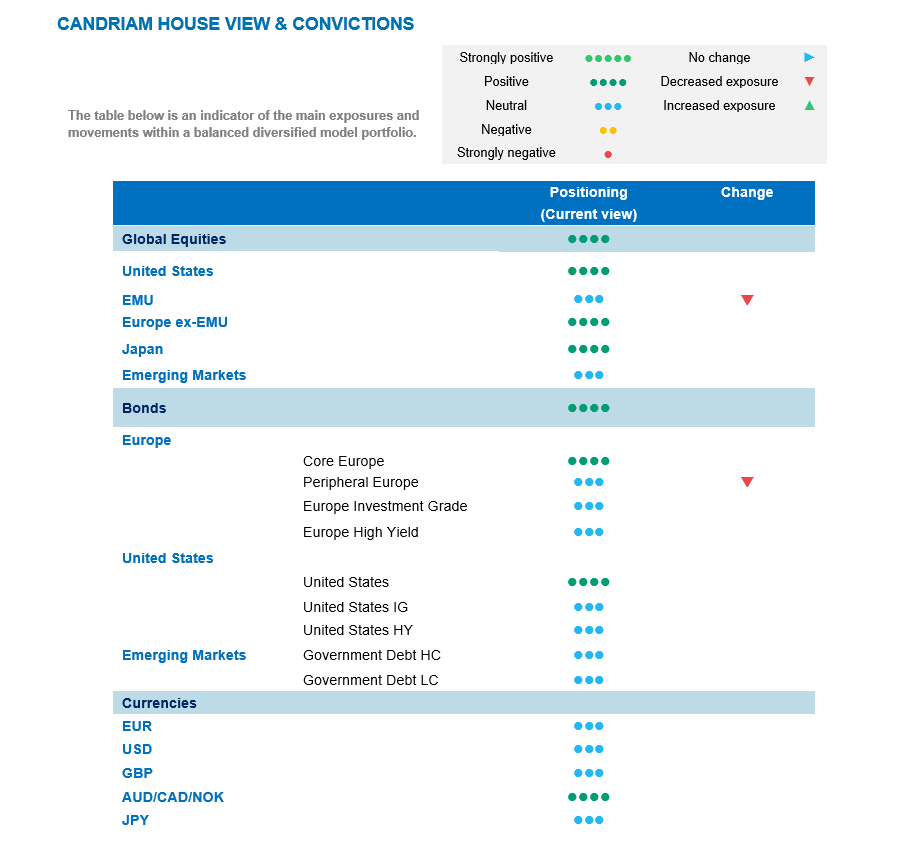

2024 was already a key election year, with more than half of the world’s population going to the polls. French President Emmanuel Macron’s decision to dissolve his own legislature in response to the European Parliament elections added to the list. The markets reacted sharply, with increased volatility on French and European assets. Facing a rise in political uncertainty, a higher risk premium appears justified in the region. We therefore decided to lower our exposure on EMU equities and non-core Euro bonds. However, our global view on developed market equities remains constructive, supported by the ongoing historical highs registered by US equities and improving fundamentals. On the fixed income side, safe bonds represent a good hedge in this context: we remain positive on European duration, also with the objective of benefiting from the carry in a context of cooling inflation and ECB and BoE rate cuts this summer. We also expected that US Treasury yields would retreat as the hawkish repricing of monetary policy from the Federal Reserve is now largely behind us.

A summer of election uncertainty

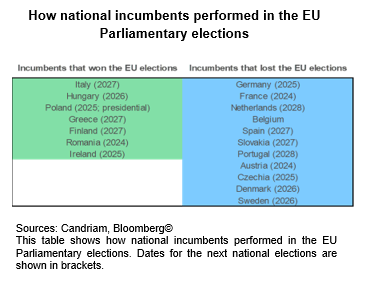

The election results in India, Mexico and South Africa sparked some volatility in recent weeks. However, the outcome of the European Parliamentary elections on 9 June added more uncertainty for investors. While the combination of the centre-left S&D, the centrist Renew, and the centre-right EPP groupings won just over 400 seats (403), which is slightly down from the 2019 elections, but still well above the 361 needed for a majority, the two parliamentary groupings further to the right – the ECR and ID – gained seats but not to levels that will dramatically alter the parliamentary outlook.

