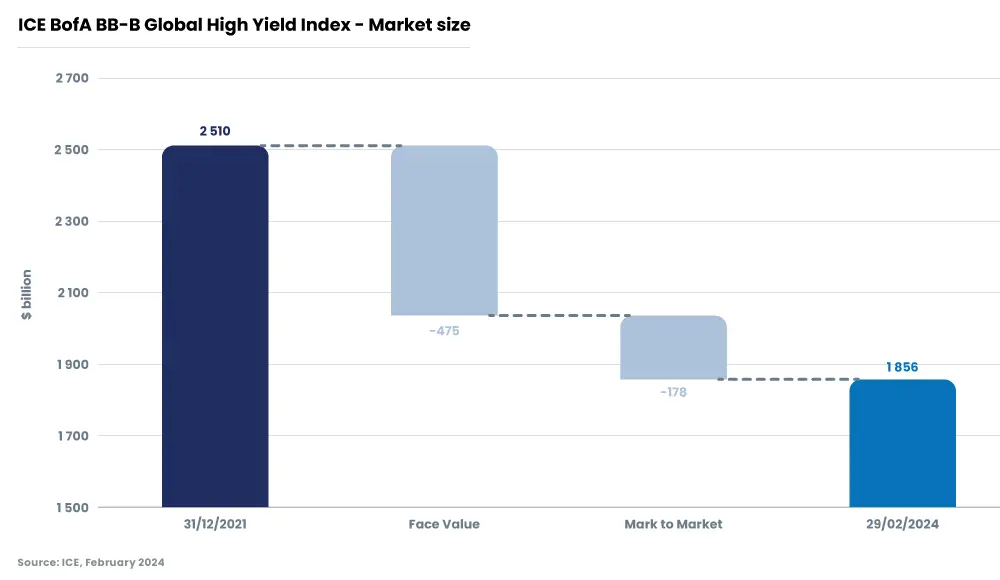

Since the end of 2021 and as a result of structural shifts in the economy, from decarbonization to relocation of supply chains and higher geopolitical risks, interest rates entered a new regime. After two years of rates considerably higher than the previous decade, what are the implications for High Yield markets?

;

;