European equities: Information technology continues to lead

European equity markets were unable to continue their uptrend since the beginning of the year over the past four weeks. Although there wasn’t a big difference between value and growth, performance dispersion in the underlying sectors was high. Information technology was once again the biggest outperformer, supported by, amongst others, investors’ interest in companies that benefit from the increased demand for artificial intelligence solutions. Besides information technology, industrials and financials also outperformed the broader European market, though to a lesser extent.

Communication services, consumer staples, utilities and consumer discretionary were the strongest underperforming sectors over the past four weeks. The latter was subject to some profit taking after the strong year-to-date rebound on the back of the re-opening of the Chinese economy. As it appears the Chinese economic recovery somewhat disappointed, investors have partially locked in their relative profits on the sector.

Separately, energy was unable to profit from Saudi Arabia’s production cut of one million barrels a day in an effort to support oil prices. Investors mainly focus on the possible demand decline in the light of the on-going economic slowdown.

Earnings Expectations & Valuations

The first-quarter earnings season was quite decent. Surprisingly, earnings growth was positive with around 70% of the European companies in the Stoxx Europe 600 beating expectations. Following the first-quarter earnings season publications, earnings revisions have become slightly positive.

Consensus expectations now point to earnings growth close to 5% in the coming twelve months for the euro zone. Considering that expected earnings growth, the European equity market valuation seems attractive at less than 12 times twelve-month forward earnings.

The UK is even more attractive than euro zone when looking at twelve-month forward price earnings, but this is for a reason. The UK is the sole region for which consensus expectations point to an earnings decline in the coming twelve months, as a result of the region’s significant commodity exposure.

Maintain defensive positioning

After the good performance since the start of the year, European equities are already taking into account a lot of positive news. Earnings expectations already consider a cyclical rebound next year, while economic data is mixed. In addition, the Chinese economic recovery seems to disappoint somewhat, and European core inflation remains stubbornly elevated. This complexifies ECB President Lagarde’s task in managing high inflation on the one hand and monitoring financial stability on the other.

In this context, we are convinced that it continues to make sense to keep a balanced approach with a defensive tilt. We made no significant strategic changes to our allocation over the past few weeks, as we still feel comfortable with our current positioning, tilted towards more defensive growth sectors, such as Consumer Staples and Health Care, despite a more difficult performance over the past weeks.

We also maintained our +1 on retail banks, favouring attractively valued retail banks, while avoiding high-risk investment banks. Selectivity is nevertheless key as the market context has become a bit more difficult given the expected evolution of the lending cycle and increased competition. A bias towards quality banks with pricing power and a competitive advantage is warranted in this context. To complete, we remain negative on Energy for the time being.

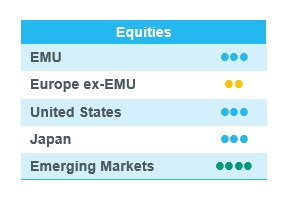

US equities: Quality growth in the lead

The US market trend remains moderately bullish, as quality growth stocks continue to lead the market. The economy is clearly slowing down at a steady pace, while inflation figures continue to ease. In the meantime, the debt ceiling discussions between Democrats and Republicans have only been a temporary source of uncertainty for equity markets.

Quality growth outperforms

US equities have been slightly positive since the beginning of May. That positive performance mainly comes from growth sectors, such as communication services, consumer discretionary and information technology. The latter was once again the biggest outperformer, supported by, amongst others, investors’ interest in companies that benefit from the increased demand for artificial intelligence solutions.

Defensive sectors strongly underperformed the broader market over the same period. Consumer staples and utilities lost significant ground, whereas health care was also slightly negative over the past weeks. Separately, energy held up quite well, as Saudi Arabia announced it will be cutting its crude oil production by a million barrels a day in an effort to support oil prices. The cut followed the OPEC’s 1.16 million barrels a day cut in April.

Decent earnings season

The US earnings season was quite good with almost 80% of the companies in the S&P 500 beating earnings expectations, according to Factset Research. Following the first-quarter earnings season, earnings revisions have become slightly positive.

Consensus expectations now point to around 5% earnings growth in the coming twelve months. Considering that expected earnings growth, the US equity market valuation doesn’t seem overly expensive.

Moderately bullish

US equity markets are nearing new highs for several reasons:

- At first, the US will probably avoid a brutal growth slowdown. Instead, the current macroeconomic environment points to a long but limited economic growth slowdown.

- Secondly, when looking at the last economic publications, such as the ISM Prices Paid, we recognize inflation continues to go into the right direction.

- Thirdly, equity markets aren’t overly expensive.

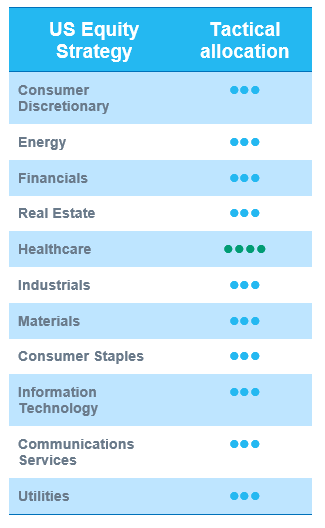

This justifies a moderately bullish view. Nevertheless, it is probably still a bit too soon to start increasing cyclical exposure. In this context, we prefer keeping a balanced portfolio aiming at alpha creation through stock picking. As such, we haven’t changed our sector grades and thus have decided to keep Health Care a +1, the one positive grade we have for the time being.

