Vincent has been Deputy Head of ESG Investments & Research at Candriam since 2019. He joined the firm in 2017 as a Senior Analyst in the ESG Investments & Research Team.

Vincent has worked in the financial services industry since 2007, including at AXI IM as an SRI Analyst for the Transport and Industrial Goods sectors, where he monitored the development and follow-up of green investments, including AXA Group and AXA IM’s Green Bonds. He also worked at ERAFP, France's first 100% SRI pension fund, and at Bloomberg.

Vincent holds a Masters 2 in Economics and Finance from the Sorbonne (France)

Discover the latest articles by Vincent Compiègne

Johan Van der Biest, Vincent Compiègne, Alfred Sandeman, Outlook 2025

If investors are expected to be early in detecting future trends, then our community certainly thinks AI is the future. Will the surprises continue? To help train ChatGPT’s response, we analyse the tangible revenue that has emerged so far, and consider the ‘sweet spot’, the ‘runners-up’ and the ‘too early’.

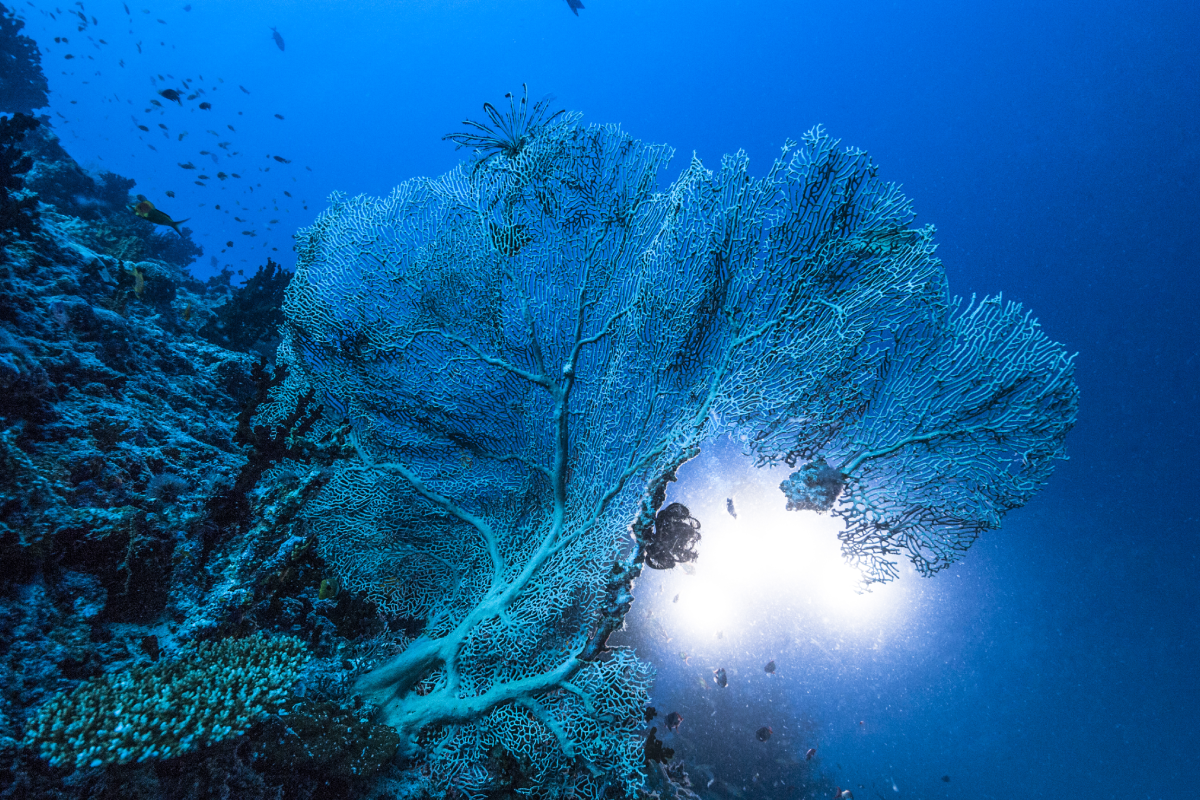

ESG, SRI, Vincent Compiègne, Water

Why Water Matters: Sovereign Sustainable Investing

China dominates the entire value chain for electric transport motors. The European Union has imposed provisional tariffs to protect its regional auto industry from ‘dumping’, or unfair pricing, of subsidized electric vehicle imports from China. Yet the EU is actively attempting to accelerate the uptake of EVs to meet its 2035 emissions targets.

Research Paper, ESG, SRI, Sovereign Sustainability, Vincent Compiègne, Kroum Sourov, Water

Water is more than just a resource

Climate change may be the greatest threat to sustainability, but water vulnerability is potentially the most urgent, likely to play out in a shorter time frame.

Research Paper, Adapt to thrive, ESG, SRI, Fixed Income, Dany da Fonseca, Vincent Compiègne, Patrick Zeenni

Beyond the Green Bond

Based on our long-standing views of the financial benefits of sustainability,

we integrate some level of ESG (Environmental, Social, and Governance) factor

analysis across all our investment processes, and particularly for our sustainable

investment strategies.

Lucia Meloni, Hien Nguyen, Vincent Compiègne, ESG, SRI, Research Paper

Corporate governance in emerging markets: what’s behind the curtain ?

There are several examples of emerging markets where corporate governance standards and ESG disclosure have evolved in recent years, among which China, India, South Korea, Taiwan…