European equities: significant outperformance of large caps

Despite a hesitant start, global equity markets ended the first month of the year on a positive note. The US was a clear outperformer, but European equity markets also ended the first month of 2024 higher. The composite purchasing manager’s index increased slightly to 47.9 in January, remaining below the 50 mark that divides growth from contraction. Meanwhile, the European Central Bank kept rates steady at its January meeting and re-iterated that future policy-rate decisions remain data dependent. A rate cut in March seems unlikely and probably should not be expected before the summer.

In terms of performance, the observed style trends have been clear over the past four weeks, since the last committee meeting. Large caps significantly outperformed small caps, as long-term interest rates have been heading higher so far this year. The German 10-year yield increased almost 30 bps to more than 2.3% at the beginning of February.

In the meantime, growth stocks took the lead once again, while there was no clear distinction between cyclicals and defensives.

From a sector perspective, Information Technology was once again the biggest outperformer, followed by Consumer Discretionary and Industrials. Consumer Staples also did quite well, outperforming the broader European market.

Materials, energy and utilities were among the biggest underperformers with the latter suffering from the increase in long-term rates in the first weeks of the month.

Earning expectations and valuations

The earnings season for Q4 2023 is currently ongoing and is clearly less constructive than in the US. Although only 20% of the companies in Europe have reported results so far, only 45% were able to beat earnings – the lowest figures since 2009 according to JP Morgan’s earnings tracker. Q4 earnings growth is currently running at -4% year-over-year and analysts continue to revise down their earnings expectations.

Currently, the consensus expectation is for 4% earnings growth in the coming 12 months. Energy and Real Estate are among the main sectors dragging expected earnings down, whereas Materials, Industrials and Healthcare are among the sectors with the highest expected earnings growth in the coming 12 months.

Even considering that moderate earnings growth, European equity markets look quite attractive. They are still trading at the bottom of their historical range when looking at the 12-month forwards price-earnings ratio of below 13.

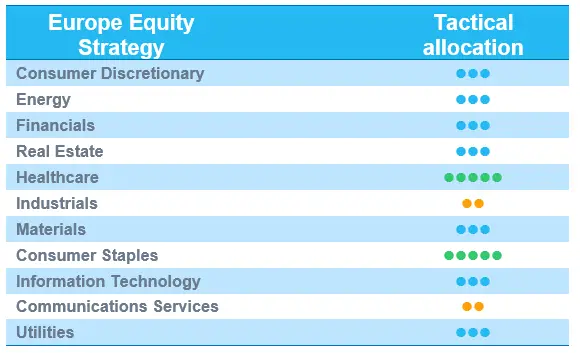

No structural changes

In this context, we have not made any structural changes to our sector allocation. We feel comfortable with our positive grade on the defensive Healthcare sector (high visibility, benefits from increasing M&A activity and attractive valuation in an environment of slowing economic growth) and Consumer Staples sector (Food & Beverage and Household & Personal Products are attractively valuated and might benefit from the easing negative GLP1-story and stabilising long-term interest rates.

US equities: strong start for US equities in 2024

Despite a hesitant start, US equity markets ended the first month of the year with a positive performance. Investors welcomed decent economic figures in the US and successfully digested strong economic growth data and changing interest-rate cut expectations by the Federal Reserve.

Big growth companies outperform

The year got off on the right footing and the observed style trends were clear. Large caps clearly outperformed small caps in January, whereas growth took the lead over value. From a sector perspective, there was no clear distinction between cyclicals and defensives. Technology and Communication Services continued to boost the market, while the more defensive Healthcare sector also outperformed the broader market. Materials and Utilities were the main underperformers, with a negative year-to-date performance. The latter suffered from the increase in long-term rates in the first weeks of the month.

Ongoing earnings season

The Q4 2023 earnings season is currently ongoing. According to Factset, around 46% of S&P 500 companies have already published results. Around 72% of those have reported higher-than-expected earnings. Current blended earnings growth is running at 1.6% year on year, marking Q4 as the second consecutive quarter of earnings growth.

Earnings expectations for the coming 12 months have remained broadly stable, with expected earnings growth of around 10%. With that in mind, the US equity market is currently trading at around 20 times expected earnings, which is above-average, but not yet overly excessive.

Comfortable with current positioning

In this context, we have not made any structural changes to our sector allocation. We feel comfortable with our positive grade on the defensive Healthcare sector, which offers high visibility, benefits from increasing M&A activity and attractive valuation in an environment of slowing economic growth.

We are also maintaining our positive stance on the Technology sector, for which we have seen good earnings publications so far. The sector should continue to benefit from stabilising interest rates, the prospect of Fed rate cuts and the support of artificial intelligence. We recognise that valuations have increased, but currently do not see them as a risk, as growth remains strong. The trend remains our friend for now and we still have some upside potential.

Emerging equities: Underperforming month

In January, EM posted negative returns (-4.7% in USD) and underperformed DM (+1.1%).

