Last week in a nutshell

- Newly appointed by the Queen Elizabeth II in her last constitutional action, the British Prime Minister, Liz Truss promptly announced a cap on soaring consumer energy bills for two years to cushion the economic shock for households.

- The European Central Bank hiked its interest rate by 75 bps, taking its main refinancing rate to 1.25%. It left the door open to another hike of that size later this year. Peripheral spreads came under pressure. The USD pulled back.

- The Fed’s Beige Book showed a light tilt in the economic activity, but the growth outlook is still weak. Fed Chair Powell reiterated the importance of maintaining the tightening cycle to combat inflation and to keep inflation expectations anchored.

- China's consumer and producer prices rose less than expected, fanning hopes for more stimulus as the economy wobbles. Meanwhile in Japan, PM Kishida ordered a fresh stimulus package in October and met with BOJ governor Kuroda to discuss the JPY's weakness.

What’s next?

- Inflation data will be in focus in the US and some European countries. It will be the last published US CPI and household’s expectations before the September Fed’s meeting on September 21st.

- In the US and in the euro zone, soft data stemming from the University of Michigan and the Centre for European Economic Research (ZEW) will be released. The US data will cover the usual current conditions, consumer expectations and inflation expectations, i.e., identified key issues of the November 8th mid-term elections. Primary races will be held in all 50 states through September.

- In China, economic activity indicators are due covering the real estate market, industrial production, retail sales and unemployment, a dashboard that should help gauge the magnitude of the economy softness and potentially fan hopes for more stimulus.

- On the geopolitical front, all eyes will be on a summit in Uzbekistan where Chinese President Xi Jinping and Russian President Vladimir Putin are expected to meet in person for the first time since the Russian invasion of Ukraine.

Investment convictions

Core scenario

- Our exposure keeps an overall broadly balanced allocation before positioning for the next stage of the cycle, whether it be a soft or a hard landing. We have an underweight stance on EMU equities, as the region is especially vulnerable to the tug of war with Russia, the high inflation, a hawkish ECB and a slowdown in economic activity.

- While the market environment still appears constrained by deteriorating fundamentals, markets are looking to central bank announcements, which, in turn, are becoming increasingly data dependent.

- Facing multi-decade high inflation, the Fed continues on its hiking cycle along with a quantitative tightening, i.e., a balance sheet reduction. In our best-case scenario, the Fed succeeds in landing the economy. As a result, we expect the rise in the US 10Y yields to fade.

- Inflation is also at highs in the euro zone, hitting businesses, consumers, and ECB policymakers alike. The ECB started its monetary policy tightening cycle in July with a 50 bps hike, followed by 75 bps in September. It also unveiled a new (“unlimited”) tool, the “Transmission Protection Instrument” (TPI).

- The risks we previously outlined are starting to materialize and are now part of the scenario.

Risks

- Upside risks include the fact that central bank actions are nearly priced for peak hawkishness in the US and weak sentiment and positioning in Europe. Downside risks would be a monetary policy error via over-tightening or a sharp recession risk via a deeper energy crisis in Europe. Meanwhile investor concerns are continuously shifting between inflation and growth.

- The war in Ukraine is pushing upwards gas prices while European activity is at the mercy of flows staying open. An emergency plan, “Save gas for a safe winter”, is in progress to curb consumption and find alternative sources of supply.

- The threat of COVID-19, and its variants, remain as the virus keeps evolving and spreading at various speed throughout the world.

