Last week in a nutshell

- First estimates of the US GDP QoQ annualised growth rate (1.1% ) showed a deceleration. In the euro zone, Q1 GDP came in below estimates as Germany was in stagnation.

- The Chinese Politburo noted that the “economic growth was better than expectation and market demand was in gradual recovery”.

- The Federal Reserve’s supervision chief called for a sweeping re-evaluation of how the institution oversees US financial firms following the failure of SVB.

- A boost in the earnings season, especially for US Tech large caps, temporarily overshadowed worries over the slowing economic growth.

What’s next?

- The focus will be on the Fed and the ECB meetings. Recent data have led markets to pencil in +25bps on both sides of the Atlantic. Focus will be on the presser regarding the guidance on the upcoming path.

- In the euro zone, first estimates of the April consumer inflation rate figures (core and headline) are expected to confirm a gradual deceleration.

- In a busy week, the US will publish its monthly job report. Given the recent increase in unemployment benefits claims, the consensus expects an addition of less than 200K nonfarm payrolls.

- The Q1 earnings season is also continuing and the line-up includes Apple, Qualcomm, AMD and several European carmakers and energy firms.

Investment convictions

Core scenario

- Our main scenario incorporates slow growth, both in the US and the euro zone and remains the most likely. However, we acknowledge that the risk of a more adverse scenario has increased.

- Looking forward, all our economic scenarios – though with different trajectories – point to lower growth, lower inflation, lower Fed Fund rates and lower 10-year bond yields by the end of next year.

- In Europe, sentiment, labour market and consumption are holding up.

- China’s re-opening following last years’ Covid-related lockdowns is very quick and growth surprises on the upside. Europe is a beneficiary of this re-opening via a resumption of its export growth.

Risks

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions in the US. Financial stability risks have resurfaced recently and represent a new macro risk.

- In Europe too, we believe the risks on growth are on the downside, either because sticker inflation forces the ECB to hike more or because of tighter credit conditions.

- Overall, central banks have a narrow path and will have to compromise between price stability (keeping rates at a restrictive level for longer than currently priced) and financial stability (decisive action to avoid materialisation of systemic risk).

- Among the upside risks, the Chinese re-opening is good news for domestic and global growth if there is no material inflation spill over via a resurgence of commodity prices in the context of constrained supply.

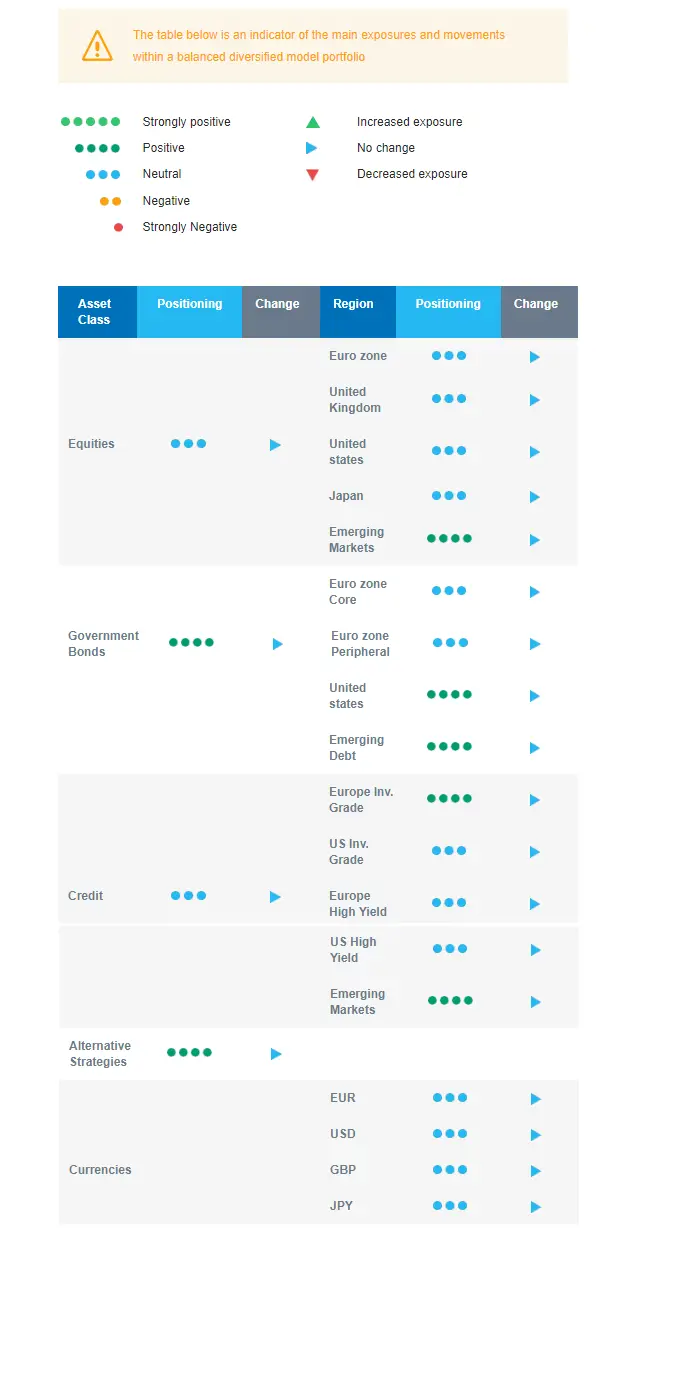

Cross asset strategy

- As better activity and lower inflation readings are mitigated by several vulnerabilities, we keep the neutral stance on equities and have further increased the duration to an overall slightly overweight duration.

- The uncertainty linked to the financial turmoil and the potential credit restrictions along with central bank’s anti-inflation stance are capping the upside potential for risky assets. On the other hand, inflation is declining, and a slow but positive growth is limiting the market downside.

- Within a neutral equities positioning, we have convictions in specific assets:

- In terms of regions, we believe in Emerging markets: China reopening is unfolding and a significant growth driver for emerging markets. Besides, there is no monetary headwind ahead as inflation readings in the region surprise on the downside and valuation is relatively more attractive.

- With Cyclicals pricing a strong rebound in the economic activity, we prefer defensive sectors, such as Health Care and Consumer Staples. The former is expected to provide some stability: No negative impact from the war in Ukraine, defensive qualities, low economic dependence, innovation, and attractive valuations. The current context continues to favour companies with pricing power, which we find in the Consumer Staples segment.

- Longer-term, we favour investment themes linked to the energy transition due to a growing interest in Climate and Circular Economy-linked sectors. We keep Technology in our long-term convictions as we expect Automation and Robotisation to recover from 2022.

- In the fixed income space, we will further add duration if we see better levels in the coming weeks.

- We are buying US government bonds as the slowdown is the most advanced in the region.

- European investment grade credit has been a strong conviction at the start of 2023 since the carry that was reconstituted by the rise in yields in 2022 looked attractive.

- We also have exposure to Emerging market debt, which should benefit from dovish local central banks, a lower USD and low investor positioning.

- We have exposure to some commodities, including gold and commodity-related currencies, including the Canadian dollar.

- On a medium-term horizon, we expect Alternative investments to perform well.

Our Positioning

We are overall slightly overweight duration, and we will keep looking for entry points. Further on the fixed income side, we have a constructive view on Investment Grade credit and Emerging market debt. In equities, our current positioning remains neutral, with a preference for Emerging markets equities.