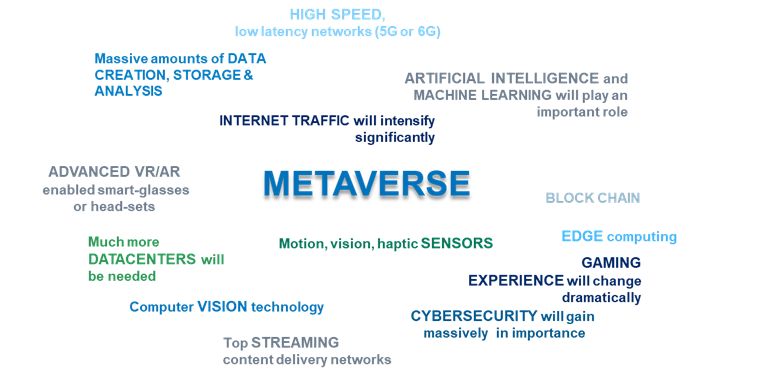

It is nothing short of a new technological revolution.

Driven by edge supercomputers, high-performance computing, new storage and connectivity capabilities, as well as the latest advances in data and content security.

The innovations that are bringing the Metaverse to life will open radically new dimensions for education, healthcare, media, entertainment and retail.

No safety in numbers

As the new technology is increasingly taken up by different sectors of the economy, this new market is expected to reach between USD 5 trillion[1] and USD 8 trillion[2]. It will be big and very diverse.

But here lies investors’ main challenge. The Metaverse can be used in all kinds of different ways – depending on the types of underlying products and services marketed - and with very different outcomes.

There are already concerns about the boost this technology can give to gambling, the echo chambers of extremism and political manipulation, and unlawful use of personal data. So how can investors navigate this exciting market without getting stuck in some nasty controversy?

[1] McKinsey

[2] Goldman Sachs/ Morgan Stanley

Imagined and reality

It is easy to imagine that new technology brings light, peace and prosperity everywhere it goes. The reality can be very different. That is why Candriam’s new Meta Global Equity strategy’s distinctive approach centres around those areas where we are comfortable with how the Metaverse is going to be used:

- A diverse, cross-sector portfolio of interesting innovative companies that use new technology to meet the demand of the ever-changing markets. In itself, a strong investment proposition.

- The latest in the offering of 14 strategies managed by Candriam’s Thematic Team. Benefiting from over 20 years of expertise that has covered areas from innovations and oncology to climate change and circular economy.

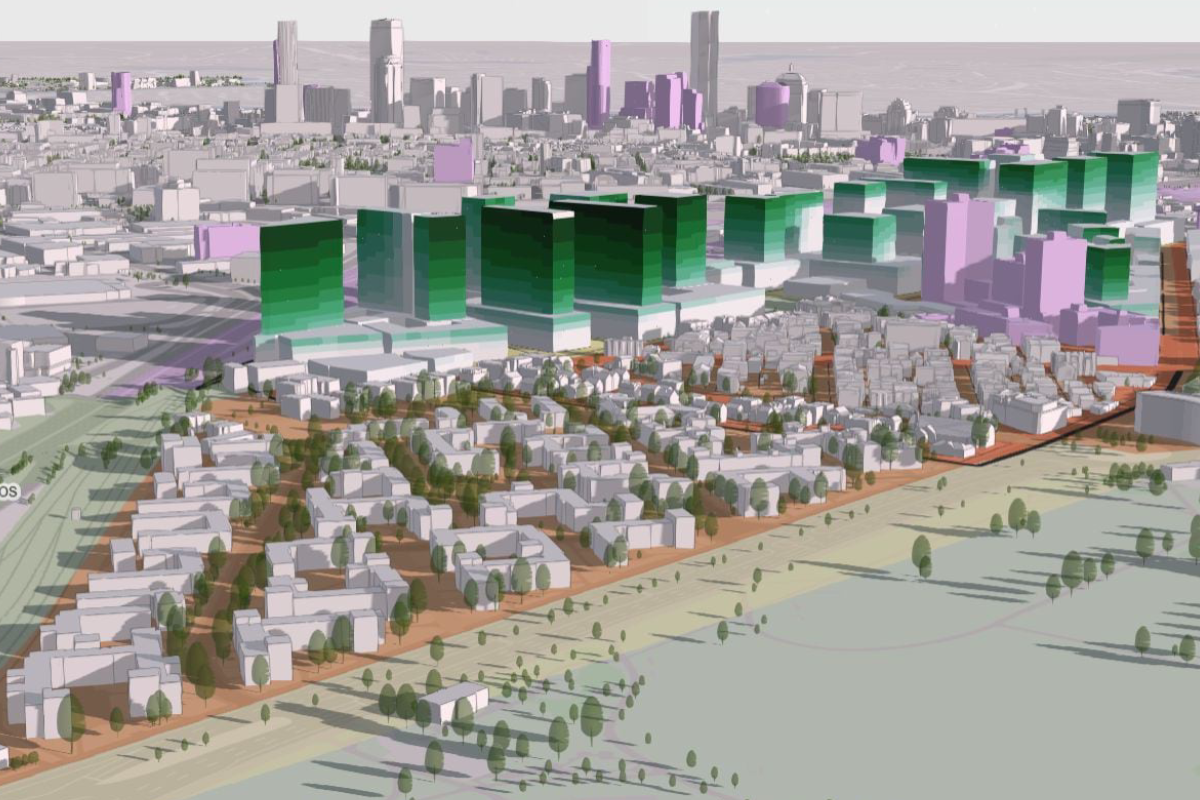

- Focus on industrial applications: education and training, healthcare and 3D modelling and simulation. The latter uses “digital twins” come up with innovative solutions for a modern age.

- ESG assessment excludes companies based on activity (weapon manufacturers, tobacco and coal companies), norms (human & labour rights, environmental impact, corruption), and specific to metaverse (concerns about data gathering & protections, privacy, excessive energy consumption and potential addictions).

The main risks of the strategy are risk of capital loss, ESG investment risk, equity risk, currency risk and ESG Investment Risk.

The non-financial objectives presented in this document are based upon the realisation of assumptions made by Candriam. These assumptions are made according to Candriam’s ESG rating models, the implementation of which necessitates access to various quantitative as well as qualitative data, depending on the sector and the exact activities of a given company. The availability, the quality and the reliability of these data can vary, and therefore can affect Candriam’s ESG ratings. For more information on ESG investment risk, please refer to the Transparency Codes, or the prospectus if a fund.