ESG, SRI

Sustainable Investing: Navigating the Palm Oil Challenge

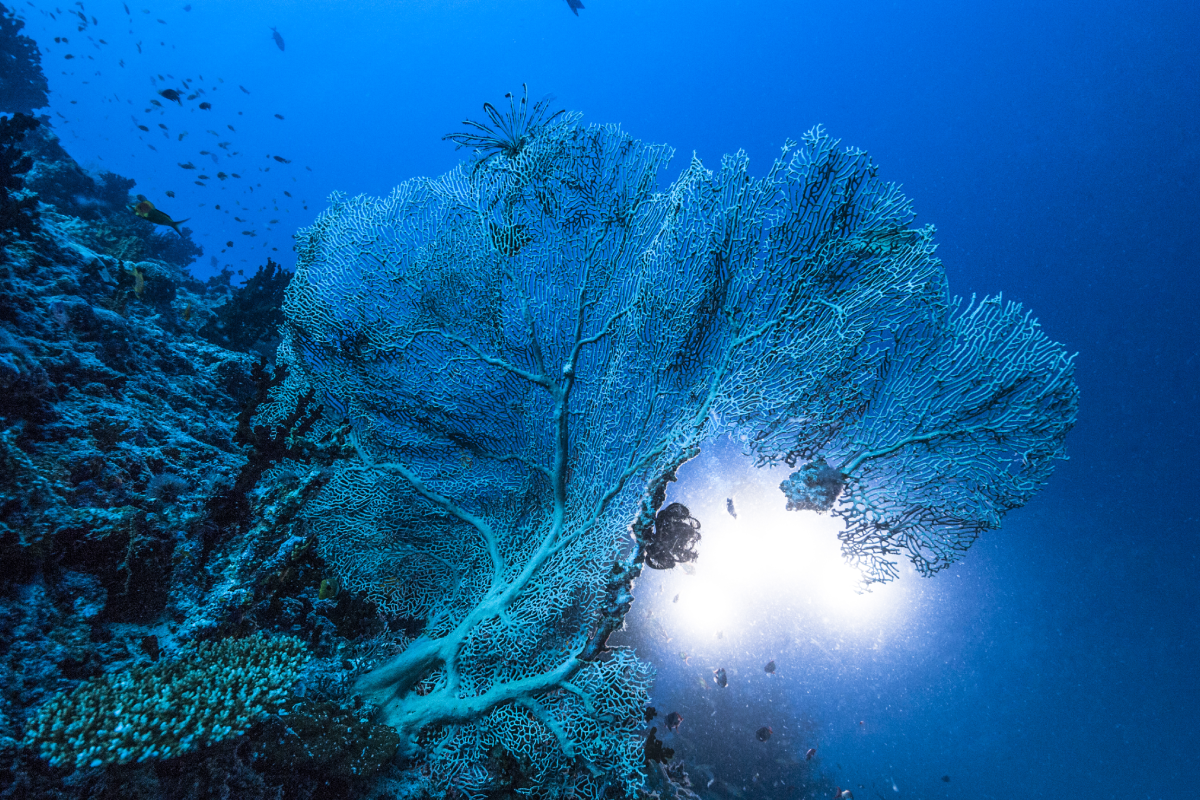

As investors increasingly prioritize sustainability, the palm oil industry has come under growing scrutiny due to its significant environmental footprint.