We note that many national governments lost the EU elections and it is therefore within politics at national level where the biggest scope for disruption lay after the EU elections. Financial markets will continue to figure out the impact of the French snap elections called for 30 June and 7 July. We expect (at least) temporary uncertainty and have slightly reduced our exposure on EMU equities and non-core Euro bonds.

This year’s US elections are also starting early

In addition to elections in France and the UK, the forthcoming US election scheduled for 5 November is now looming large on the horizon for this summer.

Donald Trump is leading Joe Biden in the probability of winning the elections, as he leads in most polls in battleground states. In the past three months, Donald Trump has flipped Pennsylvania (19 Electoral College votes), although he has recently lost his advantage in a handful of states.

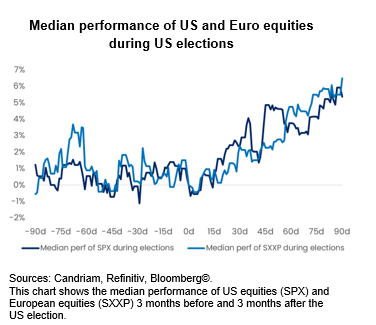

Contrary to historical observations since WWII, this year’s US presidential election has an accelerated timeline: whereas the traditional debates usually start in September, both candidates have accepted a first debate as early as 27 June. Furthermore, the sentencing of Donald Trump in the hush money trial in New York City is expected on 11 July, while the Republican Convention will start on 15 July to officially decide on his candidacy.

These events are potentially important for investors, as volatility has historically increased in the weeks before the US elections, as shown by a limited median performance of both US and Euro equities ahead of US elections.

But fundamentals also matter!

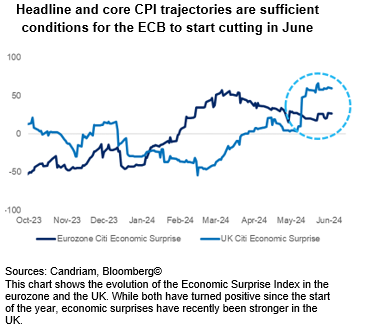

The UK will also hold snap elections, but the main uncertainty should not be about the winner but rather the state of the opposition. In this context, we prefer focusing on fundamentals, i.e. the evolution of the Economic Surprise Index in the eurozone and the UK. While both have turned positive since the start of the year, economic surprises have recently been stronger in the UK.

Regarding the growth/inflation mix, improving inflation and wage data should allow the Bank of England to start cutting its rates this summer. Now that Switzerland and the ECB have started the movement, the UK could follow suit, and reduce interest rates earlier than the Fed. In this setup, we have a slight overweight stance on UK assets overall: our positioning is notably held via a slight long duration on UK Gilts and via a preference for small and mid-caps.

Asset allocation: buy sovereign bonds and equities

Regarding equities, we have a slight overweight stance. Due to the rise in political uncertainty, justifying a higher risk premium on French and continental European equities, we have downgraded EMU equities to neutral. We expect this uncertainty to last into July, after the first round of the election.

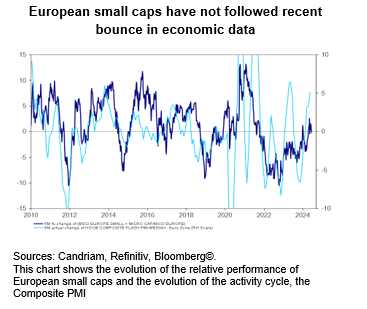

However, we maintain a Pan-European small cap bias to benefit from lower inflation, lower central bank rates and higher growth than expected. Once the election dust settles, we expect markets to adjust upwards to gradually improving fundamentals.

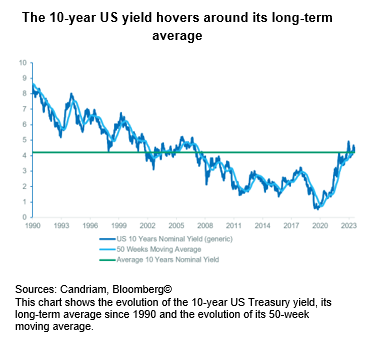

In the US, we made a portfolio adjustment mid-May by upgrading the technology sector to overweight. This decision was made on the back of good Q1 earnings and guidance, peaking long-term yields, reasonable valuations, broad market leadership within IT and the industry’s relative insensitivity to the upcoming US presidential elections. After a consolidation during spring, the Technology sector has bounced back remarkably, hitting new historical highs mid-June.