In China (-10.6%), despite an in-line GDP growth (5.2%) for 2023, the overall weak trajectory continued. The ongoing challenges were especially underscored by persistent deflation, contracting manufacturing PMI, and soft credit data. Although the PBoC injected more liquidity and reduced the Reserve Requirement Ratio (RRR) by 50 bps, resulting in a brief market rebound, sentiment remained cautious and awaited further restoration.

Taiwan (-1.5%) and South Korea (-9.7%) posted negative returns during the month, while Taiwan outperformed. The technology-led exports regained strength, helping the economy. The semiconductor industry saw further confirmation of a turning point and confidence was additionally boosted by fast-growing orders stemming from the accelerated adoption of AI. Taiwan elected a new president from the same Democratic party as his predecessor. This will have a positive impact on the stability of the chip supply chain. Meanwhile, South Korea witnessed its highest exports growth since May 2022. The Korean government mulled new policies to enforce corporate disclosure and narrow the discount of undervalued companies.

The Indian market (+2.5%) continued to be strong. The Indian stock market rose to fourth place ranking among its global peers fuelled by increasing passion among domestic investors. The government’s forthcoming interim budget in February was expected to prioritise long-term objectives while maintaining fiscal discipline, such as more investments in infrastructure and social-driven projects.

In Latam, Brazil (-5.9%) underperformed peers. while the easing cycle continued with another cut of 50 bps.

In Mexico (-1.9%), moderating inflation provided room for rate cuts in the near term.

Turkey (+10.3%) saw another rate hike. Inflation stayed at high levels but was in line with the central bank’s assessment. Greece (+5.8%) also recorded positive performance during the month, as the economy resumed growth following a prolonged period of stagnation.

Regarding commodities, oil gained +6.1% amid the present geopolitical volatilities. Gold eased by -1.1%. US yields retreated below 4% by the end of the month.

Outlook and drivers

We are increasingly optimistic on the prospects for EM equities, as a confluence of headwinds that has hindered performance over the past year begin to dissipate. Higher rates in the US, and consequently a strengthening dollar, have been a key factor weighing on EM equity returns in recent years. A possible shift to tailwinds is favourable for EM returns, including the potential for US interest rates to peak and a transition towards a more accommodative monetary policy environment. Particularly, these tailwinds are expected to be pronounced for EM growth and ESG factors, which are integral to our EM strategies.

Regionally, EM outside China have been demonstrating notable resilience, weathering the weakness associated with China’s slowdown. This has been exemplified by their capacity for turning challenges into opportunities, as the global supply chain undergoes a broad reshuffling. The semiconductor industry is seeing more signals confirming a turnaround, while the upward AI trend continues to be robust, fuelled by global techs ramping up investments.

China experienced sporadic bounces entering the new year. Subdued sentiment is leading to mounting hopes that some transformative support should be seen from the government, rather than incremental and rippling small policies. With the Lunar New Year approaching, we are closely monitoring market moves from a tactical perspective.

Aligned with our strategy, we will dynamically calibrate the portfolio’s risk appetite in response to evolving market conditions, maintaining a balanced position. We await further confirmation that the interest-rate peak is behind us, and that China's economic recovery is gaining momentum, thereby contributing to the differential growth of EM.

Positioning update

We are more optimistic on the outlook for emerging equities given receding headwinds, peaking Fed rates, the weaker USD and Growth performing better as an investment style.

We are maintaining Indian and Taiwan OW among regions and monitoring the South Korean government’s encouraging measures regarding the stock market.

No change to our sector views. We maintain a positive stance on semiconductor space.

Regional views:

No change to regional views

India: Overweight. India’s real GDP growth is projected to be 6-7%, making it the fastest-growting major economy in the region. Growth is supported by the country’s favorable demographics. Going into an election year, market expectations are for continued political stability following the results of regional elections. Public capex continues to remain the focus, together with a priority focus on renewable energy and power infrastructure, as seen in the interim budget. Fiscal prudence has also helped to bring bond yields lower, with the region’s inclusion in the JPM bond index later in the year to provide additional flows.

Taiwan: Overweight. Election results were broadly on expected lines, helping to remove one uncertainity from the markets. TSMC, the largest company in the MSCI EM Index, gained following an improved outlook,confirming a recovery in the process semiconductor industry. Themactic opportutnies such as AI are providing additional support for growth. TSMC has seen notable improvements in recent months.

China: Neutral. January remained a difficult month for China equities, with notable pressure on small cap names. Concerns on slowing consumption, deflationary challenges and inflated debt levels maintained pressure on equity performance. Policy in China has stepped up efforts to support equity markets, although we maintain our neutral view on China until we see clear a turnaround in economic conditions.

LatAm: OW. It was one of the best performing regions in 2023 and we continue to be OW. For Mexico, we are closely monitoring the country’s performance, given the potential deceleration in the US economy, as Mexico is now the US’s largest trading partner. Brazil has already entered an easing cycle, with stronger-than-expected GDP growth and a favourable political environment.

Sector and Industry views:

No changes to sector views.