Emerging nations face a dilemma. On the one hand, they have a strong understanding of the need to protect the climate for future generations. Yet the imperatives of today are to improve their societies and living standards, which requires increased energy and electricity at affordable cost.

EM Nations are Willing

Emerging nations have joined climate change initiatives, particularly net-zero greenhouse gas (GHG) emissions accords, notably by signing Paris Agreement. Back in 2015, the Paris Agreement called for Developed countries to take the lead by providing financial assistance to countries, in recognition of the greater challenges that EMs must conquer to reach the "net zero carbon". Most Emerging countries are designing and implementing low-emission development strategies (LEDS).

At the same time, emerging markets are viewed as one of the bottlenecks in climate actions. COP26, the most recent annual UN Climate Change Conference, demonstrated that emerging markets are committed to de-carbonization but highlighted their greater challenges.

A Reminder of the Challenges

We have no doubt that de-carbonization in emerging markets will be challenging.

- Investment needs are enormous. Energy transition is a costly exercise, estimated by the International Energy Association (IEA) at $150 trillion over 30 years. Emerging Markets represent around 20% of this.

- Funding is not guaranteed. These countries are already highly indebted, financial markets currently favour lower-carbon investments; our research suggests roughly 37% of Emerging Markets investors plan to cut fossil exposure; and carbon taxes are difficult to impose.

- Access to certain technologies is limited, although available in developed markets such as Europe and US.

- Critical raw materials may become scarce, such as lithium or nickel.

- Availability of specialized personnel may be a challenge

- Pressure from Developed Markets is rising for EMs to commit to more substantial pledges. For example, their is pressure on Ems to phase out low-cost coal-fired power plants.

More Energy is Needed for Living Standards

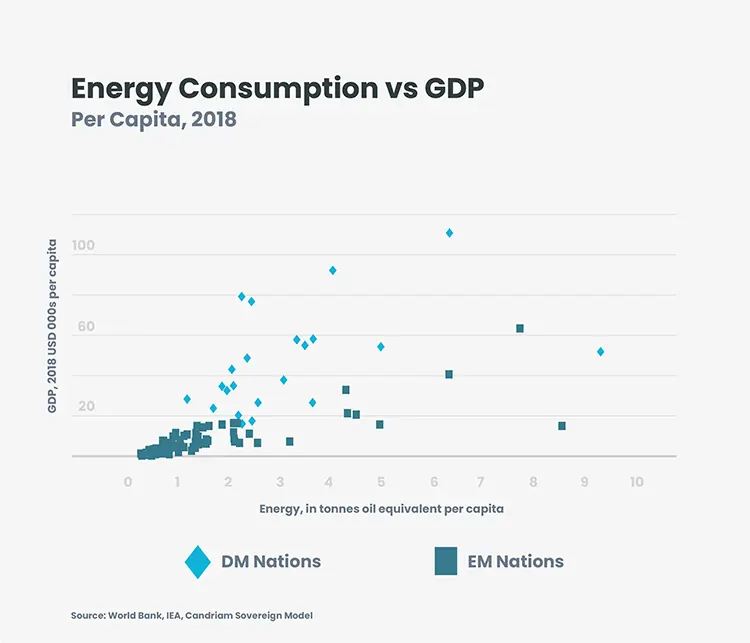

Growing populations and the need to improve living standards are priorities Emerging Nations dare not sacrifice. These require greater supply of electricity in emerging markets. Today, almost 800 million people have no access to electricity at all. Critically, there is a clear correlation between GDP per capita and energy. And economic growth does not cause energy consumption – it is the other way around.

According to BloombergNEF's New Energy Outlook 20202 estimates by 2050, emerging economies will account for 68% of global power demand. In other words, developing markets are dealing with sacrificing their growth in favour of de-carbonization without adequate means and sufficient resources.

Opportunities

Some Emerging Markets are nevertheless making good progress on decarbonisation. Emerging economies accounted for 58% of the $249 billion asset finance invested in clean energy worldwide in 20191. China and India continue to be the biggest markets for clean energy investment, with China the largest by far. Other Asian countries are leaders in electric vehicles components, with South Korea producing almost a third of global EV batteries.

Further, Emerging Markets possess substantial natural resources necessary for the green energy transition, such as nickel and copper. They also refine necessary raw materials, such as lithium and cobalt. Refining of both materials is currently dominated by China.

Employment opportunities are created by the net-zero transition. According to the IFC (International Finance Corporation) analysis of 21 major Emerging Market economies, representing 62% of the world’s population and 48% of global emissions, green investments in select sectors between 2020 and 2030 could generate 213.4 million cumulative new direct jobs. In regions such as East Asia and the Pacific (China, Indonesia, Philippines, and Vietnam) and South Asia (Bangladesh and India), the potential for cumulative new jobs is 98.8 million and 52.3 million, respectively. Smart city infrastructure to address climate change creates employment, and improves underdeveloped emerging market infrastructure. Of course, EMs and DMs face the same challenge of creating a "Just Transition" in which a nation's full society benefits, and pockets of new unemployment are prevented.

Conclusion

De-carbonization in Emerging Markets can create investment opportunities in sectors such as solar and wind energy; green energy-related raw materials production and refining; and the electric vehicles supply chain.

Renewable energy has take a foothold in the EM nations, yet coal remains the cheapest source of energy. The challenge for investors, who allocate capital, and for the globe as a whole, is to help these nations increase energy consumption in a way which is both cost-effective and emissions-constrained. EM nations face the dual imperatives of reducing emissions and simultaneously closing their gap with DM standards of living.

1 Climatescope Emerging Markets Outlook 2020, Bloomberg Finance L.P.2020