European equities: Stronger growth than expected

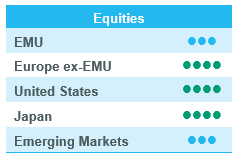

European economic growth is somewhat stronger than expected, but still well behind US economic growth. In the eurozone, the European Central Bank (ECB) is more confident about the economy’s disinflationary path, with wage growth continuing to moderate despite the recovery in activity. In May, both headline and core inflation accelerated. Despite this upside surprise, the slowdown in inflation over the last few months has enabled the ECB’s governing council to signal a high degree of confidence that rates will be cut in June, even if the path thereafter remains less clear.

Since our last committee, growth stocks have outperformed value ones, for both large, mid & small caps.

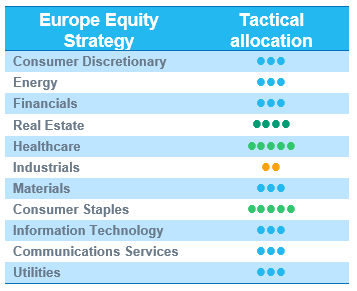

From a sector perspective, defensive sectors have outperformed the broader market over the past four weeks. Healthcare was the strongest outperformer, followed by Consumer Staples, while Energy was the clear underperformer.

Within cyclical sectors, Industrials and Financials were the best relative outperformers, while Materials was the worst performer.

Earning expectations and valuations

In the meantime, fundamentals remain reasonable for European equities. Positive earnings revisions have been supportive for the European market.

12-month forward earnings are expected to grow by 7% and are mainly supported by growth in Industrials, Materials, Information Technology, Communication Services and Healthcare. Conversely, Energy and Utilities remain the only sectors dragging down expected earnings, with negative expected growth in the coming months.

European markets are trading at the bottom of their historical range when looking at the 12-month forward price-earnings ratio of 13.6.

We tactically upgraded Telecoms on 5 June from -1 to neutral to +1. After 12 years of negative grade on the European Telecom sector, we have closed the underweight (tactical move) to go back to neutral.

- We see improvements in free cash flows for some names: DTE, TEF etc.

- Valuation is not demanding and even attractive compared to European cyclicals.

- Technical analysis shows no reason to maintain an underweight.

On 11 June, we decided to upgrade retail from -1 to neutral. The subsector, part of the Consumer Discretionary sector, includes more attractive companies (such as Inditex, which put in a strong performance).

We keep our neutral stance on media & entertainment (due to Publicis and UMG) and maintain the position on Real Estate (given an attractive valuation due to the upcoming ECB rate cut). Note that within Real Estate, we remain selective and favour certain niche segments (logistics, student houses and retirement homes) and avoid shopping malls and commercial properties.

We still remain confident in our positive stance on Consumer Staples, one of our strongest convictions in this uncertain market. Within this sector, we favour food & beverage and household & personal products companies. The Q1 earnings season has been very positive for this sector.

We also maintain our positive (+2) rating on the Healthcare sector. European Healthcare offers an attractive risk-return profile thanks to reasonable valuations, strong cash flow visibility and projected earnings growth.

US equities: Growth large caps continue to lead

US equity market bounced back after a slump in April. Investors remain optimistic about the economy, as leading indicators showed that the economy remains in good shape. However, there have recently been signs of a slight slowdown, which is why investors are expecting the Federal Reserve to cut interest rates later this year. This potential rate cut eases pressure on long-term interest rates.

Year-to-date trends continue

Since the end of April, the US 10-year yield has declined by around 30 basis points. In this context, the US equity market continued the trends started at the beginning of the year, with large caps and growth sectors outperforming.

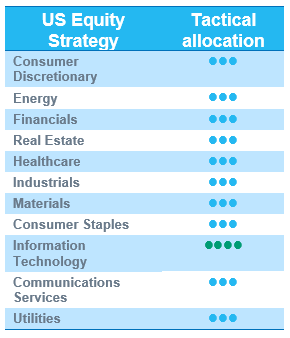

From a sector perspective, Information Technology and Communication Services remained the best relative outperformers over the past few weeks. Healthcare has also performed quite well over the past weeks relative to the broader market.

Energy has been one of the weakest sectors more recently, as the price for a barrel of Brent crude oil has dropped by more than 10% since its April high. Industrials and Materials also lagged the broader US market.

Earnings revisions turn positive

Although we are still a few weeks from the official kick-off of the Q2 earnings season in early July, investors have been adjusting their outlook. Earnings revisions have become positive over the past few weeks and investors now expect earnings growth of more than 10% this year and even more than 14% in 2025.

Earnings growth is expected be mainly driven by Information Technology, Communication Services, Utilities and Financials. Energy and Materials are the sole sectors for which investors expect earnings to decline this year.

With this in mind, it’s worth noting that US equity market valuations are above average, but are not overly expensive though, especially not when we take into account the high level of profitability.

Information technology back at +1

Since mid-March, we have had a neutral grade on US Technology. That is no longer the case. On 17 May, we upgraded Information Technology back to +1 from neutral, after a brief period of relative underperformance, on the back of:

- Peaking long-term yields.

- A good Q1 earnings season and full-year guidance, pointing to healthy IT spending across all subsegments.

