset value (“NAV) of the funds. This information is available either in English or in local languages for each country where the fund’s marketing is approved.