Recent actions in the asset allocation strategy

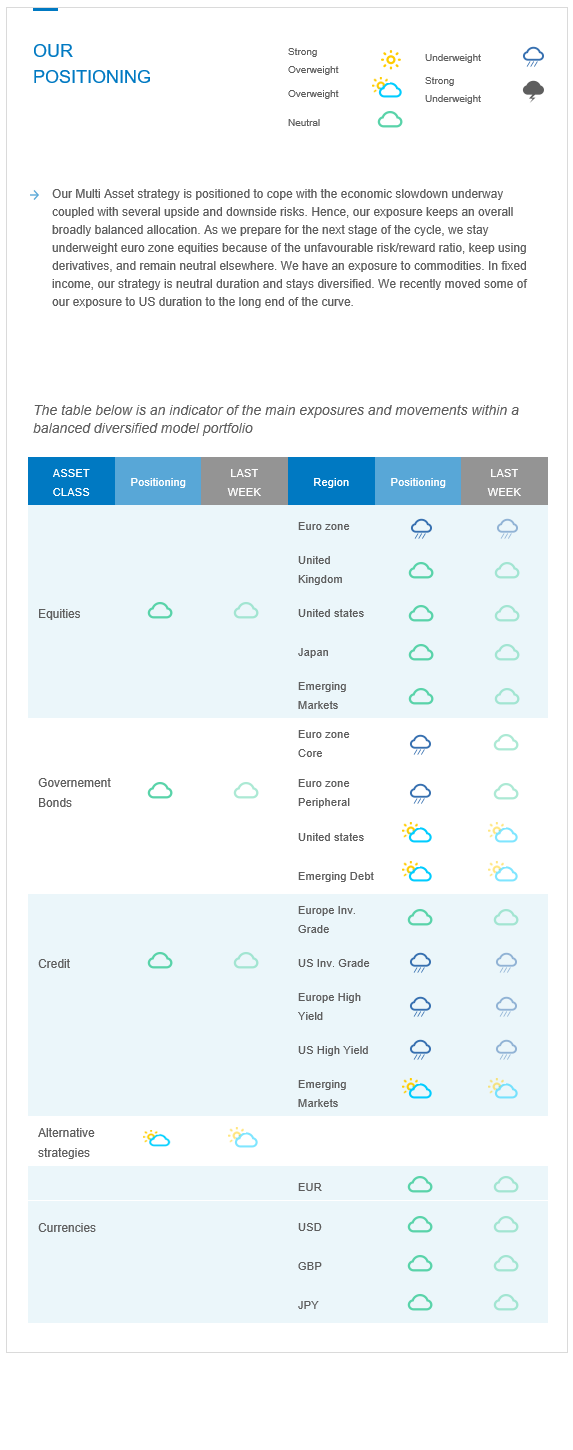

Our Multi Asset strategy is positioned to cope with the economic slowdown underway coupled with several upside and downside risks. Hence, our exposure keeps an overall broadly balanced allocation. As we prepare for the next stage of the cycle, we stay underweight euro zone equities because of the unfavourable risk/reward ratio, keep using derivatives, and remain neutral elsewhere. We have an exposure to commodities. In fixed income, our strategy is neutral duration and stays diversified. We recently moved some of our exposure to US duration to the long end of the curve.

Cross asset strategy

- Our multi-asset strategy stays more tactical than usual and can be adapted quickly:

- Underweight euro zone equities, with a derivative strategy in place. We prefer the Consumer Staples sector where we find pricing power.

- Neutral UK equities, resilient segments, and global exposure.

- Neutral US equities, with an actively managed derivative strategy.

- Neutral Emerging markets, but positive on Asian Emerging markets because our assessment indicates an improvement, especially in China, both on the COVID-19 / lockdown and stimulus fronts during H2.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure act as opposite forces for investor attractiveness.

- With some exposure to commodities, including gold.

- In the fixed income universe, we acknowledge downward revisions in growth, highs in inflation expectations and strong central bank rhetoric regarding the willingness to tighten and fight inflation. We are neutral duration, with a preference for long US duration.

- We continue to diversify and source the carry via emerging debt.

- In our long-term thematics and trends allocation: While keeping a wide spectrum of long-term convictions, we will favour Climate Action (linked to the energy shift) and keep Health Care, Tech and Innovation.

- In our currency strategy, we are positive on commodity currencies:

- We are long CAD and took partial profit on this trade.