- There is a broader market leadership within IT. Analog semis are bottoming out, a broad range of AI derivatives is performing well, cloud consumption is picking up and hyperscalers confirmed massive capex plans, supporting the whole AI value chain.

- Valuations aren’t overly expensive and the sector is relatively well insulated from any outcome in the presidential elections: if Joe Biden wins, business as usual, if Donald Trump wins, the focus will be on the US, with IT as a heavyweight in all indices.

Emerging equities: Playing a key role in global economic growth.

In May, EM rose 0.3% (in USD), significantly underperforming DM (+4.2%). EM equities experienced a rally in early May, fuelled by advances in tech/AI, supportive policy measures from China and optimism about potential Fed easing. However, the markets retreated from mid-month highs due to rising US yields, triggered by disappointing CPI data and the looming expectation of prolonged higher interest rates from the FOMC.

In the US, inflation showed more stability. For the month of April, the personal consumption expenditure price index rose 2.7% year-on-year, the same level as in March. The Fed remained patient, awaiting more definitive signs before making any adjustments. On the geopolitical front, the Biden administration raised tariffs on several Chinese goods including electric vehicles. The move was largely political, as Chinese EVs have minimal exposure to the US market.

China saw a good rebound (+2.1%), with improvement in both local and Hong Kong markets. The government entered a concrete phase, rolling out meaningful stimulus. Measures were exemplified by issuance of special treasury bonds, a relaxation of house purchase restrictions and governmental support to digest housing inventory. However, the manufacturing PMI again dropped below 50 into the contraction zone.

In Taiwan (+5.1%), the new president took office and gave his inaugural speech. Company-wise, TSMC announced an ambitious plan to build its first facility in Europe. In South Korea (-3.4%), the Value-up initiative extended vitality on the government’s agenda and won praise from companies. The Korean president was also engaged in trilateral meetings with Chinese and Japanese leaders to explore a new cooperation framework.

In India (+0.6%), the uptrend continued. The country’s credit cycle remained robust, and the government reported a high cash balance. India’s weight in the MSCI index further increased. Meanwhile, the general elections were held amid extreme heat. Prime minister Modi was expected to win a third term in June.

In LatAm, Brazil (-5.9%) experienced a pull-back, as concerns were raised over the floods’ impact on the country’s fiscal health. Mexico (-2.8%) experienced some volatility, as the left-wing party led in the general elections.

Turkey (+6.2%) saw the highest export growth in May this year. Domestic demand remained strong, which encouraged the central bank to stick to its rate hiking policy. Saudi equities were down (-8.1%), with all sectors in the red.

Brent crude fell $6.24 to $81.62/bbl, dragging the markets down. US yields ended the month at 4.51%. Gold rose by 1.8% while silver climbed 15.3%. EM equity reverted to inflows in May (though mostly in ETFs).

Outlook and drivers

EM equities have demonstrated a robust recovery this year, with some EM countries playing a key role in global economic growth.

Regionally, EM outside China have shown notable resilience. India marches on a strong growth track, supported by public capital expenditure and favourable demographics. Prime Minister Modi is expected to win his third mandate, ensuring policy continuity and stability.

Taiwan and Korea are collaborating closely with US chip leaders, heralding a new “era of robotics” according to Jensen Huang, Nvidia CEO. On top of that, Taiwan revised its GDP growth estimate upwards due to strong exports. Elsewhere, southern Asian countries are also actively positioning themselves as the latest chip hubs.

The IMF has slightly upgraded China’s 2024 GDP outlook. China’s property issues have eased, following the government’s more proactive approach. Beijing is mulling policies to help local governments digest excessive housing inventory. Other encouraging measures include the issuance of ultra-long-term bonds and the setting up of a new sovereign fund on high-tech. Nevertheless, recent PMI figures highlighted an uneven path for China’s recovery, and the need to consider investments in the country selectively.

Aligned with our strategy, we dynamically calibrate the portfolio’s risk appetite in response to evolving market dynamics, when maintaining a balanced position. We are awaiting further confirmation of the US’s dovish rates policy and China’s recovery, contributing to the differential growth of EM.

Positioning update

We are optimistic on the recovery of EM equities in 2024. We are positive about the tech sector, especially AI.

Region view – No change to our region views. China is stabilising, but with mixed economic data. We remain positive on India post-elections. We continue to be neutral on Mexico post-elections. Brazil is experiencing some near-term concerns.

No change to our sector views. We are positive on the tech sector, further supported by AI development.

Regional views:

No change to our regional views

China – Neutral: Deflation continues, with weak demand. Valuations have improved to historical levels. Stock picking is crucial in supporting performance.

India – OW: The market has seen some profit taking. Modi was confirmed to begin a third mandate with fewer seats. We will have more visibility when the budget is out in July. We maintain our positive view on India.

Mexico - Neutral: The market experienced volatility on election day. We did not expect radical changes post elections and continue to monitor the situation.

Brazil – Neutral: Several factors weigh on the country’s performance, including US inflation and a natural disaster in the south of the country.

Sector and Industry views:

No change to sector views

We remain OW in tech/AI. TSMC reached an all-time high. SK Hynix is poised, as a key supplier to Nvidia.