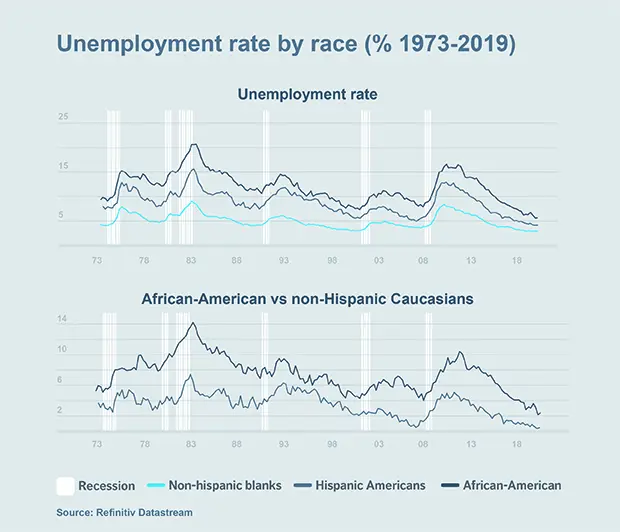

At the Jackson Hole Economic Symposium in August of this year, Jerome Powell announced a change in the Federal Reserve’s monetary policy strategy. Although the 2% target still remains in place, average inflation targeting has now been adopted. Following a period of low inflation, the US central bank will therefore let inflation drift slightly higher than its target level. In parallel, the Fed has also redefined its full employment objective, now undertaking to drive business activity to a level which not only allows the largest number of Americans to have a job, but also ensures that economic conditions improve for the whole population. The Fed therefore intends to contribute towards more inclusive growth which will benefit all communities more equally. To illustrate this change in strategy, Powell referred to the 10 years preceding the current crisis. By keeping the economy under pressure, monetary policy has enabled the unemployment rate among black and Hispanic Americans to reach all-time lows (chart 1)… and to significantly reduce the employment rate gap between communities.

By redefining its full employment target, the Federal Reserve has clearly implied that interest rates will remain durably low across the entire yield curve. Indeed, low interest rates are the only lever available to the Fed to encourage private and public spending and thus stimulate business activity. There is a risk however that the change in strategy may clash with another of the central bank’s key roles, i.e. maintaining financial stability. If indeed low rate policies encourage higher spending, they do so by pushing private agents to borrow. Overall debt will therefore increase over the next few years in the US and also in other parts of the world where dollar-denominated loans are undertaken. There is therefore a real risk that a new wave of debt will lead either to a crisis, or at least to a period of financial instability.

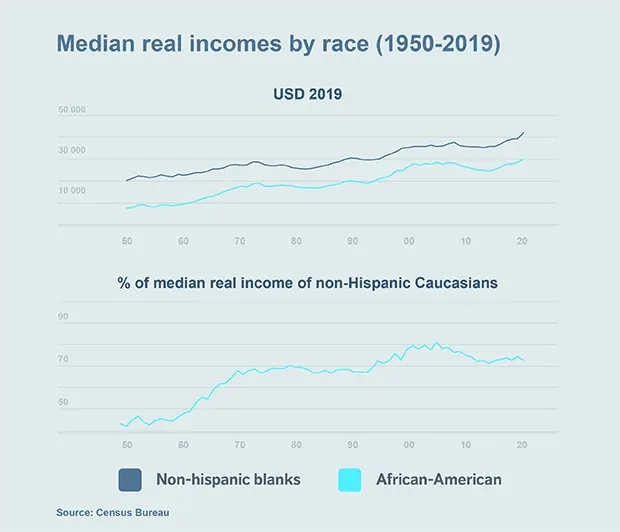

As regard the new full employment objective, the past few decades have clearly demonstrated that the central bank has not been the main driving force behind any real reduction in inequalities. Targeted education and redistribution policies need to be implemented to achieve this goal. Although the Federal Reserve has periodically succeeded in raising wages among black and Hispanic Americans more rapidly by keeping the economy in full employment for as long as possible, it has never managed to avoid recessions, which have been accompanied by a fall in living standards among the poorest. Only the war on poverty waged by President Johnson under the Great Society programs in the early 1960s durably reduced the income gap between black and white Americans (chart 2). Median incomes among black Americans are still nonetheless 30% lower than among the white population… which is the same disparity as during the early 1970s!