Last week in a nutshell

- Global PMIs showed improving data, alleviating worries of an impending recession but raising expectations for more monetary tightening.

- Euro zone preliminary data on inflation revealed a drop in energy prices but a surprisingly sticky underlying inflation. Along with robust activity data, this also led to higher market pricing for future ECB rates.

- Activity data released in China confirmed the strong rebound following the end of the zero-Covid strategy and the start of the New Lunar year.

- Despite rising yields, global equities started the month of March positively, regaining some of the performance lost in February.

What’s next?

- In the US, Fed chair Jerome Powell will testify on the US central bank's semi-annual monetary policy report to Congress.

- China kicks off its annual session of National People’s Congress meeting, consolidating President Xi Jinping’s authority and outlining key government policy goals, including a new annual economic growth target.

- In terms of data, a robust monthly US job report is expected, while Chinese inflation and trade-related data will help investors further assess the magnitude of the re-opening.

- The Bank of Japan, which still has barely tightened its monetary policy, will meet. A decision is possible but unlikely as the leadership is about to change with Kazuo Ueda to replace Haruhiko Kuroda early April.

Investment convictions

Core scenario

- Our current economic scenario is based on a soft landing of the US economy in 2023. We expect a consolidation phase on financial markets in the short-term after a strong start to the year as the robust outlook is increasingly reflected in markets.

- Credit is a strong conviction for the start of 2023 since the carry that was reconstituted by the rise in yields in 2022 looks attractive. We are overweight Credit, including Emerging market debt.

- We see equity markets moving within a broad range: limited to the upside by the actions of central banks, which will ensure that financial conditions do not ease too quickly if the economy is holding up well and supported by a faster monetary policy pivot if the economy is hit too hard.

- We expect emerging markets to outperform as valuation is relatively more attractive while Asia keeps superior long-term growth prospects vs. developed markets, given that China’s re-opening is rather quick.

- Euro zone activity was shielded by a fortuitous combination of a mild winter, a reduction in consumption thanks to targeted measures, increased gas storage and falling energy prices. Sentiment, labour market and consumption are holding up while inflationary pressures resurfaced. With the re-opening of China, Europe should likely resume its export growth.

- In this environment, we expect Alternative investments to perform well on a medium-term horizon.

Risks

- Overall, inflation declines and a rise in growth at some point in 2023 is limiting the market downside. But we know that the central banks anti-inflation stance is also capping the upside potential for risky assets. We note a more hawkish tone in recent weeks, which pushes yields higher.

- As central banks become more data dependent, and, for the time being, the economy is surprising on the upside, markets are pricing in a more restrictive Federal Reserve than anticipated.

- The dramatic drop in gas prices makes a European recession scenario less likely. However, another risky scenario is now emerging as core inflation is not showing sufficient signs of slowing down and could lead the ECB to tighten its monetary policy further.

- Among the upside risks, the Chinese re-opening is good news for the domestic and global growth as long as there is no global inflation spill over via a resurgence of commodity prices in the context of constrained supply.

Cross asset strategy

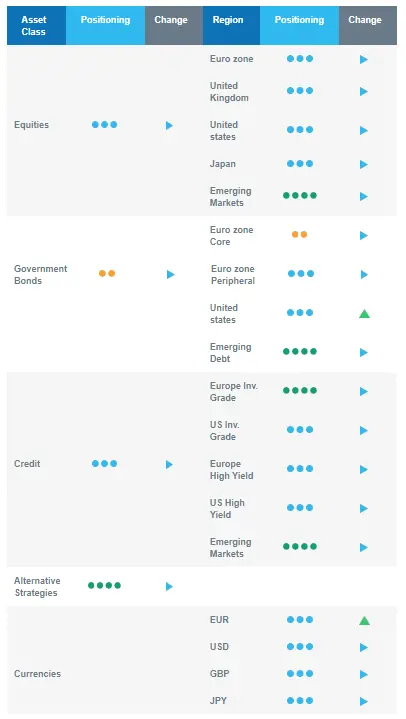

- Our multi-asset strategy is currently neutral as signs are pointing towards a consolidation. With a less attractive risk/reward on the US equity market, we keep a neutral stance on equities.

- We are neutral equities vs bonds. We have convictions in specific assets.

- Within regional equity preferences, we believe in the Emerging markets region, as valuation is relatively attractive and there is room for a catch-up vs. developed markets.

- In the current environment, we prefer defensive sectors, such as Healthcare and Consumer Staples while a pause in the Tech sector appears warranted.

- The Health Care sector is expected to provide some stability: no negative impact from the war in Ukraine, defensive qualities, low economic dependence, innovation, and attractive valuations.

- In addition, the current context continues to favour companies with pricing power, which we find in the Consumer Staples segment.

- In bonds, most asset classes have an attractive carry. European investment grade credit is one of our strongest convictions. We also have exposure to emerging debt and to global high yield debt.

- We have a slight short duration positioning, via core Europe.

- We have exposure to some commodities, including gold and commodity-related currencies, including the Canadian dollar.

- In our long-term thematics and trends allocation: We favour investment themes linked to the energy transition and keep Technology in our long-term convictions. We expect Automation and Robotisation to recover in 2023, and a growing interest in Climate and Circular Economy-linked sectors (such as Industrials and Technology).

Our Positioning

Our current positioning is neutral equities, with a preference for Emerging markets. On the fixed income side, we have a constructive view on Investment Grade credit. We keep a slight short portfolio duration via EU sovereign bonds. In the context of robust growth and the reopening in China, we remain allocated to some commodities.