Renta variable

Deslocalización: Un catalizador para la fabricación inteligente

Biotecnología : 25 años de innovación al servicio de la salud

Recovering investor sentiment after “Liberation day”

PFAS: Un genio que salió mal

Shock to the system

La complejidad de invertir en defensa

Europe at the forefront

A positive start to the year

No debemos descuidar la renta variable europea

Waiting for Trump 2.0

A positive market response to the US elections results

Positive outlook for US equities

The Fed's action rekindled the bullish momentum in all risky assets

Perspectivas económicas de China: Oportunidades y amenazas ante las elecciones estadounidenses

Financial markets are being shaped by growth concerns and political uncertainties

Tech Boosts US, Political Risks Weigh on Europe

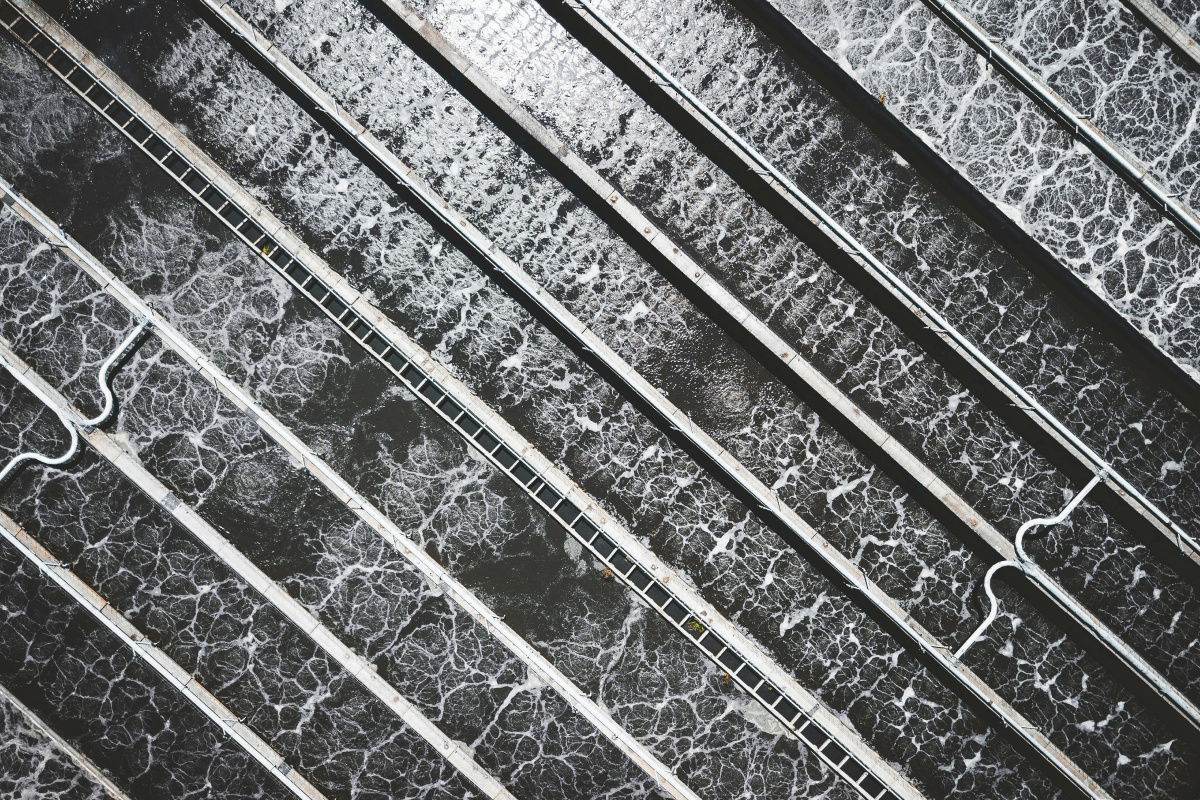

Riesgos relacionados con el agua: ¿Cómo crear estrategias de inversión respetuosas con el agua?

Revelando los Próximos Gigantes del Crecimiento en Mercados Emergentes Excluyendo a China

Green is back

Del carbono a la estrategia: por qué integrar el clima en sus inversiones

Pequeñas capitalizadas europeas: ¡finalmente se espera un rebote!

Markets lost ground in April

Actualización Tensiones en Oriente Próximo