Last week in a nutshell

- Global flash PMI’s showed a widening gap between services and manufacturing activity.

- In Europe, consumer confidence slightly improved despite restrained household budgets. In the UK, inflation data disappointed, exceeding expectations.

- The publication of the FOMC Minutes highlighted the need to retain optionality after the last meeting and to raise the US debt ceiling.

- Unlike Germany, the US economy grew in Q1 and more than previously reported. Consumer spending was stronger than expected.

What’s next?

- In the US, the debt ceiling negotiations will be the focus, as the US Treasury could run out of cash as early as June 1st. Drawing out the resolution may impact the nation’s credit rating and above all, confidence.

- The publication of the US employment report will shed some light on the resilience of the labour market and by the same token will hint at the Fed’s upcoming monetary path.

- With first estimates of inflation data in the euro zone and its key country, market participants will assess its softening and how the services component is faring.

- The next OPEC+ policy meeting will take place, testing the strength of the alliance between Russia and Saudi Arabia given their contradictory preliminary forecasts on the likelihood of cuts.

Investment convictions

Core scenario

- Our main scenario incorporates slow growth, both in the US and the euro zone and remains the most likely. The magnitude of the downside risk will depend on the economic slowdown. In our central scenario, it should be limited in a tighter trading range.

- Looking forward, all our economic scenarios – though with different trajectories – point to lower growth, lower inflation, lower Fed Fund rates and lower 10-year bond yields by the end of next year.

- In Europe, sentiment, labour market and consumption are holding up and the stock market is supported by a more attractive valuation than the US.

- Chinese pent-up demand is a positive point but returning to pre-pandemic trends is slow. Positive growth surprises with downside inflation surprises are usually supportive for financial markets overall.

- Europe is a beneficiary of this re-opening via a resumption of its export growth.

Risks

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions in the US. Financial stability risks have resurfaced recently and represent a new macro risk.

- In Europe too, we believe the risks on growth are on the downside, either because sticker inflation forces the ECB to hike more or because of tighter credit conditions.

- Overall, central banks have a narrow path and will have to compromise between price stability (keeping rates at a restrictive level for longer than currently priced) and financial stability (decisive action to avoid materialisation of systemic risk).

- Among the upside risks, the Chinese re-opening is good news for domestic and global growth.

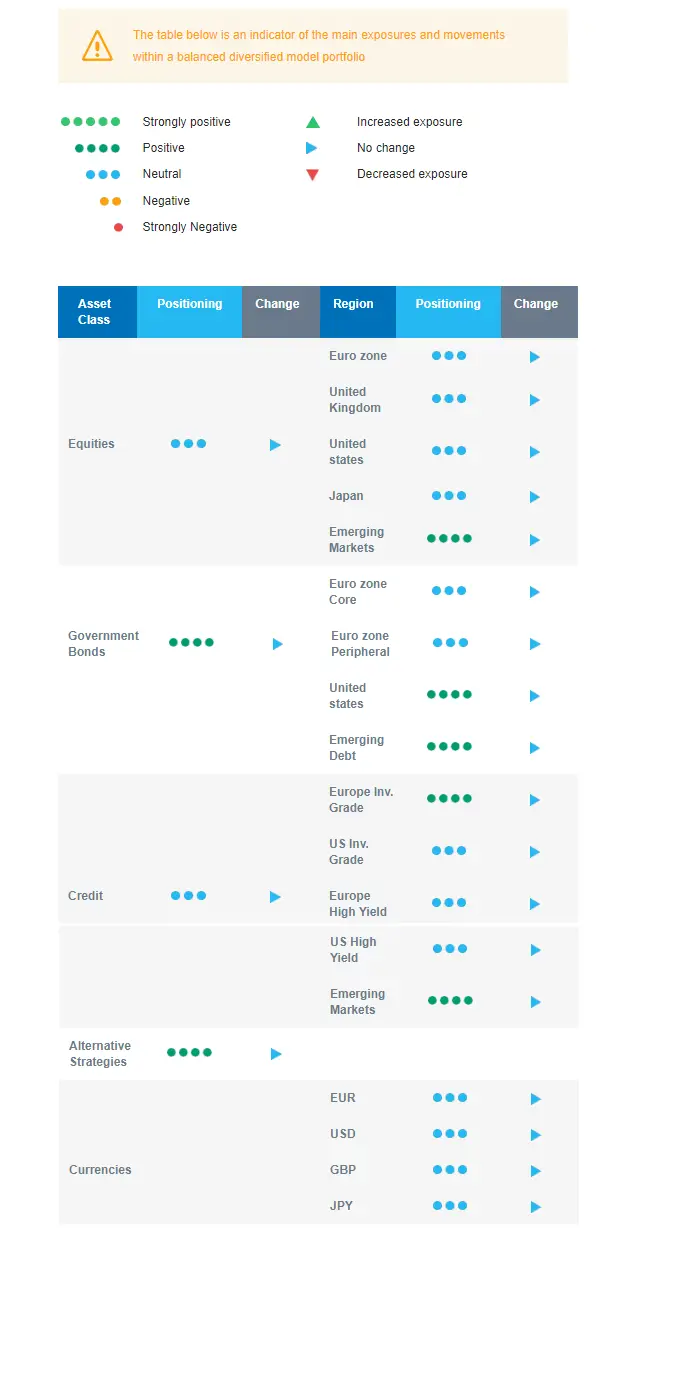

Cross asset strategy

- We stay neutral on equities, considering the limited upside potential and have increased the duration.

- The uncertainty linked to the financial turmoil and the potential credit restrictions along with central bank’s anti-inflation stance are capping the upside potential for risky assets. On the other hand, inflation is declining, and a slow but positive growth is limiting the market downside.

- Within a neutral equities positioning, we have convictions in specific assets:

- In terms of regions, we believe in Emerging markets: China reopening is unfolding and a significant growth driver for emerging markets. Besides, there is no monetary headwind ahead as inflation readings in the region surprise on the downside and valuation is relatively more attractive.

- At this stage of the cycle, we prefer defensive over cyclical names, which are already priced for a recovery, especially in Europe. We prefer Health Care and Consumer Staples. The former is expected to provide some stability: No negative impact from the war in Ukraine, defensive qualities, low economic dependence, innovation, and attractive valuations. The latter, pricing power.

- Longer-term, we favour investment themes linked to the energy transition due to a growing interest in Climate and Circular Economy-linked sectors. We keep Technology in our long-term convictions as we expect Automation and Robotisation to recover from 2022.

- In the fixed income space, we have increased the duration and we are positive on US government bonds.

- We are positive on US government bonds as the slowdown is the most advanced in the region. We do not expect a Fed easing as early as markets do.

- European investment grade credit has been a strong conviction at the start of 2023 since the carry that was reconstituted by the rise in yields in 2022 looked attractive.

- We are cautious on High Yield bonds.

- Emerging bonds continue to offer the most attractive carry and the USD is not strengthening.

- We have exposure to some commodities, including gold and commodity-related currencies, including the Canadian dollar.

- On a medium-term horizon, we expect Alternative investments to perform well.

Our Positioning

We are overall slightly overweight duration, and we will keep looking for entry points. Further on the fixed income side, we have a constructive view on Investment Grade credit and Emerging market debt. In equities, our current positioning remains neutral, with a preference for Emerging markets equities.