Regarding fixed income, we are reassured by recent inflation data and central bank meetings, and think that further upcoming rate cuts are an additional element which should act as support while capping long-term bond yields. Furthermore, both consumer and producer prices in the US have shown a significant cooling again, which should represent another step in the right direction for interest rates, i.e. moving lower.

We have kept our exposure on Credit at neutral (investment grade, high yield and emerging market debt). Last month, we booked some handsome profits on this long-standing conviction in a context of tight credit spreads. While we do not expect a material rise in spreads in the foreseeable future, there is little room for improvement either.

Clearly, we prefer taking the duration risk via sovereigns and the risk assets via European small caps or US Technology stocks.

We keep a positive stance on equities and duration

Equities: we have slightly reduced our stance on equities from overweight to slight overweight. The recent rise in political uncertainty has spilled over into financial markets and French assets, leading to somewhat higher volatility in the region.

Bonds: we are reassured by recent inflation data and central bank meetings, and think that further upcoming rate cuts are an additional element which should act as support while capping long-term bond yields. It is the first time in the 25-year history of the ECB that the reference rate has not been cut due to faltering activity but improving disinflation.

Currencies: commodity currencies could regain in appeal as the global manufacturing cycle picks up. We have reduced our long position on the Japanese yen as the BoJ appears overly careful.

We reduce EMU equities to neutral

French President Emmanuel Macron’s decision to dissolve his own legislature in response to the European Parliament elections increased volatility on French and European assets. Facing a rise in political uncertainty, a higher risk premium appears justified. We keep a Pan-European small cap bias to benefit from lower inflation, lower central bank rates and higher growth than expected.

Valuations remain attractive on UK markets, with a potential for multiples expansion, while the Bank of England should start cutting rates this summer, following the ECB.

Regarding the US, beyond robust earnings, the favourable repricing of monetary expectations is another support for Tech.

Upgrade of Global Tech on 17 May

Last month, we made a portfolio adjustment by upgrading the technology sector to overweight. This decision was made on the back of good Q1 earnings and guidance, peaking long-term yields, reasonable valuations, broad market leadership within IT and the industry’s relative insensitivity to the upcoming US presidential elections.

Prefer sovereign carry to spreads

Facing a rise in political uncertainty, safe bonds represent a good hedge. We therefore reduce EMU non-core holdings. We are positive on core European duration, as a safe haven, and UK duration, with the objective of benefiting from the carry in a context of cooling inflation and ECB and BoE rate cuts this summer.

With the expectations that US Treasury yields would retreat as the hawkish repricing of the monetary policy from the Federal Reserve is largely behind us, we seized an entry point on the asset class (around 4.60%). We were reassured by recent central bank meetings and think that the upcoming central bank rate cuts are an additional element which should act as support while capping long-term bond yields.

EMU Core: safe haven, upcoming cuts and easing inflation should be a support for the asset class.

EMU Non-Core: given the recent rise in European uncertainty, we reduce our stance.

Euro IG: we keep our exposure at neutral after booking some handsome profits on this long-standing conviction in a context of tight credit.

Euro HY: high-yield spreads are tight while credit conditions act as a headwind. Stabilising rating drift but defaults on the rise.

US Gov: US yields fell from 5.0% in mid-October to 3.8% at the end of 2023, and back to 4.7% in April. We have reached the attractive entry point we were looking for.

US IG: returns could be impacted by a consolidation following sharp spread tightening.

US HY: some caution on US HY, as the tightening of spreads means that the buffer for rising defaults has decreased.

EM Government Debt: spreads have already tightened significantly. In addition to hard currency exposures, a strong US dollar represents an additional risk for local currency bonds.

EM Corporate: highest regional real yield level offering carry but a strong US dollar represents a risk.

Commodity currencies could benefit from pickup in global manufacturing cycle

EUR: the EUR is currently vulnerable due to election uncertainty in France but supported by the bottoming out in activity.

USD: the markets expect a less rapid monetary easing than in Europe, which represents a support for the greenback.

JPY: we have a neutral view on the Japanese yen as the BoJ appears overly careful in its tightening process.

AUD/CAD/NOK: commodity currencies could regain in appeal as the global manufacturing cycle picks up.