Emerging equities: China’s post-Covid recovery is milder than expected

In the month of May, equity markets suffered from downward pressure due to intensified US debt ceiling negotiations. President Biden and House Speaker McCarthy eventually reached an agreement, raising the borrowing limit until late 2024. Meanwhile, US-China tensions lingered with twists and turns. The two competitors continued to show military aggressiveness without an established communication channel. Divisions existed between leaders at the G7 summit, followed by a conclusion of “de-risking not de-coupling” China. A few signs of stabilisation have been observed, however, as China’s new ambassador assumed office in the US. The position has been vacant for nearly six months. A talk between the two countries’ top commerce officials was also organised. The competition between the two countries is expected to last, as China plans to land astronauts on the moon before 2030. Over the month, Emerging Markets posted negative returns (-1.9% in USD), underperforming Developed Markets (-1.2% in USD) by 0.7%.

As one of the global focuses, China’s post-Covid recovery was milder than expected. There was a lack of meaningful policy response from Beijing, and the government is considering tax incentives for manufacturing companies. In terms of external policies, China banned Micron from critical infrastructure for security reasons, leaving room for local and South Korean chip producers. Until now, the US government allowed South Korean companies to have one last year to “fill the gap”. South Korean and Taiwanese tech companies also benefited from AI’s promising potential. Jensen Huang, the CEO of Nvidia (an American leader in AI), released impressive guidance for the company and addressed several speeches about a “new computing era”. This re-ignited investors’ passion for the global tech sector. Another positive news came from Syngenta, a Swiss agricultural conglomerate. The group is seeking an IPO in Shanghai.

Politics also played an important role in other emerging countries. In Thailand, the pro-democracy party won the general election but had difficult discussions to form a coalition government and this led to a weakening effect on the local currency. Recep Tayyip Erdogan will remain president of Turkey after a run-off victory. He replaced almost all cabinet members, and Mehmet Simsek was named the new finance and treasury minister. Simsek is a former Merrill Lynch economist who is well received by investors. Greece was the top-performing market in May. Its ruling party won the general election, easing concerns of forming a coalition. Argentina was the best performer in LatAM on anticipations that positive changes could follow the general elections in August and October.

Gold was down 1.4% and silver fell 5.6% over the month. Crude oil was shadowed by volatilities with Brent eventually falling 11.5%. EMFX declined 2.0% amid a worsening earnings outlook and uneven recovery in China’s economy.

Outlook and drivers

Despite the near-term fluctuations, the long-term outlook for Emerging Markets equities remains positive.

China’s manufacturing PMI data have experienced a slight decline, falling below 50 for two consecutive months. This is in line with the expectation of an uneven trajectory of the economic recovery. China is facing major headwinds that are difficult to address, including macro weakness and worsening geopolitics ahead of the US elections. The rebound proved to be milder than expected, and investors are expecting to see that Beijing catches the momentum and implements stimulus. The competitive environment in the consumer retail sector may trigger a shift in sector leadership, which is potentially beneficial for Chinese consumers. Furthermore, the current market scenario includes new secular growth themes such as digital/cloud rollout for Chinese enterprises, advancement of high-end manufacturing, and integration of AI features by software and gaming giants.

The rising demand for AI, ChatGPT-associated processing and memory semiconductors is a tailwind for selected companies in Taiwan and South Korea. In addition, the latter is poised to gain advantages from the United States' Inflation Reduction Act (IRA)-related demand and the EU's transition towards clean technology.

The portfolio’s holdings demonstrate a great potential for constant growth and generate higher returns on equity when compared to the benchmark average.

Positioning for recovery

We downgraded China in our regional allocation to neutral and maintain Consumer Discretionary to neutral to reflect near term economic oscillations.

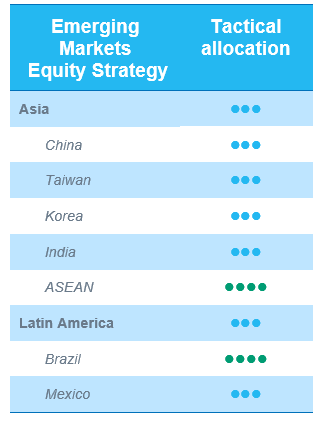

Regional views:

China: Neutral – Previous optimism for the region was driven by 3 factors – reopening-driven recovery reflecting in earnings pickup, attractive valuation comfort, and more to come policy support. The latest data from China, however, revealed consumer weakness: decreasing exports/imports, falling CPI figures, and remaining-neutral credit impulse. Additionally, large ecommerce names facing growth concerns are entering a new phase of increased competition. Geopolitical risk and uncertainities are back on the table and could continue to add to headwinds.

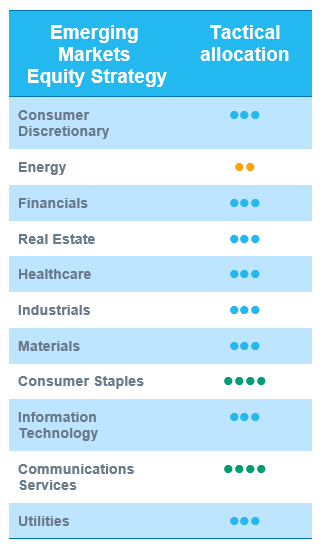

Sector and Industry views:

Consumer Discretionary: Neutral

Following up on our recent update of a slower than expected consumer recovery in China, the consumer discretionary sector, which includes large China ecommerce names like JD.com, Alibaba etc., could continue to come under pressure, as they tackle challenges of weakening sentiment and increasing competition.

We remain neutral to the sector. We continue to monitor the upside risk as China’s mid-year sales will arrive in June.

Views from last month: