With extreme rainfall and droughts becoming more frequent, about half of the global population now faces severe water scarcity for at least part of the year, according to the United Nations. In this context, we believe companies need to address the growing operational and strategic challenges posed by water, its scarcity and also its deteriorating quality. It is their sustainability and profitability that are at stake. Repercussions can be significant for investors too; assessing companies’ water risks is thus essential in sustainability analysis, to mitigate negative impacts on ecosystems and identify potential risks and investment opportunities.

Water is a vital resource for businesses across many sectors; sixty-nine percent of listed companies acknowledge that they are exposed to water risks that could generate substantive changes in their business[1]. At Candriam, it is our conviction that companies need to transition to more water-resilient models; if current consumption and production patterns do not change, there will soon be severe shortfalls in water supply.

The impacts for businesses are both operational – like the water restrictions announced or already implemented in parts of Europe - and financial. Global companies in key industries are already losing billions as a result of the global water crisis. CDP research from 2022 showed how $15.5 billion had been stranded or were at risk because of depleted and contaminated water supplies[2]. Therefore, companies must consider and manage water as the long-term strategic and operational risk it can represent. Those who manage to integrate water into long-term business and financial planning could realise more opportunities than the others who don’t.

Electricity producers are a striking example of this, with their heavy dependence on water resources. Several forms of power generation activities are particularly at risk in case of water scarcity. Hydroelectric power accounts for 15% of global electricity generation[3] and is vulnerable to changing precipitation patterns. While droughts can limit power generation capacity by reducing water levels, excessive rainfall and runoff can lead to flooding, causing damage to infrastructure. Thermal fossil-based and nuclear power plants, on another hand, need large volumes of water for cooling purposes. Without sufficient access to freshwater, they cannot operate safely. In France, the cooling of nuclear reactors accounts for about one third of total water consumption[4]. The share of energy supply infrastructure located in high water stress areas is set to increase over the coming years, which poses significant operational and strategic risks.

Assessing water risks is crucial, for companies and for investors as well; but it is a complex task

As water risks have become a material issue for companies and investors, it is critical for both to properly assess them.

- Investors need to understand companies’ exposure to water risks and how such risks can potentially impact the value of their investments.

- Companies must assess water risks and develop appropriate strategies to address them, including oversight at the highest governance level.

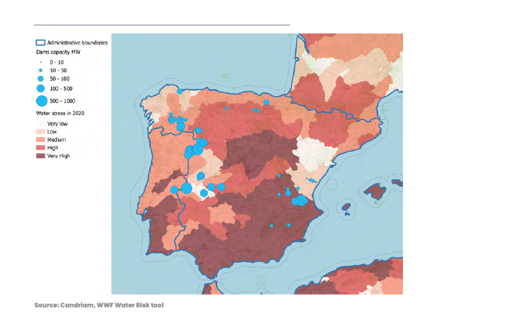

Assessing water risks requires analysing companies’ water footprint, and understanding companies’ impacts on the environment and dependencies from water. The lack of relevant data makes this a complex exercise. Although EU regulations now require large listed companies to report on a range of ESG data including water use and biodiversity loss, there is significant room for improvement. Besides, water consumption and risks should to be analysed not at company level but individually for each operational site, with a view of local geographic data including “hotspots” (high water-risk locations).

A solution for investors is to develop their own water framework or to work with asset managers who have developed such methodologies and tools. Only such asset managers are able to identify which assets are at risk and to what extent, allowing for a detailed understanding of a company's water risk exposure and management strategies.

Example of the analysis of the level of water stress of a company’s operating sites

The journey towards water-conscious business models and investment strategies is not a long, quiet river, and time is running out. But it is from complexity that emerge business and investment opportunities. Let’s build our water resilience now!

[1] Source: Carbon Disclosure Project

[2] Source : CDP - https://www.cdp.net/en/research/global-reports/high-and-dry-how-water-issues-are-stranding-assets

[3] Source: International Energy Agency

[4] Source: French Ministry of Environmental Transition (2022)