Last week in a nutshell

- OPEC+ decided to leave its output policy unchanged. Oil production targets will remain the same as oil markets were still assessing the impact of the Chinese demand. Meanwhile G7 nations and Australia agreed to a $60/Bbbl price cap on Russian oil. Russia may cut its oil production in response, President Vladimir Putin said.

- Producer prices in China fell less than expected (-1.3% YoY vs. -1.5%) as the Chinese economy continued to be held back by strict confinement measures. Producer prices in the US were hotter than expected (+7.4% vs 7.2%) in November but continue their downtrend since the peak reached in March at 11.7%.

- The preliminary December Consumer Sentiment survey for the US revealed that household inflation expectations for the next year fell to 4.6%, the lowest since September 2021. The University of Michigan, conducting the survey, added that “consumers’ concerns over high prices in a variety of contexts have eased somewhat”.

- On the US political front, Democratic senator Raphael Warnock won the Georgia Senate runoff election, defeating his Republican opponent, Herschel Walker. Arizona Senator Kyrsten Sinema declared as an independent but made clear she intended to keep working with Democrats.

What’s next?

- Central banks will dominate the news flow with the US Federal Reserve, the European Central Bank, the Bank of England, and the Swiss National Bank all meeting. The last Fed committee of 2022 will likely shift to a reduced pace of rate hikes in what will go down as the sharpest monetary tightening episode in more than four decades.

- In Europe, the ZEW survey will reveal data on German and euro zone sentiments. While Germany introduced a gas price brake, the energy crisis will remain present during the winter months. Fiscal policy will remain a tailwind for corporates and households.

- The UK will publish a series of activity-related data, including its GDP growth rate, industrial and manufacturing production, and inflation rate that will complete the picture of recently deteriorating job and real estate markets.

- The week will end with the publication of preliminary surveys of global manufacturing and services activity as investors look closely at the intensity and speed in the slowdown as well as any further deterioration in sentiment.

Investment convictions

Core scenario

- Our asset allocation has become constructive on attractive price levels and is now getting support from improving fundamentals.

- The extreme market configuration in October was a buy signal. Since then, we have kept a constructive -overweight equities- positioning into year-end but with a controlled risk budget.

- We expect emerging market assets to outperform as valuation has become attractive while Asia keeps superior long-term growth prospects vs. developed markets.

- We have a portfolio duration slightly shorter than the benchmark. Along with central bank monetary tightening since last spring we have gradually increased our fixed income exposure duration, via the credit segments and continue sourcing carry from emerging market debt.

- Central banks must strike a balance between the fight against inflation and the risk of financial instability. Hence, the next interest rate hikes will be smaller but the terminal rate in 2023 could be higher than expected some months ago.

- We expect Alternative investments to perform well in this environment.

Risks

- Upside risks include that central bank actions are nearly priced for peak hawkishness and neutral sentiment and positioning. Chinese re-opening in 2023 would be a substantial support for the global economy.

- Further, governments in Europe are adding fiscal aid as the energy crisis deepens, which mitigates its negative impact.

- Overall, inflation declines and a rise in growth at some point in 2023 is limiting the market downside. But we know that the central banks anti-inflation stance is also capping the upside potential for risky assets.

- Downside risks would be a monetary policy error via over-tightening in the US, a sharp recession risk via a deeper energy crisis in Europe or an unexpected new, harsh Covid-related Winter lockdown in China.

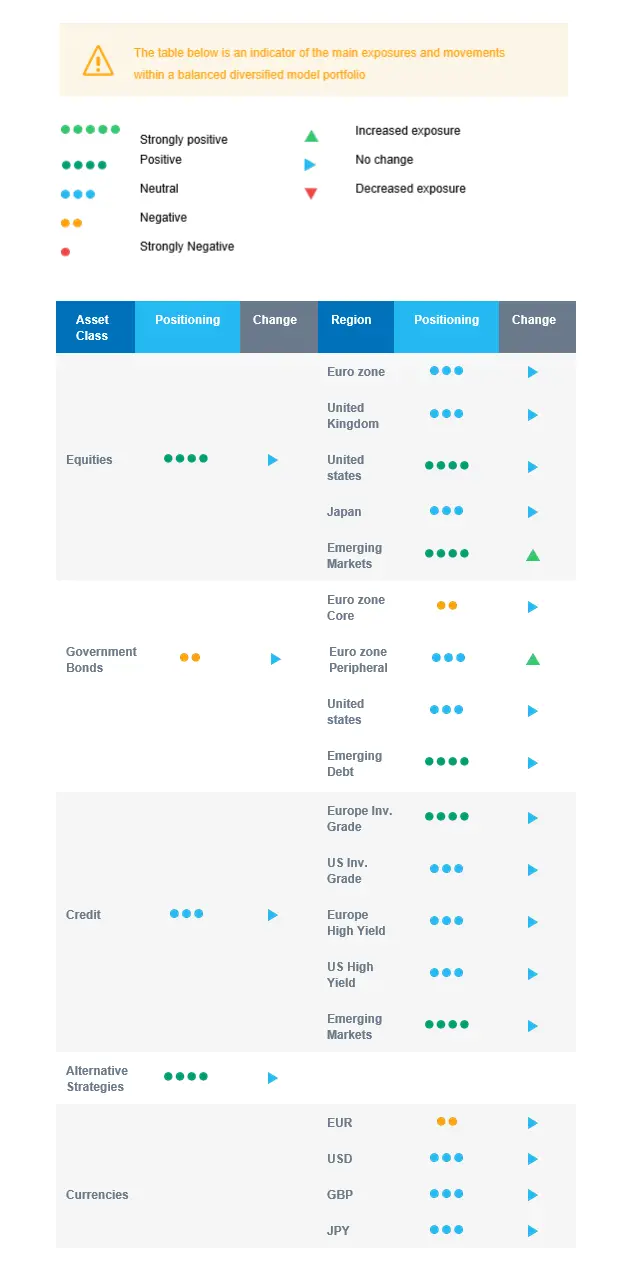

Cross asset strategy

- Our multi-asset strategy has become more constructive and overweight equities on attractive price levels but remains nimble and can be adapted quickly. Right now, we have few strong regional convictions as markets have rallied strongly in past weeks:

- Neutral euro zone equities.

- Neutral UK equities, resilient sector composition and global exposure.

- Overweight US equities.

- Overweight Emerging markets, via Asian Emerging markets, expected to outperform as valuation has become attractive and there is room for a catch-up vs. developed markets.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure usually act as opposite forces for investor attractiveness.

- Positive on sectors, such as healthcare, consumer staples and the less cyclical segments of the technology sector.

- Positive on some commodities, including gold.

- In the fixed income universe, we have a slight short duration positioning.

- We continue to diversify into European investment grade credit and source the carry via emerging debt and global high yield debt.

- In our long-term thematics and trends allocation: We favour investment themes linked to the energy transition and keep Health Care, Tech and Innovation in our long-term convictions.

- In our currency strategy, we diversify outside the euro zone and are long CAD.

Our Positioning

Our current positioning is overweight equities with a preference for US and Asian Emerging markets. On the fixed income side, we keep a slight short portfolio duration via EU core bonds. We have become less cautious on the European periphery and have a constructive view on credit, including high yield. The latter looks attractive with a sufficient buffer for defaults. We remain allocated to commodity currencies via the CAD.