Asset Allocation, Macro, Emile Gagna, Florence Pisani

Konjunkturabschwächung in Sicht...

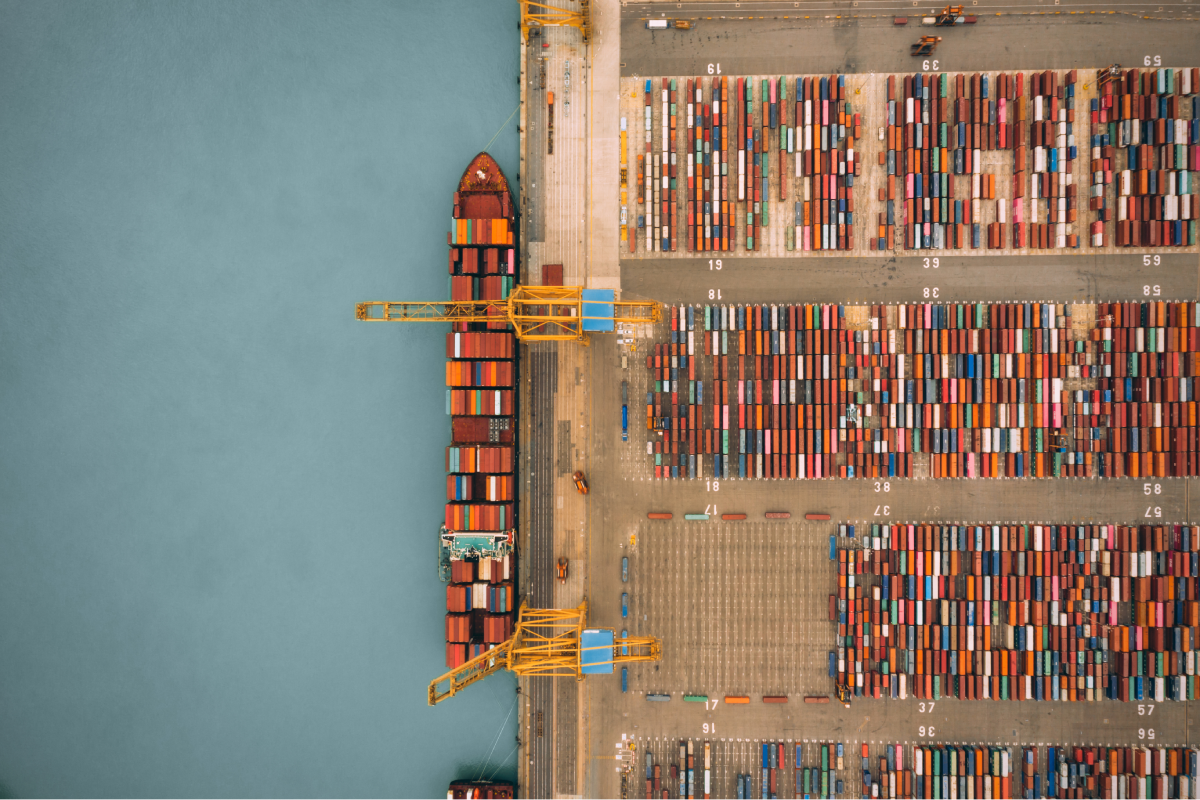

Trotz zunehmender geopolitischer Spannungen zeigte sich die Weltwirtschaft Anfang 2025 überraschend widerstandsfähig, und die Inflation normalisierte sich weiter.